A standard brokerage account, sometimes called a taxable brokerage account or a non-retirement account, provides access to a broad range of investments. This includes stocks, mutual funds, bonds, exchange-traded funds and more.

To enter this type of account into the AdviserGo software follow the steps below.

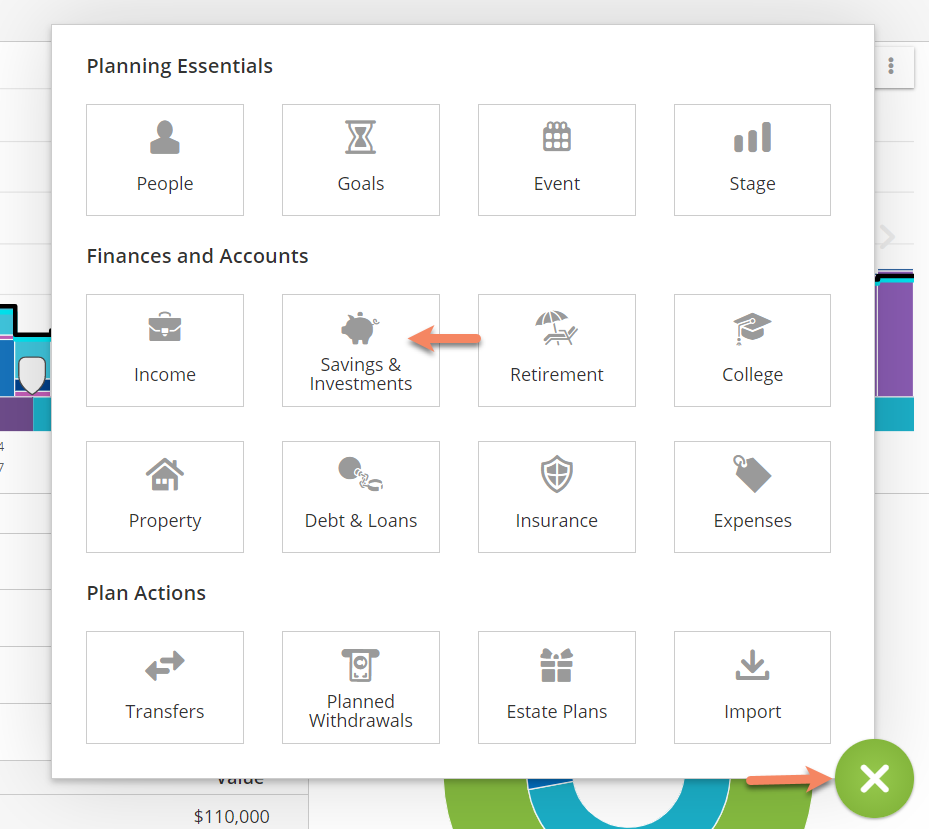

From the Dashboard click the (+) button and select Savings and Investments.

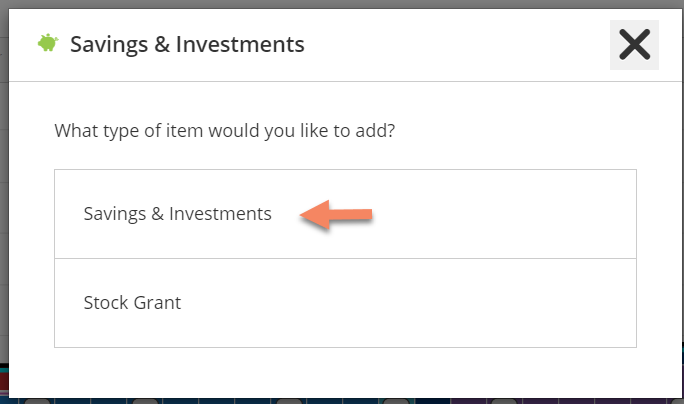

Select "Savings & Investments".

