What is the Software’s Default Estate Distribution?

Without specifying an estate distribution, the software will make a few basic assumptions about the distribution of your estate.

1. If you are married or in a civil partnership and provided you’ve included your spouse or partner in your plan, the software will pass the entire estate on first death to the surviving spouse or partner.

2. If you have a partner in your plan but are not in a legally recognized civil partnership and your partner is included in your plan as what we call, for lack of a better term, a “non-legal partner”, the estate will pass on first death to the surviving partner and will be taxed accordingly.

3. If you are single, having no spouse or partner, but have children or grandchildren who are entered in your plan, the estate will be divided evenly among the surviving family members and taxed accordingly.

4. If you are single and your plan involves no other family members, the software will calculate estate taxes and pass your entire estate to the intentionally ambiguously named “persons outside plan”.

5. For couples, on the death of the second person in the couple, assets are distributed evenly among any survivors (children, grandchildren, other relatives) entered in the plan. If there are no survivors in the plan, the entire estate will pass to “persons outside plan”.

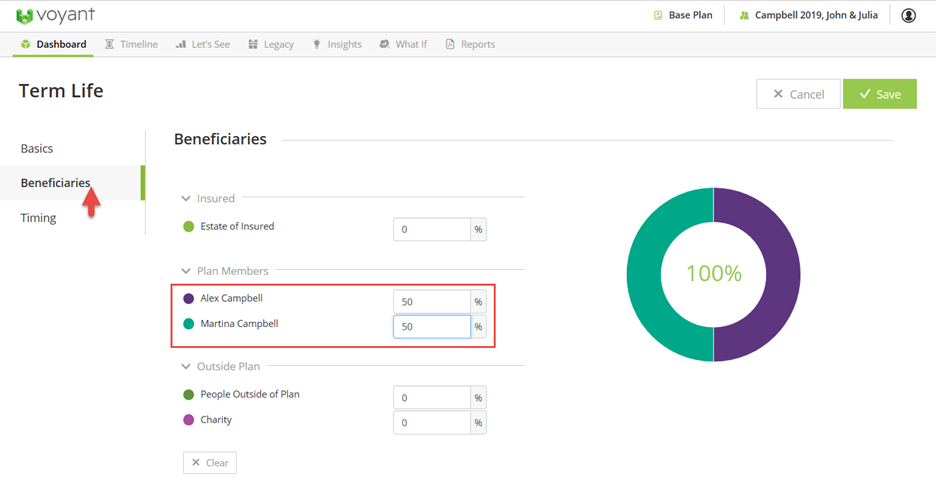

Setting Beneficiaries on Individual Assets and for Protection Policies

These are only the initial default distributions used by the software. Any beneficiaries designated for specific assets and protection policies will override the general estate distribution. If you specify beneficiaries for a term or whole life policy, for example, these distributions will be made accordingly, regardless of your plan’s overall estate distribution.

For example, the software may be set to assume that your surviving spouse would receive 100% of your estate, but if you were to designate a child as the sole beneficiary of your term life policy, the policy's benefit will be received by your child.

Note – If you do not designate at least one beneficiary for a protection policy, the software will assume benefits from the policy are distributed to the estate of the insured. This would be the case even if the policy is written in trust. To ensure that benefits paid from trust to specific people or to charity, rather than into the estate, either specify who the beneficiaries will be, if they are included as people within the plan, or set the policy beneficiary to the intentionally vague “persons outside of plan”.

Estate Plans - How to enter an alternative estate distribution

The Estate Plans screen allows you to specify overall estate distributions if they are to be handled differently from the software’s default assumptions.

