Pay-outs from Critical Illness (CI) policies are triggered using the special Critical Illness icon found in the Special Events section of the events 'palette'.

Ordinarily, one would be modelling the pay-out from a CI policy, as a hypothetical situation, within a 'what-if scenario; there is nothing to stop you from doing this in the Base Plan, however, should it apply to your client's current situation.

In any case, have your CI policy entered on the Insurance, Critical Illness screen with the owner of the policy selected.

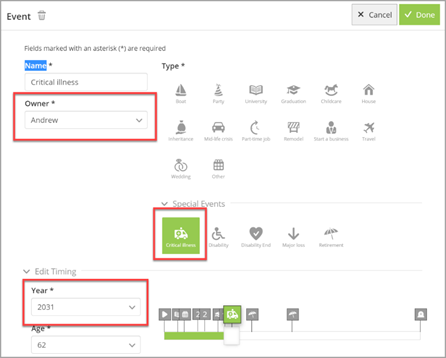

To trigger a pay-out from the policy, go to the Timeline and double click in the Timeline to add an event The Events panel will appear. Check the policy owner. Select the Critical Illness Special Event and select the year in which the CI pay-out is being scheduled to occur.

This event will trigger the pay-out of any active CI policies owned by the owner of the Critical Illness event, provided the policy is still within its term (is active) in the year the critical illness event is scheduled.

NB: note that unlike an Income Protection event, the CI event does not end one's employment, since you could be critically ill and continue to work. If you want to assume that the client's income ends with the critical illness, in your scenario, select the CI event as the end event for the person's employment. To do this, go to the Dashboard, select the person's income, go to Timing and drag the Critical Illness Event into the Employment Ends box to mark the end of the income.

The Income Steps could also be used - for example - to schedule a 'step-down' to part-time employment and a reduction in income, at the Critical Illness event, if the income is to decrease but not end entirely. The What If scenario will need to be tailored to reflect the consequences of a critical illness, with respect to earnings and expenses.

It may well be, if following one or other of the suggestions outlined above, that the introduction of a 'critical illness' will result in a shortfall, in the client's 'cash flow'.

You could use the Lump Sum Savings Insight to get an indication of the CI cover required to cover this shortfall, click here to read more about this Insight.

Finally, in many instances, clients have term life cover, with CI riders. Since we don't currently model a combined life/CIC policy, we usually recommend that advisers enter both types of cover into the client plan individually, while only entering a premium amount for one of the two, usually the term cover. If this is the case and you are running a CI scenario, remove the life policy from the Term & Endowment screen so as not to double-account for the pay-out, given that combined policies will ordinarily pay-out on a 'first event' basis, only. Also, move the premium, which was once paid via the life cover, over to the CI policy, in the Insurance, Critical Illness screen. All of this needs only to be done in your CI pay-out scenario, and only in cases where the term and CI cover are linked.

To view the pay-out from the CI policy, go to the Cash Flow tab in Year View, move the slider to the year/age in which the critical illness is scheduled.

Pay-outs can also be seen on the Insurance tab.

The Critical Illness Event can be used in conjunction with the Income Protection Events, more information in this guide: Disability Special Events - Loss of Income and Income Protection - Australia