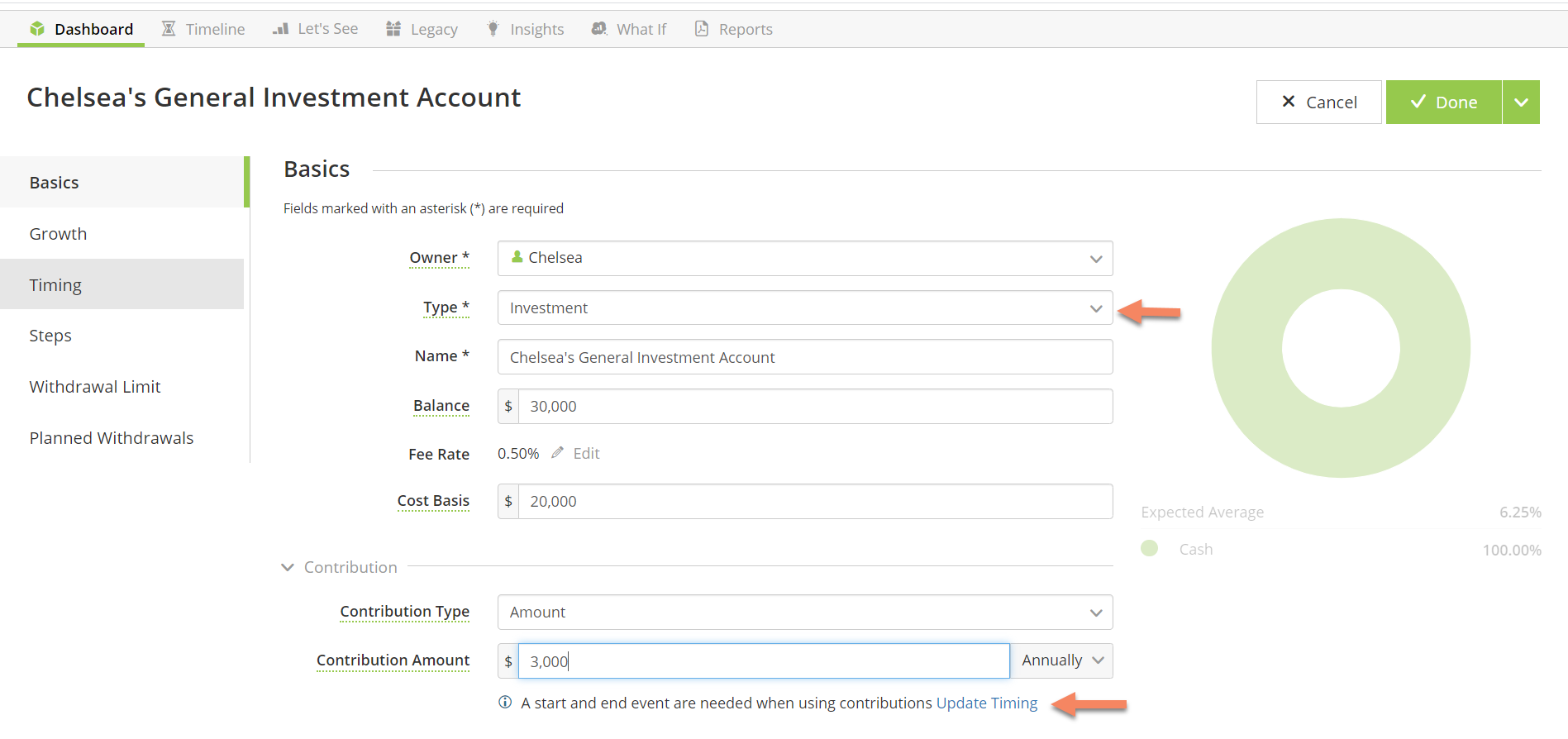

Enter your basic Investment information. If your client is currently making contributions to this account make sure to enter contributions at the bottom of this screen. If you are entering contributions you will be prompted to click on "Update Timing".