1. To add an estate distribution to your plan, go to the Dashboard screen in AdviserGo.

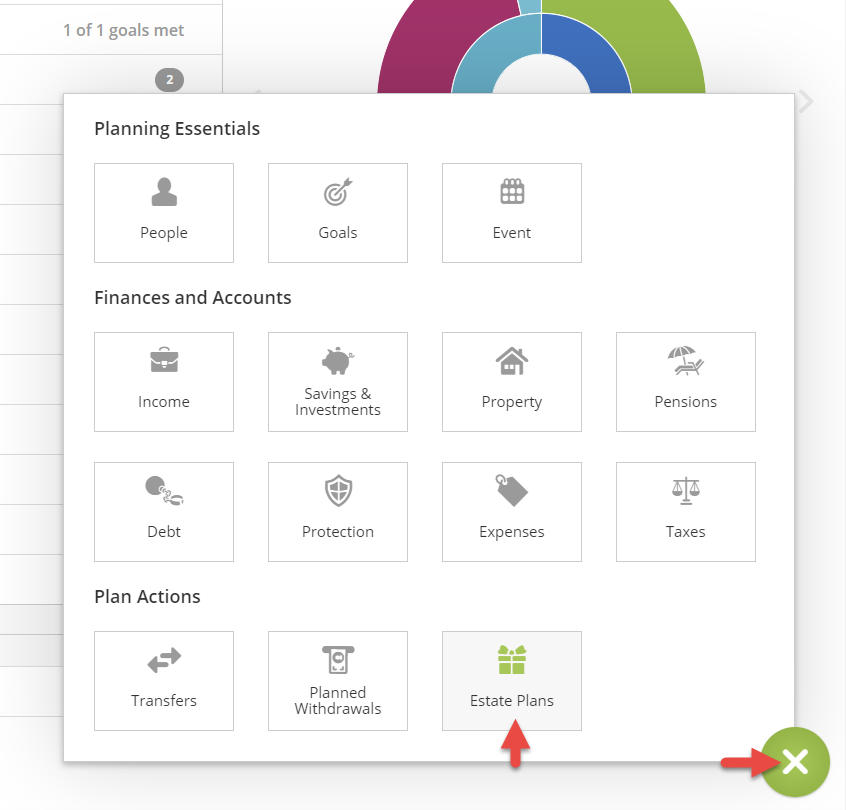

2. Click the plus (+) button bottom-right and select Estate Plans.

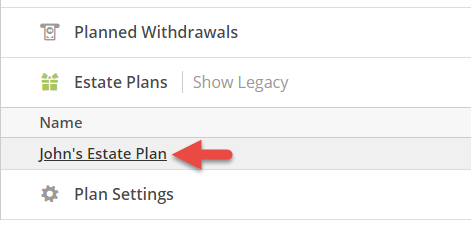

Or if you need to view or edit an estate plan which has already been entered, on the Dashboard screen in AdviserGo, expand the Estate Plans section of the dashboard and click the link to the estate plan.

If no Estate Plans section is shown on the Dashboard, your plan does not yet include any estate plans.

3. Owner - Select the person in the plan whose estate distribution you are entering.

In a plan, individuals can have only one estate distribution per person. If a person already has an estate distribution entered in the plan, their name will be filtered from this list of owners.

Estate plans can be entered for the primary client -- the first entered when setting up the plan -- and the primary client’s spouse or partner.

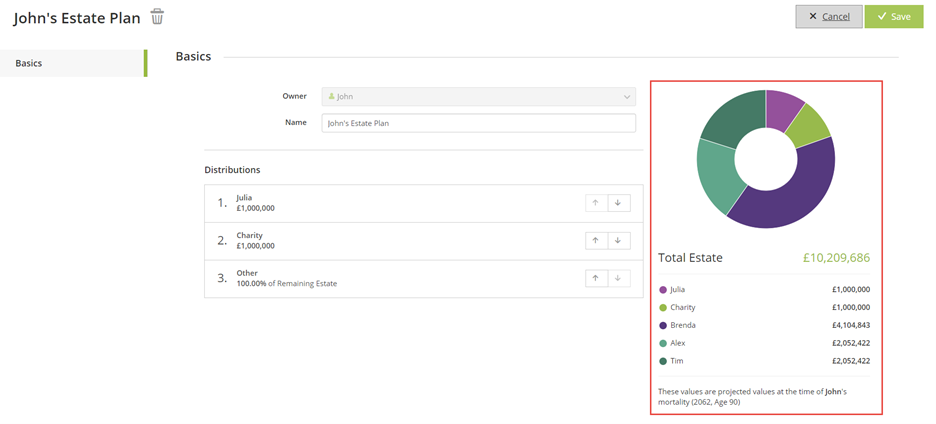

4. Name - The software will give the estate distribution a default name – e.g. Julia’s Estate Plan. You may enter in this field an alternative name for the estate distribution, if necessary.

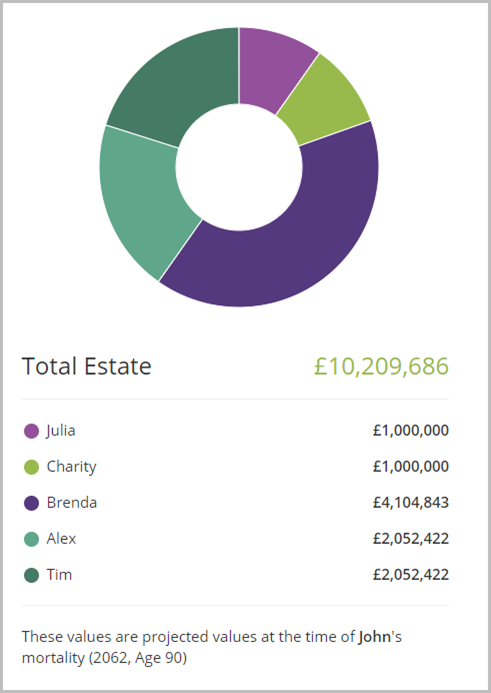

The right side of the screen shows the projected value of the owner’s estate at time of death. This total is normally a projection of one’s assets minus debts and other liabilities at time of death.

