Step by Step how to input a Superannuation pension

This guide walks through setting up Accumulation and Retirement phase pensions and moving money from one to the other.

- First enter the Employment Income into the plan

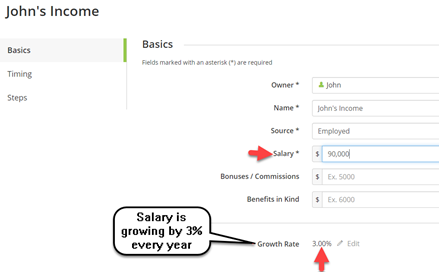

Before entering an Accumulation pension which has employer contributions we need to make sure there is an Employment entry in Voyant. Employer contribution percentages will be based on this salary each year.

To add one go to the + button bottom right in Dashboard and select Income > Employment.

Note the Growth Rate – the salary amount will increase each year by this growth rate.

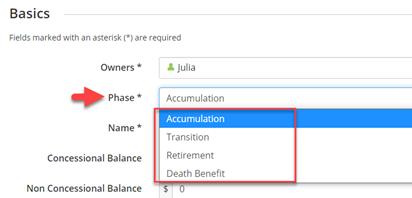

- Set up an Accumulation Phase Pension in Voyant

Go to the + button bottom right in Dashboard and select Pension > Superannuation.

There are different Phases of Supers available. Select the appropriate Phase. In this guide we start with an Accumulation phase pension.

Enter the current balances of each pot in the Concessional, Non concessional and Other Balance fields.

Basics

Here is an explanation of each field when entering a Superannuation:

|

Concessional Balance |

Taxable component, taxed element balance |

|

Non Concessional Balance |

Tax Free component balance |

|

Other Balance |

Taxable Component, untaxed element. Includes Public Sector pension balance |

|

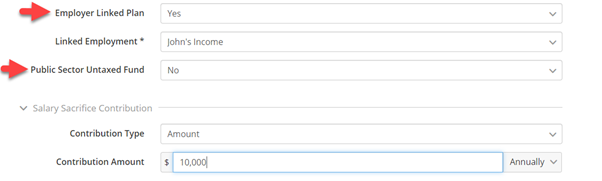

Employer Linked Plan and Linked Employment |

Selecting Yes to Employer Linked Plan and link the pension to the Employment (already entered in the plan see above). This will automatically start the Guaranteed Employer contributions. It will also reveal the Salary Sacrifice contribution fields. |

|

Public Sector Untaxed Fund |

If Yes is selected here, the contributions go in Gross and into the ‘Other Balance’ pot. I.e. the Super does not paid tax on this money going in. |

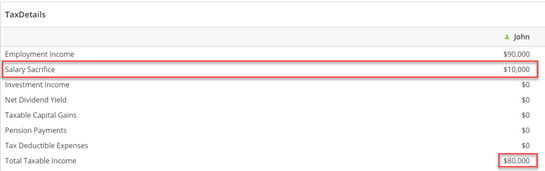

Salary Sacrifice Contribution

Enter the Gross salary sacrifice contribution in this section. Tax will be deducted where relevant.

Money added via Salary Sacrifice will increase the Concessional pot balance.

Non-Concessional Contribution

This contribution will be made gross and add to the Non-Concessional pot.

There are Concessional and Non-Concessional Contribution limits in Voyant. It won’t allow contributions above these amounts. See the Plan Settings section below for how these contribution limits increase over time.

Additional Employer Contributions

Add further employer contributions above the minimum guaranteed contributions here.

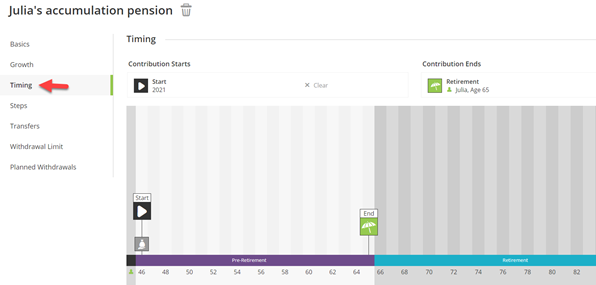

Timing of Contributions

Before Saving there are some other screens to go to.

Go to Timing to set when the contributions will occur in the plan. Click on the Event to set at the start or end event as required.