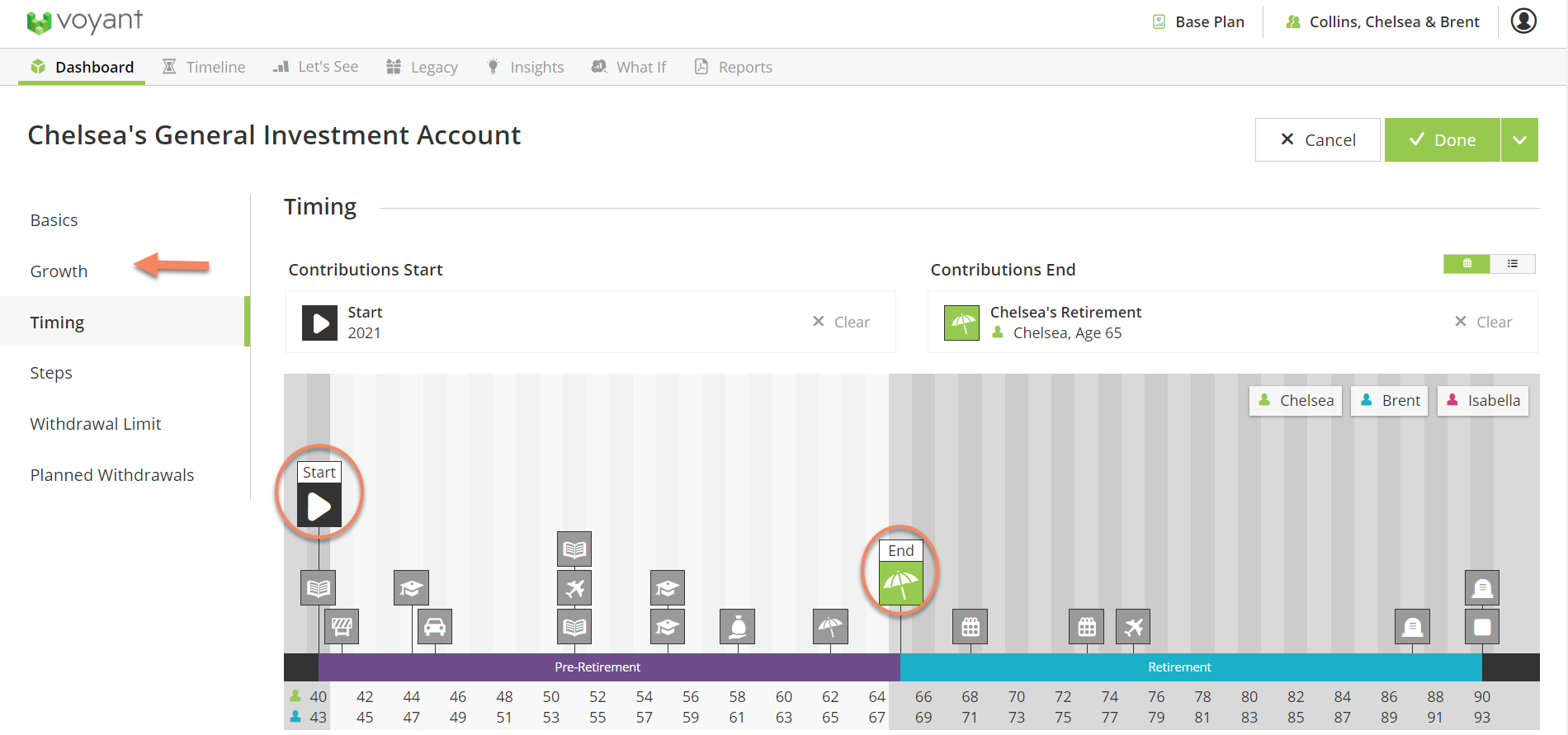

Select your Start and End Events for the contributions. You can either select already existing events on your timeline or you can double click anywhere on the Timeline to create a new event. From here let's look at the "Growth" tab.