Note - Life expectancy is set on the Timeline screen, by positioning the person’s Mortality event on the planning timeline. The default life expectancy is normally age 90 or 100, but this can be changed by moving the Mortality event up or down the timeline.

Items that reside outside of your estate, such as pensions and trusts, are excluded from this number since this is an estate distribution. Protection policies and other items that have specific beneficiaries, such as the insurance element within bonds/life funds, will also be excluded from this total even if they are set to pay into the estate.

This estate allocation section of the screen is designed to give you a general idea of the future size of the estate and the amounts that could be distributed to the inheritors as specified in the estate plan.

The amounts shown are gross of any potential inheritance tax, if inheritance tax is applicable in your jurisdiction. This is not an actual estate tax calculation.

Case Study 1 – Leaving a Specific Amount to Children

To offer one example of how to set up an estate plan, let’s look at a plan for John and Julia Campbell, which includes their children, Alex and Martina. It is John’s wish to bequeath a specific amount, £500,000, to his children if he were to die before Julia.

To record his wishes and to tell the software to distribute John’s estate differently than it would normally, we will need create an estate plan (i.e. estate distribution) for John.

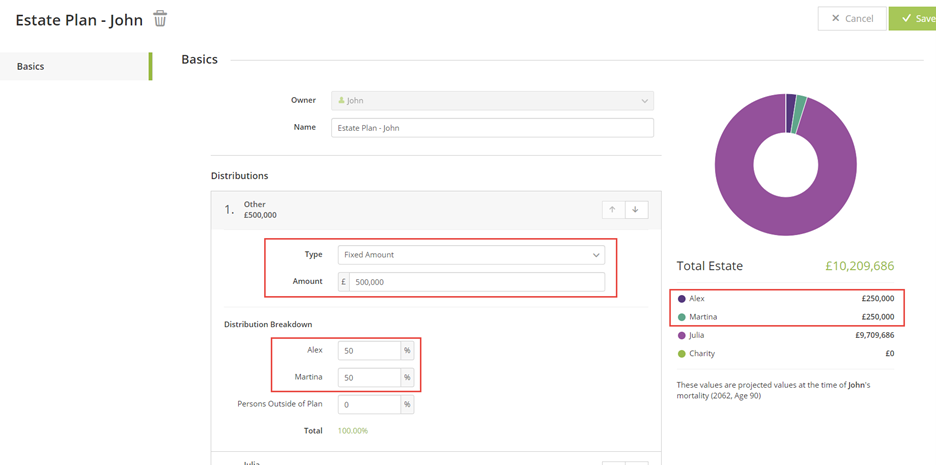

1. First, use the arrows to position the Others section at the top or middle of the list of distributions if it isn’t already so positioned.

2. Click the Others section, which will expand to show its details.

3. Type - Select “Fixed Amount”.

4. Amount – Enter in the total amount of the estate that is to be distributed £500,000. Again, this is a fixed future value that will not be inflated between now and death.

5. Distribution Breakdown - Enter for Alex 50% and for Martina 50%.

These instructions will result in £500,000 of the estate being divided 50/50 between Alex and Martina. Alex will receive £250,000 and Martina too will receive £250,000, as is shown in the distribution amounts on the right side of the screen.

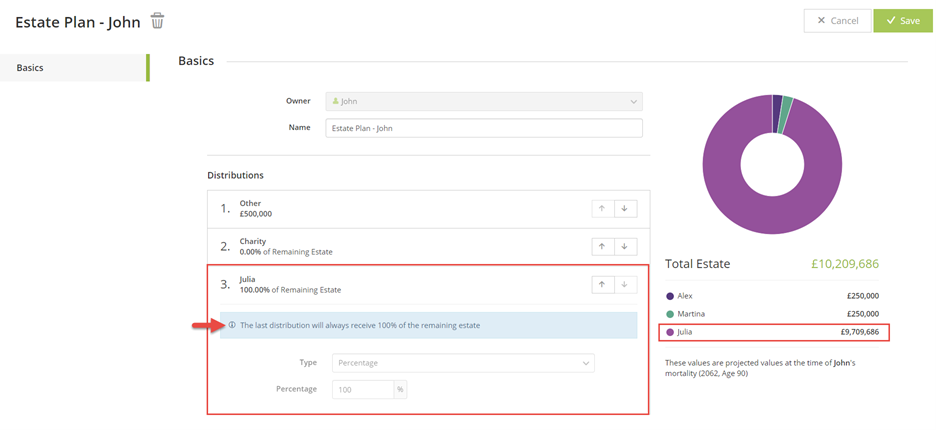

Since John has no plans to leave part of his estate to charity, this section of the distribution is left at 0%, so that the remainder of the estate will pass tax-free to Julia. Her section of the estate distribution is listed at the bottom of the Distributions list, meaning that she will receive all that remains in John’s estate after £500,000 of his estate is distributed to and split between Alex and Martina.