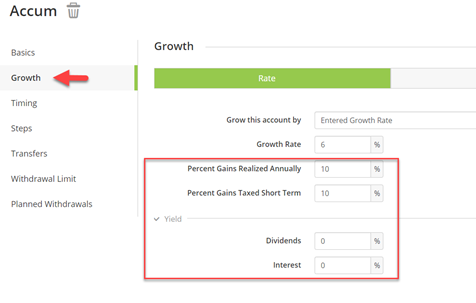

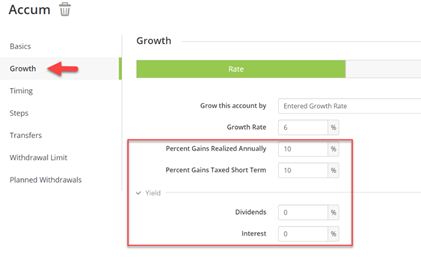

Growth

Finally go to the Growth screen. In here you can set the Growth on the pension. See separate guide on Portfolio/ holdings.

If there are any gains realised annually, dividends or interest you will see tax on these in Voyant each year.

Note the ‘Percent of Gains Realized Annually’ are classed as long-term earnings. To specify what percentage of these are short term fill in the appropriate percentage in ‘Percent Gains Taxed Short Term’.

Dividends and Interest are both classed as short-term (annual) gains.

Press Done to finish entering the Accumulation pension.

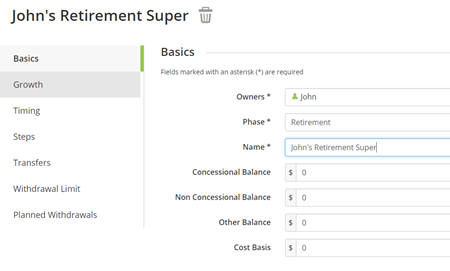

- Set up a Retirement Phase Pension

Go to the + button bottom right in Dashboard and select Pension > Superannuation.

Select the Retirement Phase.

Check growth rates as above.

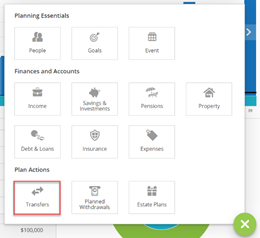

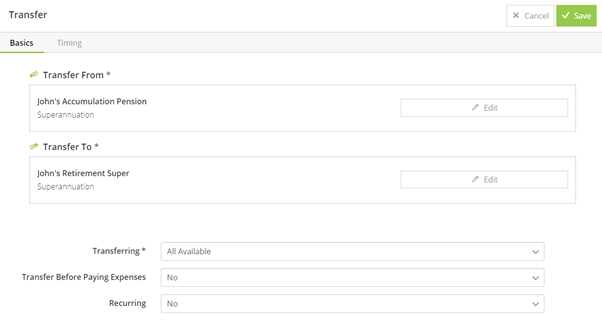

- Set up a Transfer to move money from the Accumulation Phase to the Retirement Phase

Go to the + button bottom right in Dashboard and select Transfers

Transfer money from the Accumulation Pension into the Retirement pension. ‘All available’ will move the whole account up to the Transfer Balance Cap assumed for that year.

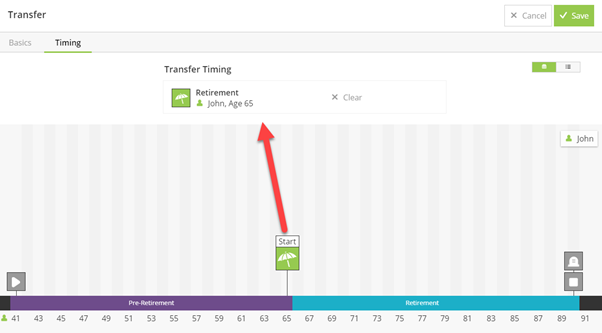

In the Timing tab specific when in the plan you would like this transfer to occur. Select the appropriate event and click ‘Set as start event’.

Click Save

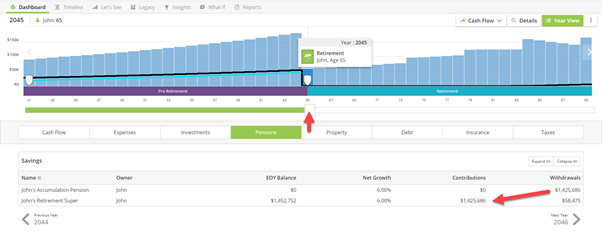

Go to Year View > Pensions tab for the year of the Transfer and see money moving from one account to the other.

