The new Goal Priority Analysis offers a tool for goal-based planning, designed for having a deeper discussion with your clients about which goals are most important to them and what might be done to fulfill them. This insight offers advisers and their clients a dashboard on which to review goals, to see clearly which are being fulfilled and which are not, and an opportunity to reevaluate and reprioritize them.

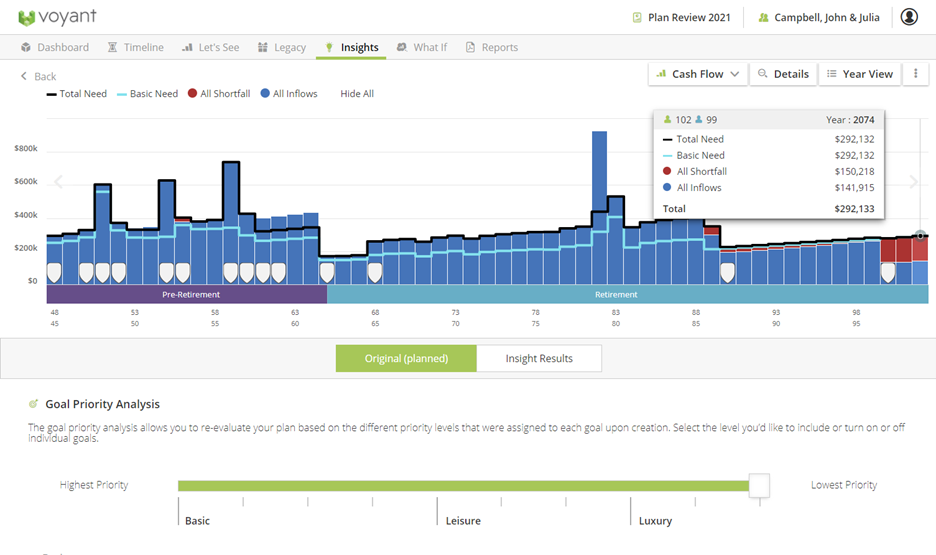

As may be the case at some point in a long-term cash flow projection, numerous planned goals and expenses may be in competition for finite resources. If the income and assets available at a given point in time are insufficient to completely fulfill one’s planned expenses and goals, the cashflow problem will be noted with a red shortfall in the Cash Flow chart.

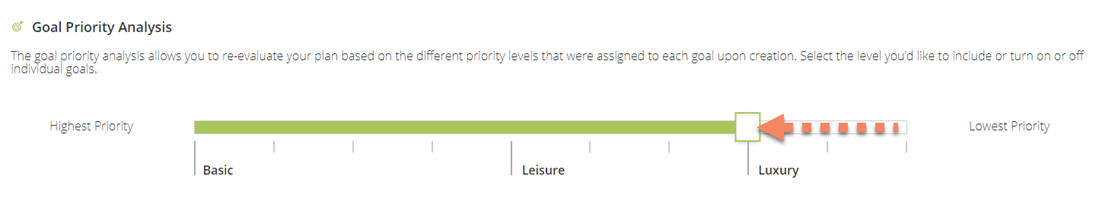

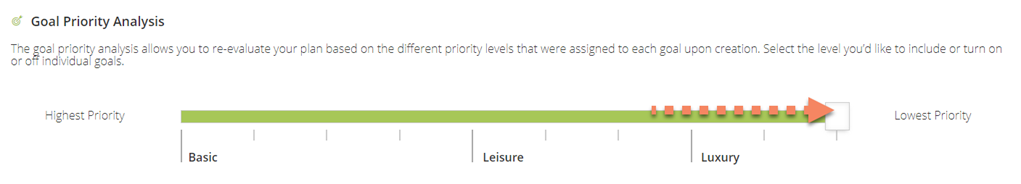

Which goals are most important to your clients and what is their impact on other goals and your client’s long term financial we wellbeing? When cash flow challenges loom in the horizon, the Goal Priority Analysis allows users to remove lesser, non-essential goals from a plan, based on priority level, and to rerun the plan to see if doing so results in a successful plan. For example, the slider could be used to omit all lower priority Luxury goals from a plan.

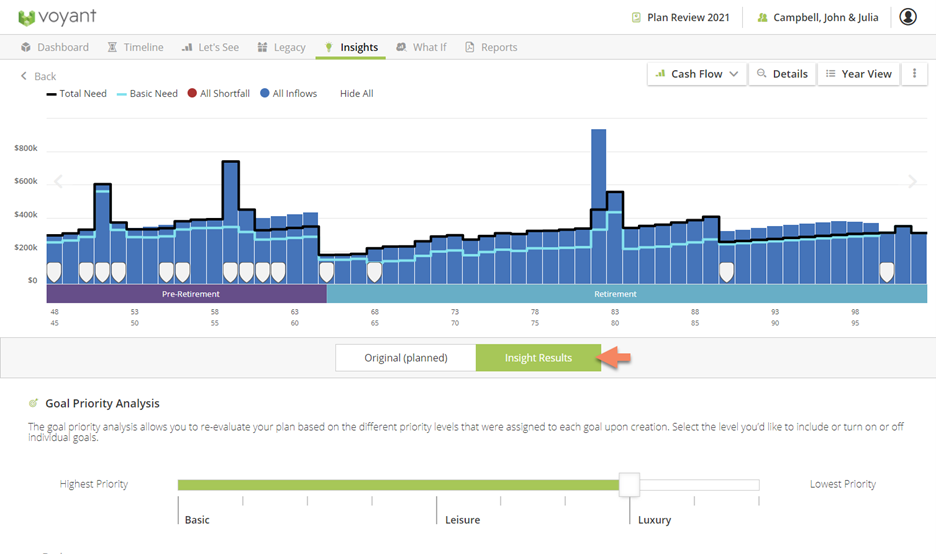

Scroll to the bottom of the screen and click Get Started to rerun the plan. The top of the screen will show the plan results with goals in the Luxury category and below omitted.

Note - This slider works interactively with the list of goals that follow it. If you use the slider to omit goals at certain priority levels, these goals will also be shown as being deactivated (disabled) in the list of goals below it.

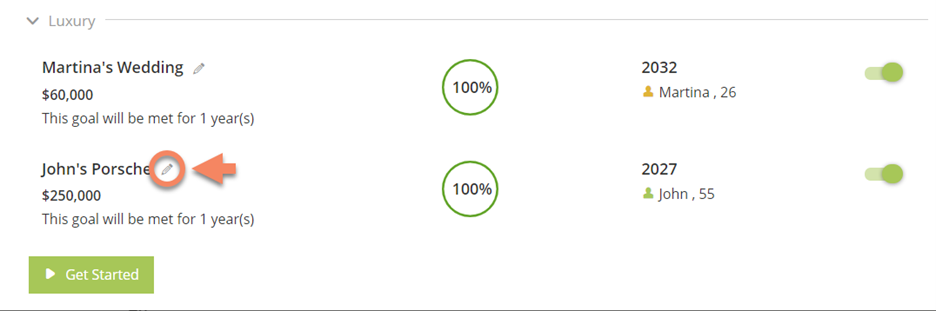

A more finessed approach might be to review and possibly omit specific goals.

A complete list of goals and their likelihood of success is shown in the middle of the screen.

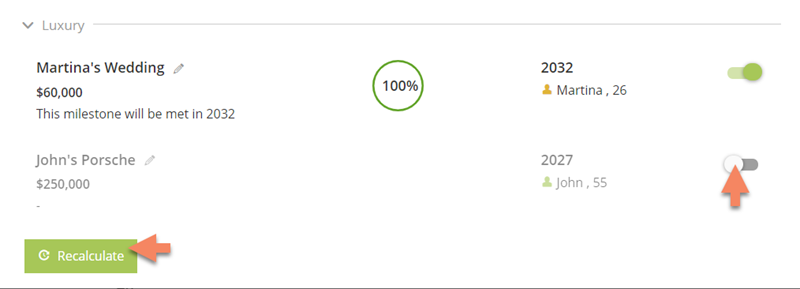

Individual goals can be omitted by switching them off. For example, we could toggle off John’s goal to buy a Porsche to see what effect omitting that specific goal would be to overall success of the plan. Sacrificing a particular goal might allow other goals to then be achieved.

Scroll to the bottom of the screen and click Recalculate (or Get Started) to rerun the plan.

Tip – If you a goal or a set of goals are already disabled (greyed out) in the list, check the slider at the top of the screen. This slider works interactively with the list of goals that follow it. If you have already used the slider to omit goals at certain priority levels, these goals will also be shown as being deactivated in the list of goals below it. Move the slider to the far right to restore a complete interactive list of goals to the screen.

Again, the top of the screen will show the plan results with any deselected goals omitted.

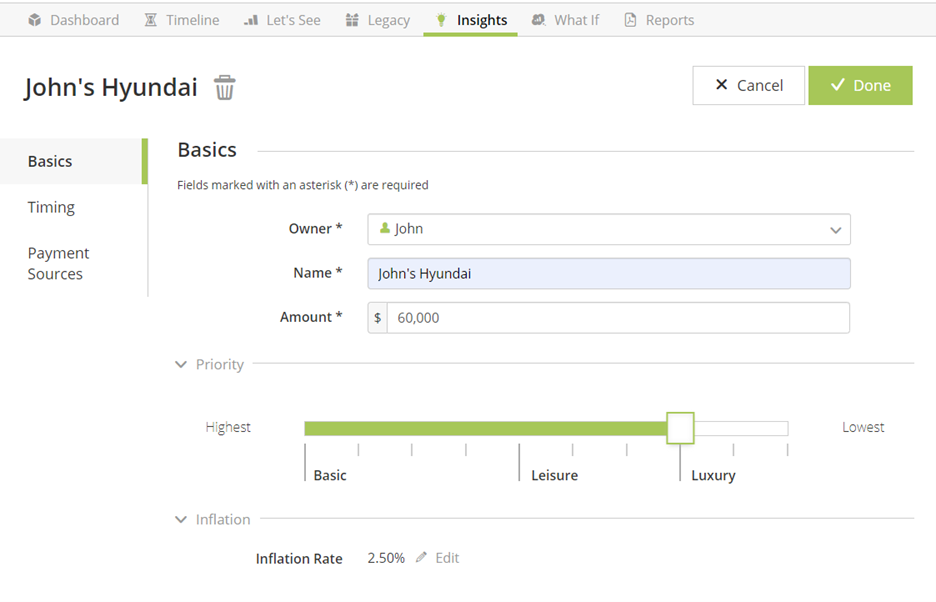

Accompanying each goal is an unassuming little edit icon. When clicked, this link will allow you to revisit goals and make edits to them on the fly. For example, we could click the edit link to revisit John’s car purchase, allocating perhaps a smaller sum to it or changing its prioritization, to then see what impact this would have on the plan’s success.

While previously goals were highlighted with the progress bars on the Timeline and Dashboard screens, with the introduction of the Goal Priority Analysis, advisers have even more of an incentive to enter future aspirational expenditures as Goals and to do goal-based planning with their clients.

Related Article

Added in Release 5.43.0 - 2021-04-05