What would happen to John’s estate plan if he were to die after Julia?

If John is the first to die, bulk of his estate will be left to his wife Julia with a specified amount being split between his children. But what will happen to John’s estate distribution if Julia dies before John?

To avoid being overly complex, estate plans are assumed to relate to the assumptions you make in the plan about who is to die first and who will be the second to die. The software does not currently go to the level of specifying contingent beneficiaries in estate plans.

If you change these assumptions, which is most commonly updated in a what-if plan, consider revisiting the estate plans and adjust or delete them if they are not valid in the context of the scenario.

In John’s case, the software would still carry out the sections of John’s estate plan that are still valid, the distribution of £500,000 to the children. The remainder of the estate originally set to be inherited by his wife Julia will pass instead to “persons outside of plan”.

You might leave the estate distribution as is and assume that the distribution to unnamed “persons outside of plan” would go to the children. However, if in this scenario you would rather change the software’s assumption and divide the estate evenly among any survivors (in this case their children, Alex and Martina) then you could simply delete John’s estate plan, reverting to the software’s default logic.

Case Study 2 – A Second Marriage

Let’s look at another case that illustrates the flexibility of the reworked Estate Distribution screen.

• Jim Thompson and Susan Rutherford have recently married. Both were previously married and both have amassed their own wealth.

• Both also have children from previous marriages. Jim’s children, Tim and Brenda, are entered in the plan as are Susan’s children, Judy and Frank.

• They both want to leave a specific amount, £1,000,000, to one another.

• Jim would also like to leave 10% of his overall estate to charity to help reduce the inheritance tax on the remainder of his estate, which will be distributed to his children.

• They both want the remainder of their respective estates to be distributed equally to their own children. Tim and Brenda will receive the remainder of Jim’s estate; Judy and Frank will receive the remainder of Susan’s estate.

This type of arrangement would have been extremely difficult to model in earlier releases of the Estate Plans screen, as specific amounts could not be left to a charity or a spouse. Only a percentage of the remaining estate could be bequeathed either.

To distribute their estates in this manner, we cannot rely on the software’s default assumptions about estate distributions. We will need to enter the details in an alternative estate plan for Jim and one for Susan.

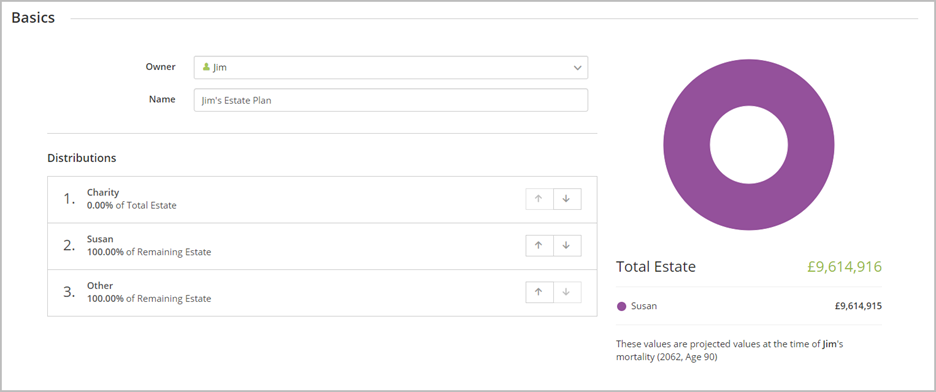

Let’s begin with Jim’s estate.

1. To add an estate distribution for Jim, go to the Dashboard screen in AdviserGo.

2. Click the plus (+) button bottom-right and select Estate Plans.

3. Owner - Select Jim.

4. Name - Leave the default name, “Jim’s Estate Plan", in place.

Now let’s rearrange the subsections under Distributions so that they begin with the most specific distributions, those to his wife and to charity, and end with the distribution of the remainder of the estate to his surviving children, Tim and Brenda.

5. Use the up-arrow button to move Charity to the top of the list, if it isn’t already the first item listed. Since the plan is to reduce the inheritance tax rate by leaving 10% of his overall estate to charity, it is best to begin with this charitable gift at the top of the list.