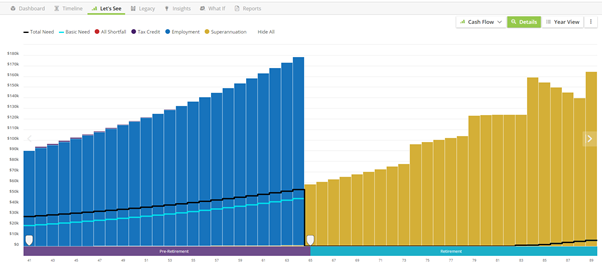

Let’s See

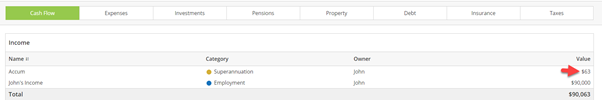

The minimum required withdrawals will be shown in the cash flow from the Retirement pension.

Looking at the Year View to see the Pension details

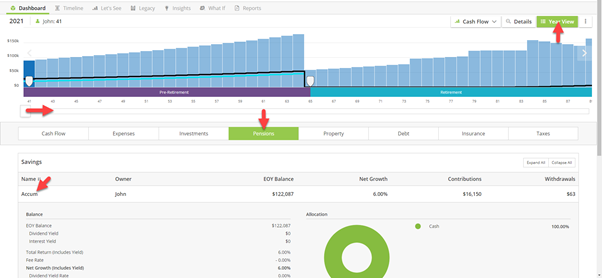

Go to Year View > Pensions to see the pension you just entered and the details modelled for each year of the plan. Click on the name of the pension to reveal more information.

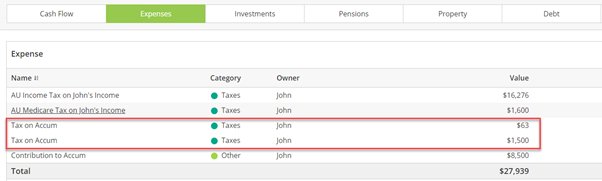

Go to the Taxes tab to view the tax on any gains realized or dividends/ interest in the pension.

See tax on annual gains, dividends and interest paid as an Expense in Year View. Also see any Tax on salary sacrifice contributions.

And money coming out of Pension in the cash flow to pay the tax on gains.

Relevant Plan Settings

|

Pension COLA rate |

Increases the transfer cap amount |

|

National Average Earnings |

Controls the indexation of Superannuation related tables. Including the annual concessional contributions and non-concessional contribution limits to Supers. Non concessional contribution caps are equal to 4 times the value of concessional contribution caps. Also increases the employment earnings each year unless changed for that individual salary entry. |

|

Centrelink COLA rate |

Controls the indexation of age pension related values including benefit amounts, benefit thresholds, and income and asset test thresholds. |

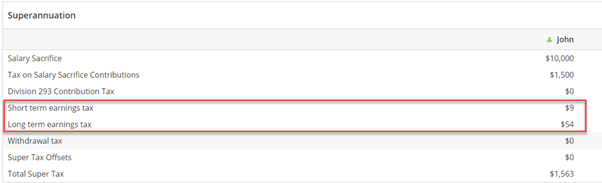

Example 1 – Gains realized annually in Accumulation Pension

If the initial pension balance is $100,000 and growth rate is 6%, Percent of this growth realised annually is 10% and of this short-term gains are 10% then in year 1:

$100,000 x 6% = $6,000 growth

10% of this growth is realized = $6,000 x 10% = $600

Of this 10% are short term gains = $600 x 10% = $60

Tax $60 at short term rates x 15% tax rate in year of example = $9

Tax $540 at long term rates x 10% tax rate in year of example = $54

Total tax in that year assumed $63

This is shown in Year View - Taxes tab, Expenses tab and Cash Flow tab as money removed from the Super to pay this.

Example 2 – Salary Sacrifice and Guaranteed Employer Contributions

An example is shown below. When entering the Pension the Super is linked to an Employment so will automatically start the guaranteed employer contributions. The salary sacrifice field is also completed.

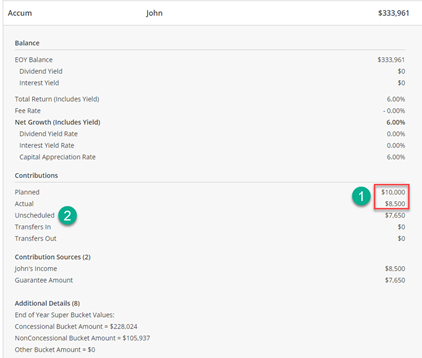

Now in Let’s See > Year View > Pensions tab:

- Planned and Actual Contributions show the Gross Salary Sacrifice contribution and the Actual contribution made after tax (15% in year of screen shot) respectively.

- Unscheduled Contributions are the Employer contributions – also after tax (15% in year of screen shot)

Salary sacrifice reduces taxable income.

Go to Year View > Taxes tab: