AdviserGo will work out most of the future cash flow for you, if you let it. If annual income doesn’t fully meet planned expenses, the software will automatically top-up income from liquid assets in order to prevent potential shortfalls in the cash flow, provided you place no Liquidation Limits on these accounts.

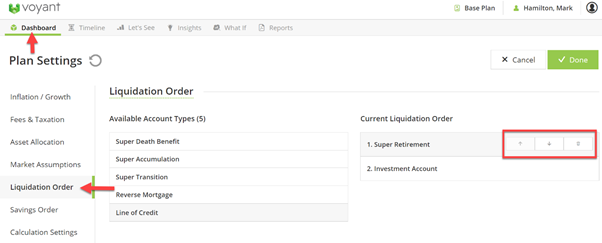

The order in which assets are liquidated, can be set at a very general level, by asset category, in Plan Settings > Liquidation Order. Plan Settings can be found on the Dashboard.

The software recognises that you have to take the minimum withdrawals from your Super and it will therefore prioritise these withdrawals above cash in the liquidation order.

The default liquidation order, which can be changed, is normally Super Retirement first, then Investment Account.

To change the high level Liquidation Order click on the category you want to move in the Current Liquidation Order column and use the arrows to move it up or down the list.

The Available Account Types in the left column allow for product-specific account types to be added and positioned among the broader asset categories. For example, if the strategy is to liquidate Super Transition before Super Accumulation, these two types of accounts could be added to the liquidation order to the right and positioned accordingly.

More information on each liquid asset category

Cash accounts are a category of accounts not shown in the Liquidation Order. These accounts are intentionally excluded from the Liquidation Order because they are usually liquidated prior to the types of accounts shown in the liquidation order. Cash accounts include:

- The notional, default Cash Sweep Accounts created by the software for each person in the plan (e.g. John’s Cash, Julia’s Cash),

- Current and Savings accounts.