Note - If we were to position his wife Susan’s distribution of £1,000,000 at the top of the list, the software would then leave 10% of his estate after the distribution of the £1,000,000. This would result in less than 10% of his overall estate going to charity.

6. Use the up-arrow button to move his wife Susan’s section to the middle of the list.

With these adjustments, the Other section should be positioned at the bottom of the list and as such will receive the entire remainder of Jim’s estate after the first two distributions to Susan and to charity.

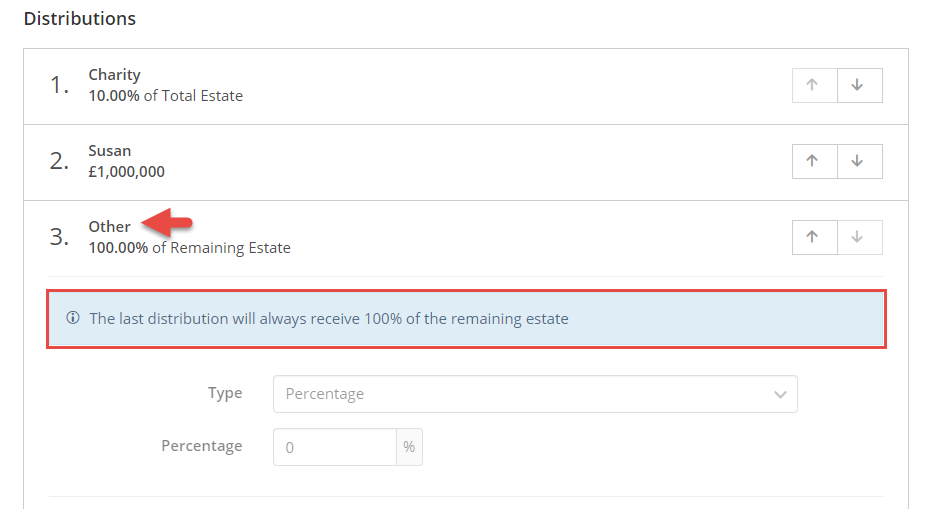

The estate distribution should be arranged as follows. Because of its position at the bottom of the list, Other will receive whatever remains in the estate after the first two distributions.

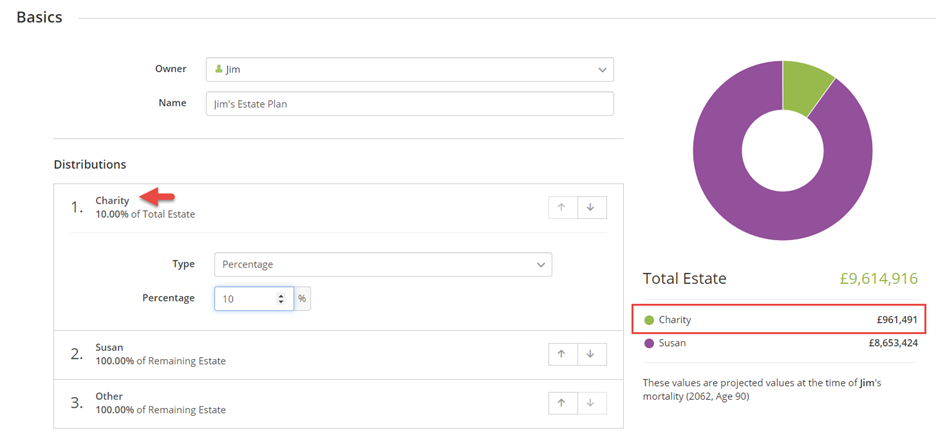

Jim plans to leave 10% of his overall estate to charity.

7. Click to expand the Charity section of the distributions.

8. Type – Select Percentage.

9. Percentage – Enter 10%.

The estate allocation to the right side of the screen will update automatically to show the portion of the estate allocated to charity. This estimated future distribution amount is an estimate gross of estate taxes.