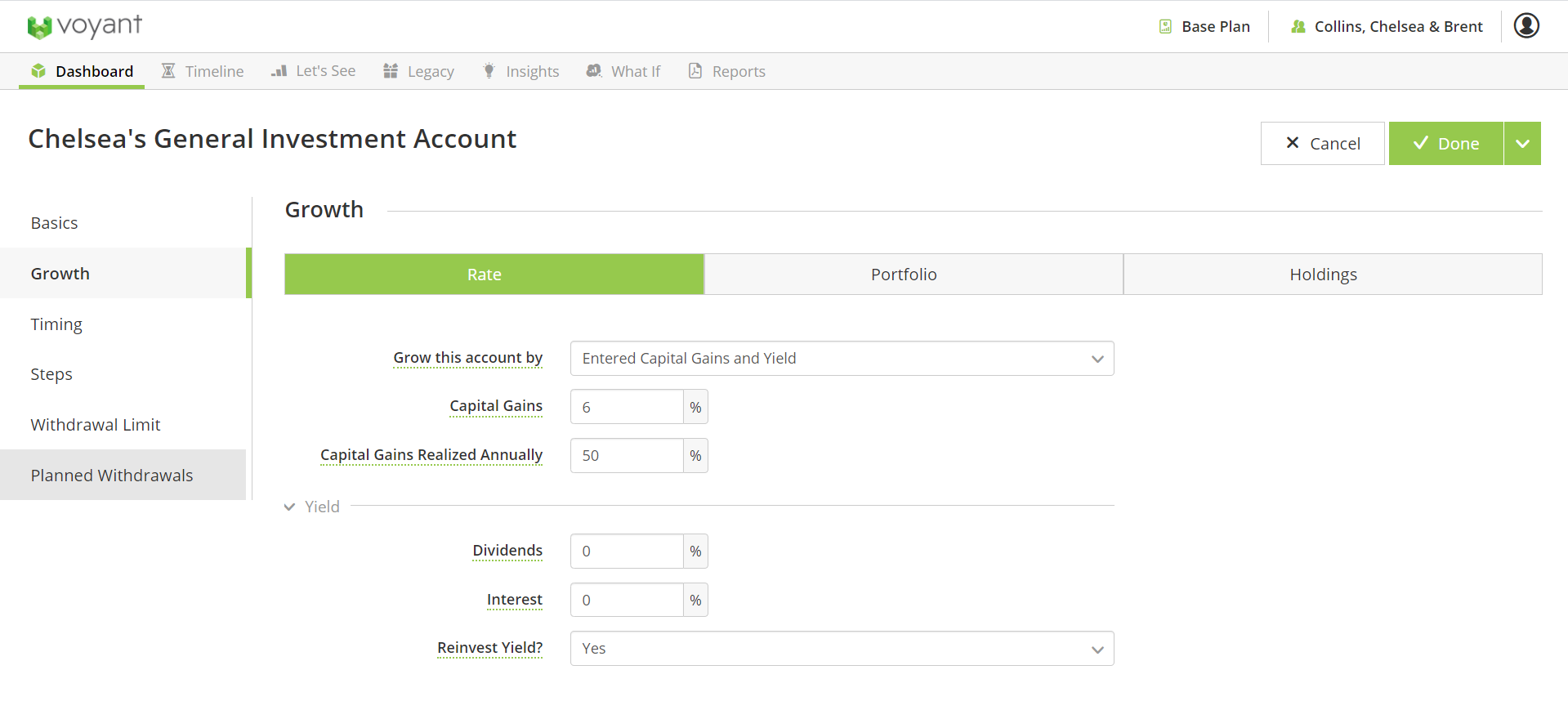

You can either operate off of a general growth rate like in the following example where it is set to 6%.

