Capture surplus income through contributions into Savings and Investments

Leaving surplus income set to be assumed spent often gives AdviserGo the opportunity to test for savings shortfalls, lower than necessary returns on investments, or potential future issues with liquidity.

You can then have proactive planning discussions with your clients and model the effect of future savings and investments. Planned future contributions can be set to capture some, if not all unallocated income, thereby allocating it to specific accounts. This process encourages a discussion with your clients about where they might best invest or save their future surplus earnings.

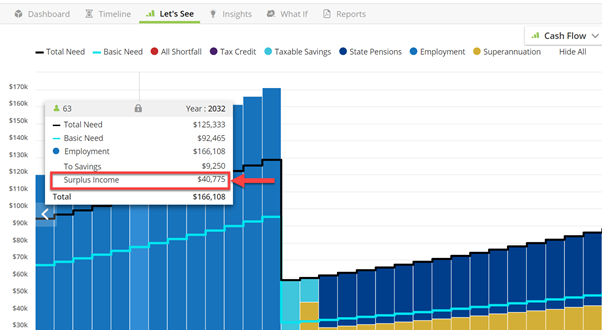

The black line running across the cash flow chart is the need line. This line represents your client’s total annual taxes, expenditure, and any planned savings and investments that are being met successfully in that year of the plan. When a bar of the cash flow chart exceeds the need line, this indicates either unallocated surplus or in some cases liquidations and transfers.

If you plan to deposit previously unallocated surplus into investments and savings, the black need line will rise to show that this surplus income is being captured through planned contributions.

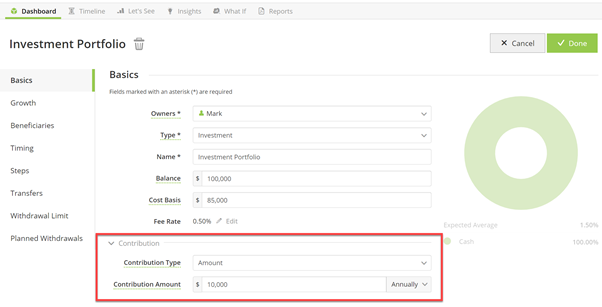

To set regular contributions to a savings account, select a savings or investment account or a pension scheme in the plan.

Tip - You could also create a hypothetical future investment to which future contributions will be scheduled. If the account does not currently exist, simply create an account with a zero balance, at present. This empty account will act as a container, which later will be filled with planned future contributions, provided the funds are available.

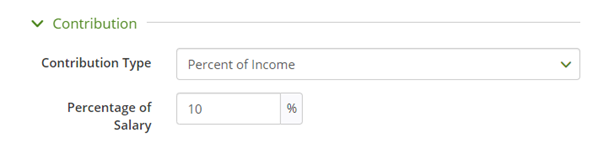

In the Contribution $ field: Enter the annual contribution amount or set contributions as a percentage of the owner’s income.

Note - If you set contributions as a percentage of income, once the owner’s earnings (employment income) end so too will contributions. This rule does not apply to fixed contributions.

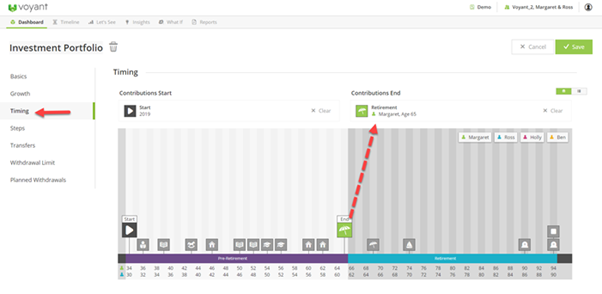

Go to the Timing tab. Selections on this screen will be used to set the time span over which the contributions are to be made to the account.

- Select a start event - an event to schedule the beginning of these contributions. Drag the event icon up from the timeline below into the Contributions Start box above. If contributions are to begin as of the start of the plan (e.g. your client is already making regular contributions), simply select the Start

- Select an end event - an event to indicate when these contributions will end. Drag the event icon up from the timeline below into the Contributions End box above. If contributions are to occur until the very end of the plan, select the final Mortality event as the end event.

If you don't already have events on the timeline that are positioned appropriately to be used as start or end events, new ones can be easily added by clicking double-clicking any bar of the chart and adding new events on the fly.

Scheduled future contributions will only be made if funds remain available after expenses are met.

Future contributions will be reflected in the position of the black need line on the Let’s See cash flow chart.

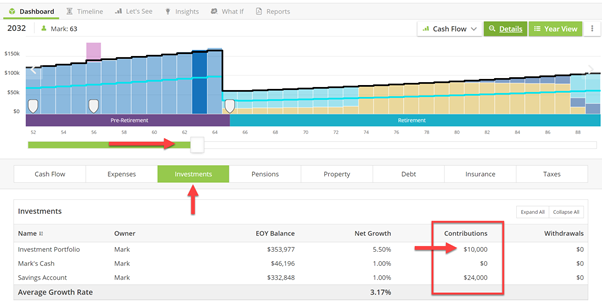

To view these contributions, go to the Dashboard or the Let’s See screen and double-click any bar of the chart or click the chart details button, top-right.

The chart details will then be shown.

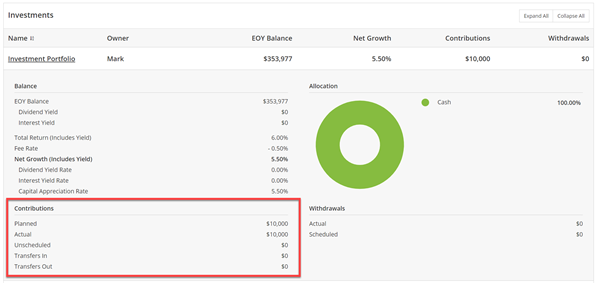

Select the Investments tab. Total contributions will be shown in the Contributions column.

Click the name of the investment to expand the panel, which will show further details about the account including the original planned contribution and the amount of the actual deposit. The actual deposit may be lower than the planned contribution if the funds are unavailable to make the full deposit or if the planned contribution exceeds allowable contribution limits.