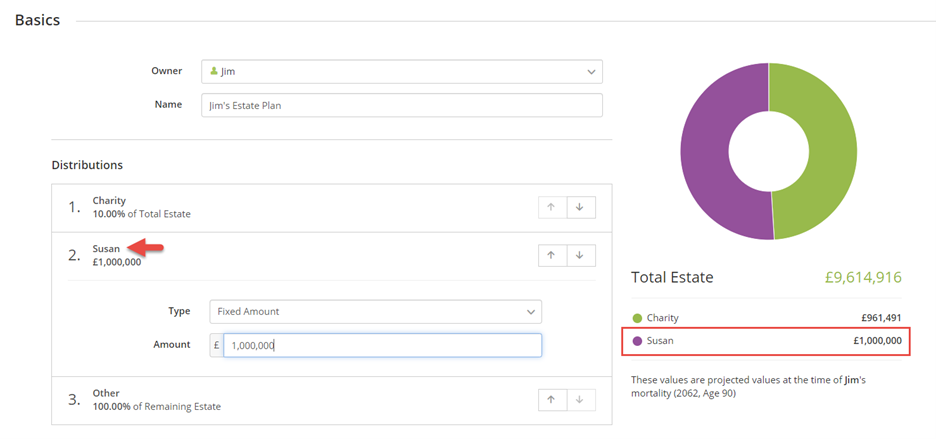

Jim wants to leave Susan, his wife, a fixed amount of £1,000,000.

10. Click to expand Susan’s section of the distribution.

11. Type – Select Fixed Amount.

12. Amount – Enter £1,000,000.

The estate allocation to the right side of the screen will update automatically to show the £1,000,000 allocated to Susan.

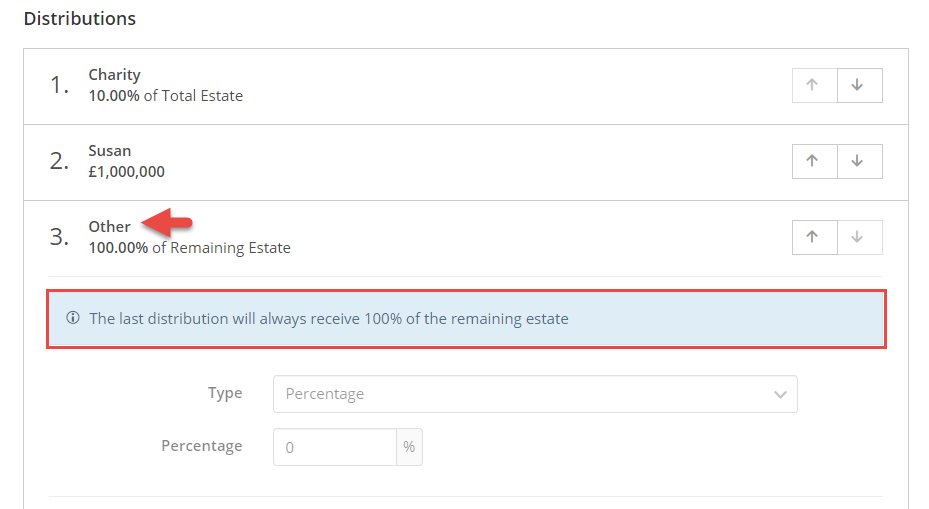

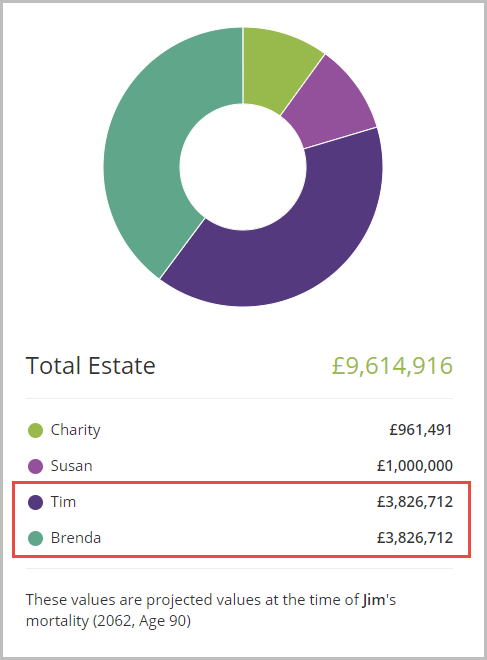

Jim’s children, Tim and Brenda, are to receive the remainder of his estate.

