This guide is about how to set up a Recontribution Strategy from a Superannuation Retirement Pension into an Accumulation Super and then into another Retirement phase Super.

First: Set up accumulation and retirement phase supers in the normal way, including the transfer from one to another at retirement. E.g. at age 63

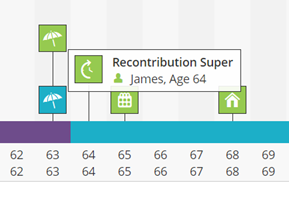

- EVENT: Create a new event on the timeline for when the recontribution strategy is to occur. E.g at age 64.

-

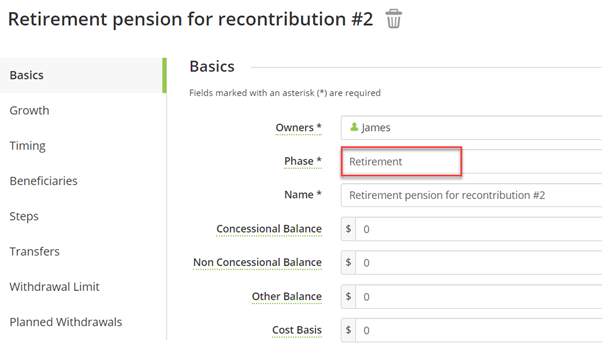

SUPER: Create a new retirement phase super #2

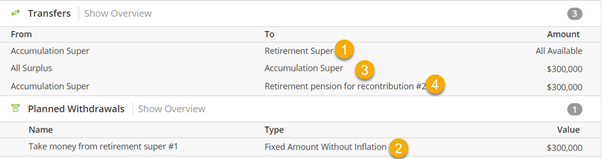

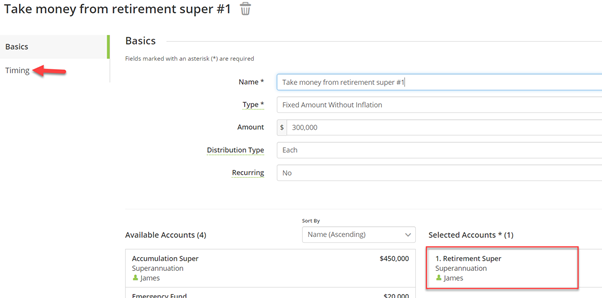

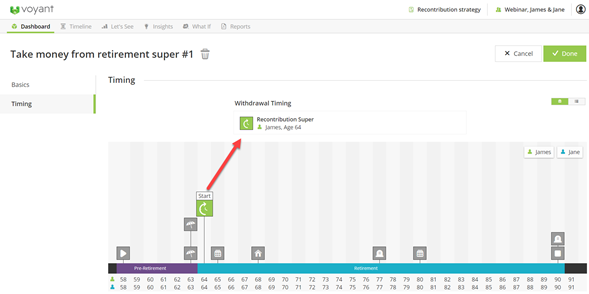

- PLANNED WITHDRAWAL: Go to the + button in Dashboard - Planned Withdrawals Set up a Planned Withdrawal from the Retirement phase super #1 to take money out.

In Timing set this to be the Recontribution event created in point 1 above

-

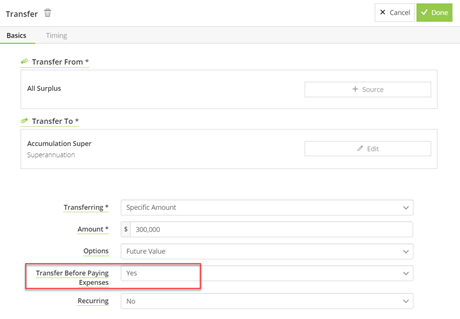

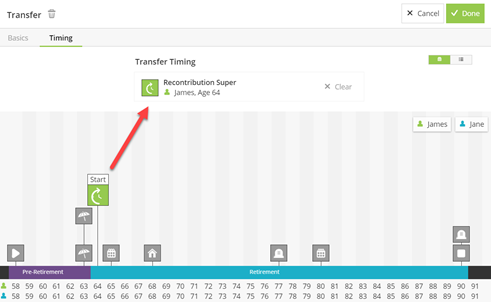

TRANSFER: + button bottom right in Dashboard - Transfers

Create a transfer from All Surplus to the Accumulation Super. Make sure transfer before paying expenses is set to Yes

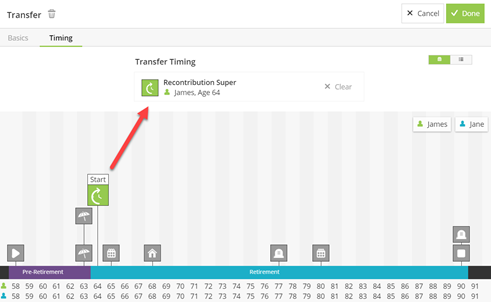

Timing is the Recontribution event

Click Save + Add Another

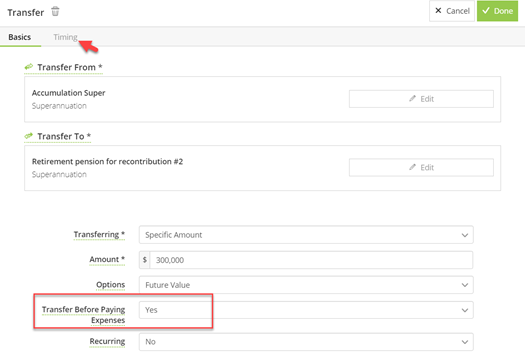

- TRANSFER: Create a transfer from Accumulation Super into the new retirement phase super #2. Make sure transfer before paying expenses is set to Yes

Timing is the Recontribution event

- YEAR VIEW: Go to Year View to check it is set up how you would expect and also to see the difference in values between the Concessional and Non-Concessional buckets.

- The Pensions tab should show money coming out of the Retirement 1 pension and into the Accum pension, then out of the Accum pension and into the Retirement 2 pension, as shown in the screen shot below

- There should be no tax in the Taxes tab because of this withdrawal

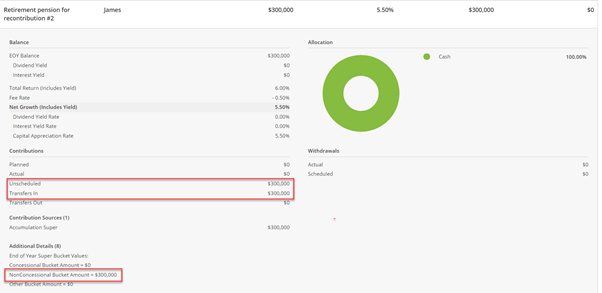

- The money will go into the Non-concessional bucket of the Retirement 2 pension. Click on the name of the pension in Year View to see this detail and the different values compared to before the recontribution.

- The transfer amount adds onto the Transfer Balance. Click on the name of the pension in year view to see this detail

- The system applies the contribution limits and the carry forward rules to Super contributions

Click on the name of the Retirement Super #2 to see more information

Summary

Along with the original Accumulation to Retirement pension transfer you will have 3 transfers and 1 planned withdrawal.