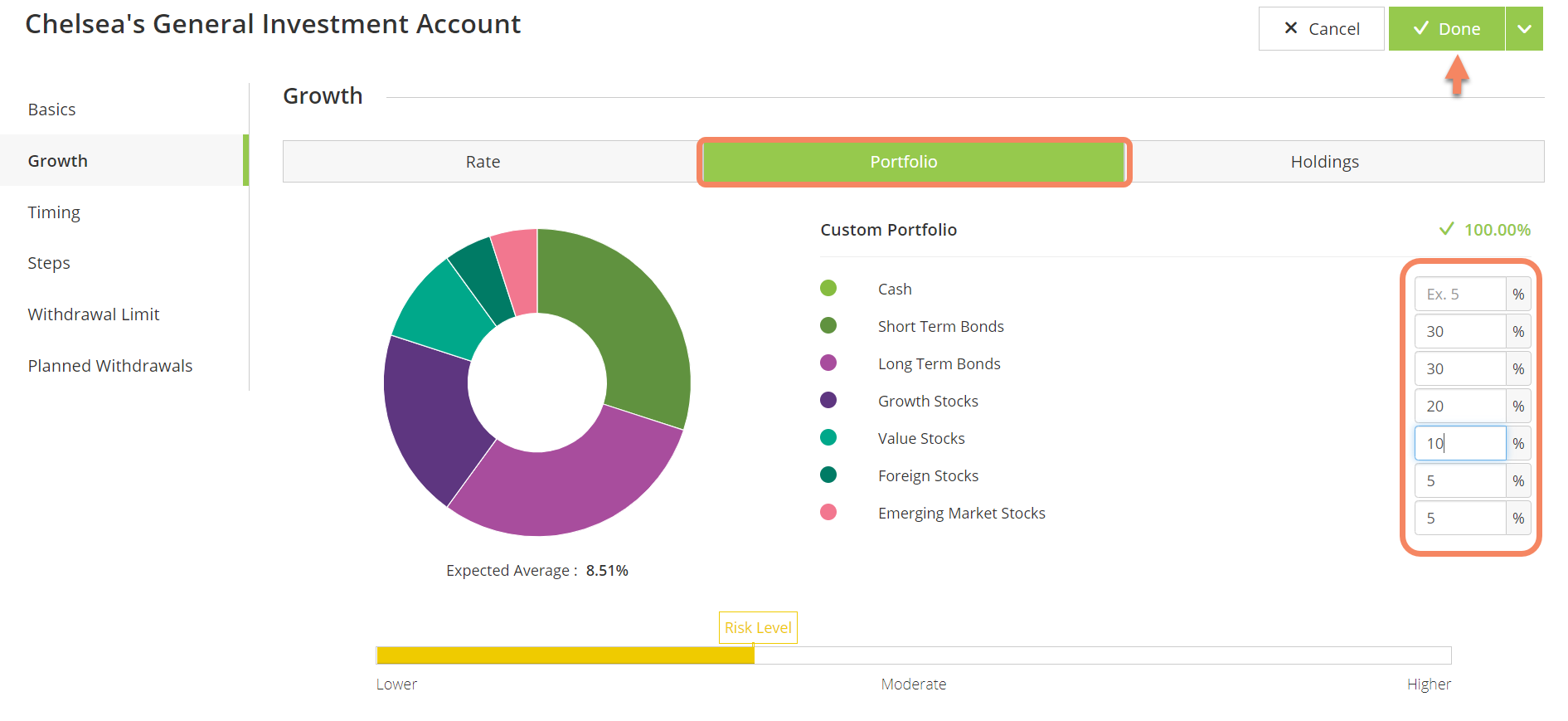

Or by clicking on the Portfolio tab you can enter a diversified portfolio. (Example below) Click "Done" to save and return to the Dashboard.

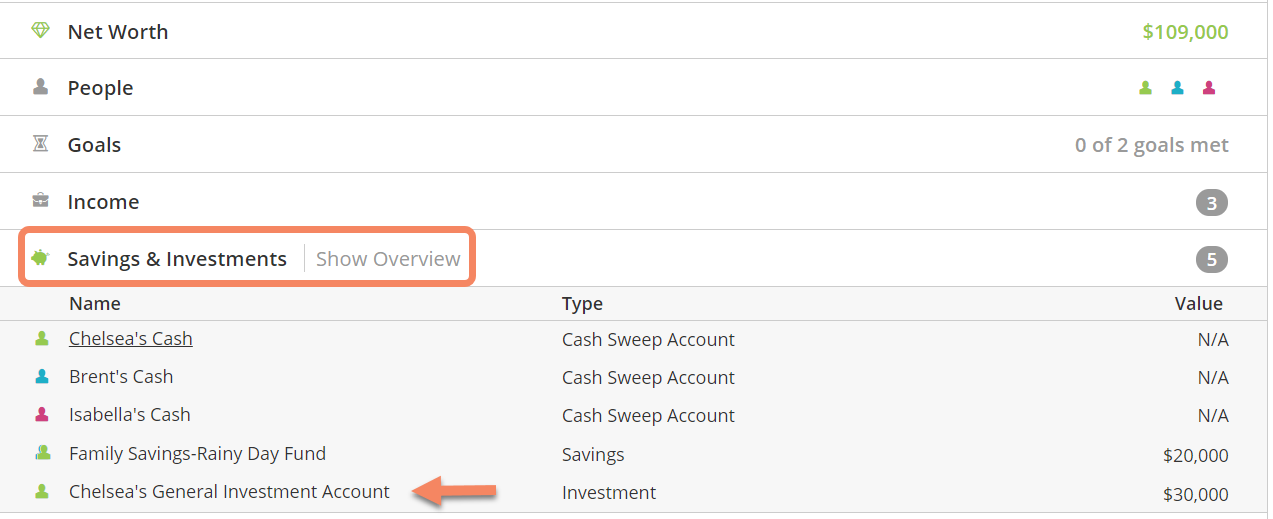

You will then be able to access and edit this account from the Dashboard under the Savings and Investment Section.