13. Click to expand the Other section of the distribution.

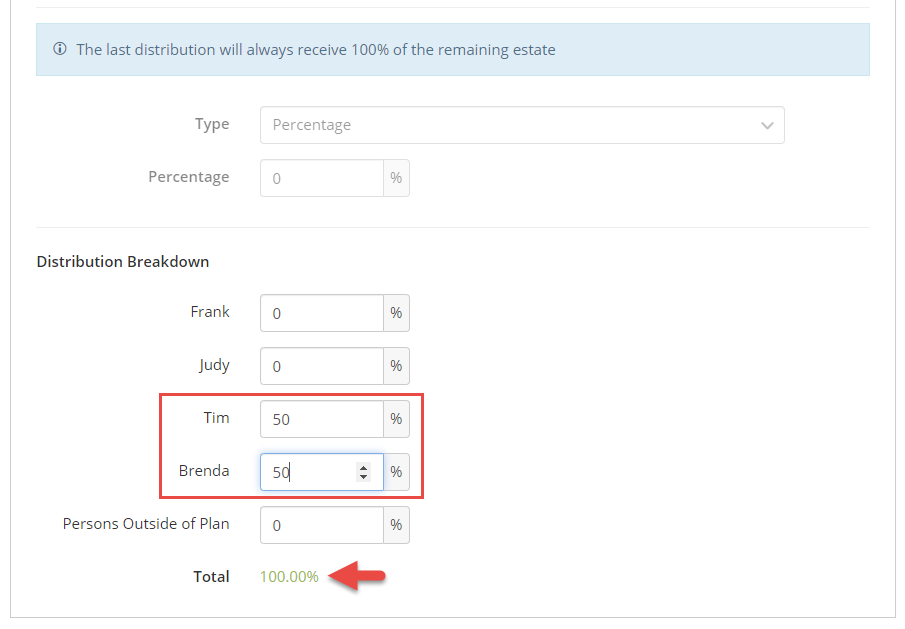

The Type and Percentage fields will be disabled. As the message above states, the last distribution in the list will always be set to receive 100% of the remainder of the estate – i.e. whatever remains in the estate once the top two distributions have been fulfilled.

14. In the Distribution Breakdown, enter 50% next to Tim’s name and 50% next to Brenda’s.

Note - Your entries in this section of the estate plan must result in 100% distribution of the estate. No portion of the estate can remain unallocated. At the very least you would need to account for unallocated amounts going generally to “Persons Outside of Plan”.

The estate allocation to the right side of the screen will update automatically to an estimate of the amounts remaining in the estate that will be distributed to Tim and Brenda. These amounts are gross of estate taxes.

15. Click Done top-right to save your changes.

Susan’s estate plan would be entered in a similar manner, omitting the amount left to charity and distributing the remainder of her estate to her two children, Frank and Judy.

1. To add an estate distribution for Susan, again, starting on the Dashboard screen in AdviserGo, click the plus (+) button bottom-right and select Estate Plans.

2. Owner - Select Susan.

3. Name - Leave the default name, “Susan’s Estate Plan, in place.

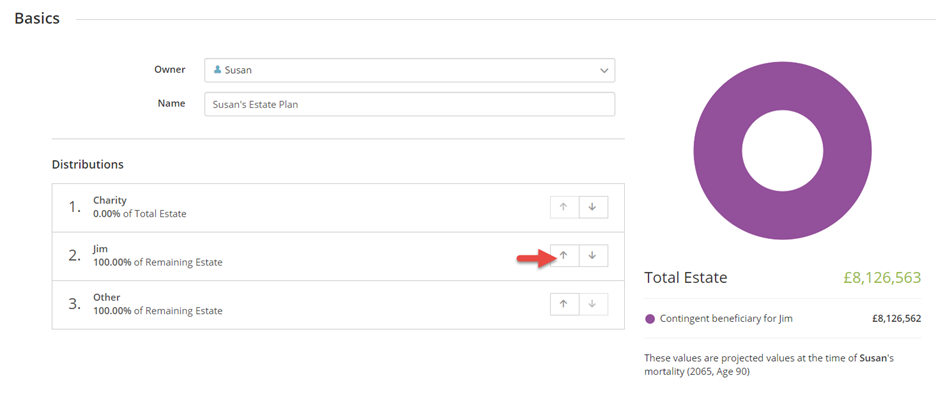

Rearrange the subsections under Distributions so that they begin with the most specific distributions, those to her husband and end with the distribution of the remainder of the estate to her surviving children, Frank and Judy.

4. You may leave Charity at the top of list with a default distribution of 0%. Susan doesn’t have plans to leave a portion of her estate to charity.

5. Use the up-arrow button to move her husband Jim’s section to the middle or top of the list.

With these adjustments, the Other section should be positioned at the bottom of the list and as such will receive the entire remainder of Susan’s estate after the first two distributions to Jim and to charity.

The estate distribution should be arranged as follows. Because of its position at the bottom of the list, Other will receive whatever remains in the estate after the first two distributions.

