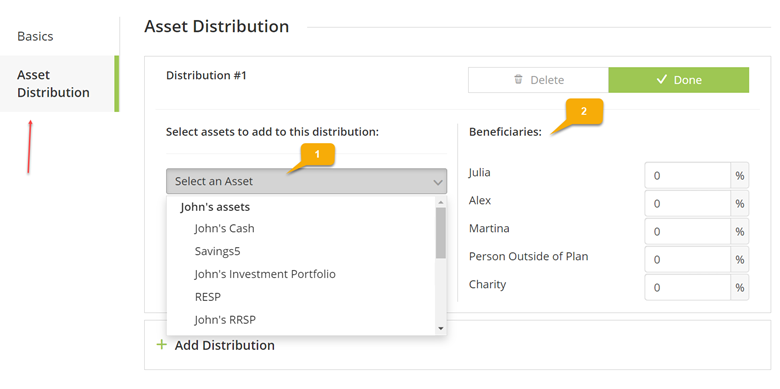

The new Asset Distribution option in the Estate Plan module sets the rules on how different assets in a plan are meant to be bequeathed to heirs. One can designate an asset or an account to heirs in their estate plan. Within one estate plan, an adviser may have several designated assets each with its own distribution rules. The heirs of an asset can be a charity, person in the plan or person outside the plan.

From this section, an adviser can select an asset and indicate the breakdown by beneficiary.

• owned or jointly owned by the owner of the Estate Plan.

• owned by a beneficiary of the asset,

• contingent inherited assets.

An asset can only be designated once. When it is added to a distribution, the asset is cleared from the selection dropdown. When the asset is removed from the distribution, it will once again, be added to the dropdown list of available assets.

Note - We have also taken this opportunity to add the concept of ownership type to properties. This allows an adviser to indicate whether jointly owned properties are joint tenants or tenancy in common.

Calculation Notes

Assets are not liquidated unless there is a particular need such as paying a debt or taxes or if the liquidation timing was specified on the Asset Timing tab.

If an asset is not liquidated, it is transferred to the heirs according to the designation specified by the adviser. If the asset is liquidated, and after debts and taxes are paid, the liquidation funds are distributed to heirs per the distribution rules.