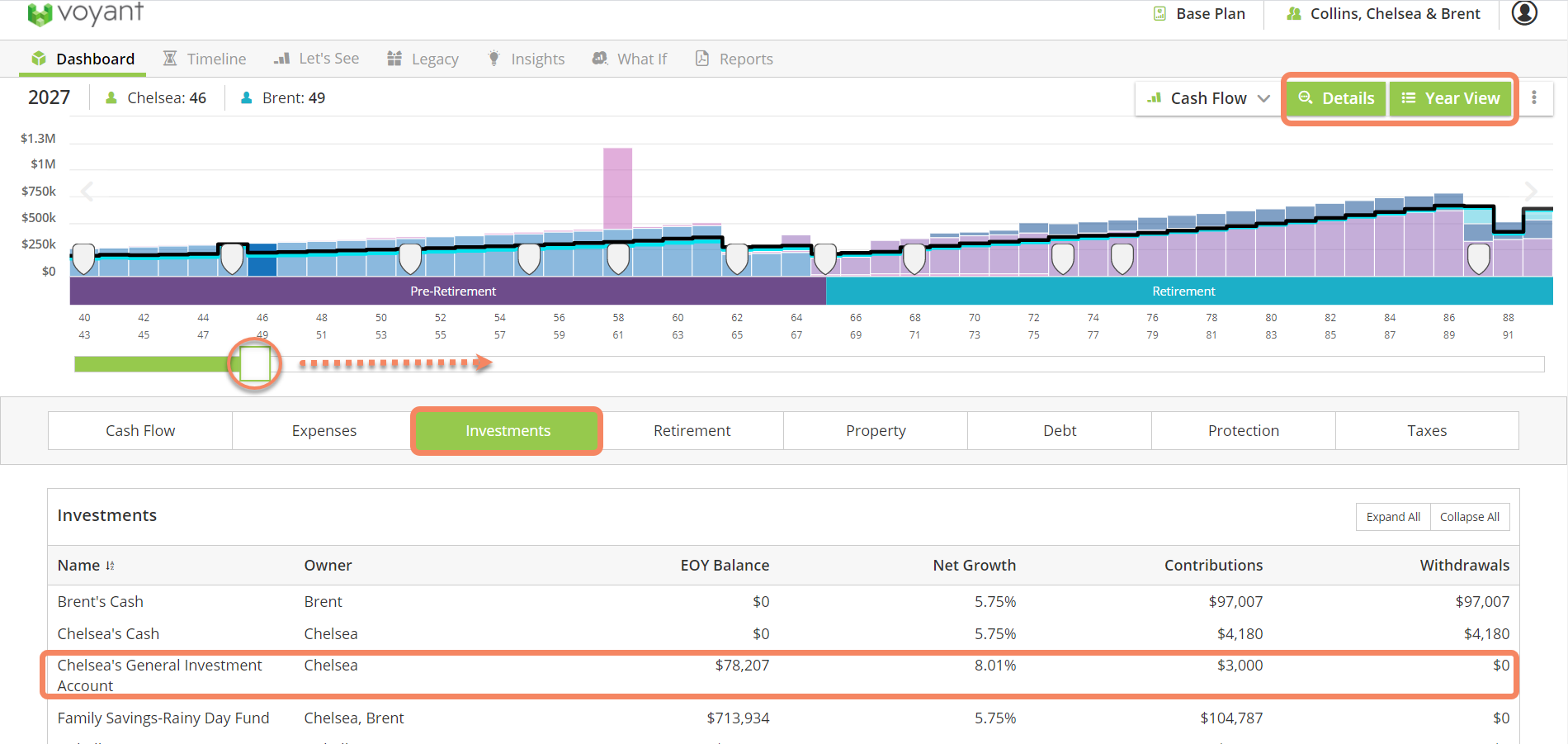

To see how the software is using this account in the background go to the Details>Year View screen. Select the Investments tab and move the slider up and down the Timeline to see details.

Note: By default this account will be set to an "as needed" withdrawal strategy in Retirement. Meaning this account may be drawn upon in Retirement to help avoid a shortfall in the plan. To amend this and set a different strategy please read more about planned withdrawal strategies.