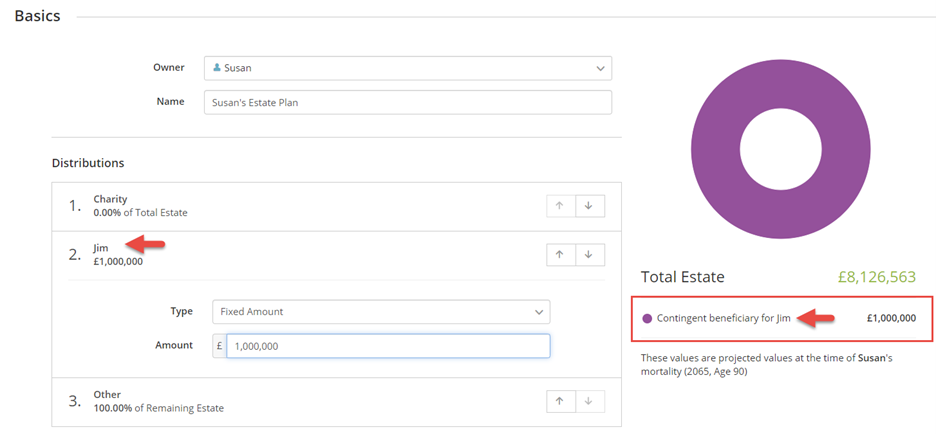

Susan wants to leave Jim, her husband, a fixed amount of £1,000,000.

16. Click to expand Jim’s section of the distribution.

17. Type – Select Fixed Amount.

18. Amount – Enter £1,000,000.

The estate allocation to the right side of the screen will update automatically to show the £1,000,000 allocated to Jim.

Notice that rather than going to Jim, the £1,000,000 is shown to be distributed to the “Contingent beneficiary for Jim”. This is the software telling you that based on the placement of Jim’s Mortality event on the planning timeline (on the Timeline screen), Jim is assumed to die prior to Susan. If we were to change this assumption, the £1,000,000 would be distributed to Jim. However, as the plan currently stands, it would be distributed to “persons outside of plan” who in a will would be listed as contingent beneficiaries.

Susan’s children, Frank and Judy, are to receive the remainder of her estate.

19. Click to expand the Other section of the distribution.

The Type and Percentage fields will be disabled. As the message above states, the last distribution in the list will always be set to receive 100% of the remainder of the estate – i.e. whatever remains in the estate once the top two distributions have been fulfilled.

20. In the Distribution Breakdown, enter 50% next to Frank’s name and 50% next to Judy’s.

Note - Your entries in this section of the estate plan must result in 100% distribution of the estate. No portion of the estate can remain unallocated. At the very least you would need to account for unallocated amounts going generally to “Persons Outside of Plan”.

The estate allocation to the right side of the screen will update automatically to an estimate of the amounts remaining in the estate that will be distributed to Frank and Judy. These amounts are gross of estate taxes.

21. Click Done top-right to save your changes.

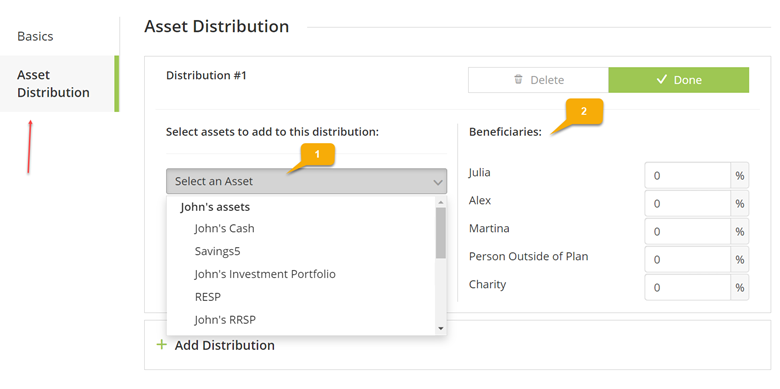

Designate beneficiaries for individual assets

The Asset Distribution tab allows you to set rules on how different assets in a plan are meant to be bequeathed to heirs. One can designate an asset or an account to heirs in their Estate Plan. Within one Estate Plan, an adviser may have several designated assets each with its own distribution rules. The heirs of an asset can be a charity, person in the plan or person outside the plan.

From this section, an adviser can select an asset and indicate the breakdown by beneficiary.

• owned or jointly owned by the owner of the Estate Plan.

• owned by a beneficiary of the asset,

• contingent inherited assets.

An asset can only be designated once. When it is added to a distribution, the asset is cleared from the selection dropdown. When the asset is removed from the distribution, it will once again, be added to the dropdown list of available assets.

Note - We have also taken this opportunity to add the concept of ownership type to properties. This allows an adviser to indicate whether jointly owned properties are joint tenants or tenancy in comment.

Calculation Notes

Assets are not liquidated unless there is a particular need such as paying a debt or taxes or if the liquidation timing was specified on the Asset Timing tab.

If an asset is not liquidated, it is transferred to the heirs according to the designation specified by the adviser. If the asset is liquidated, and after debts and taxes are paid, the liquidation funds are distributed to heirs per the distribution rules.