Scheduling planned withdrawals from your client's retirement account

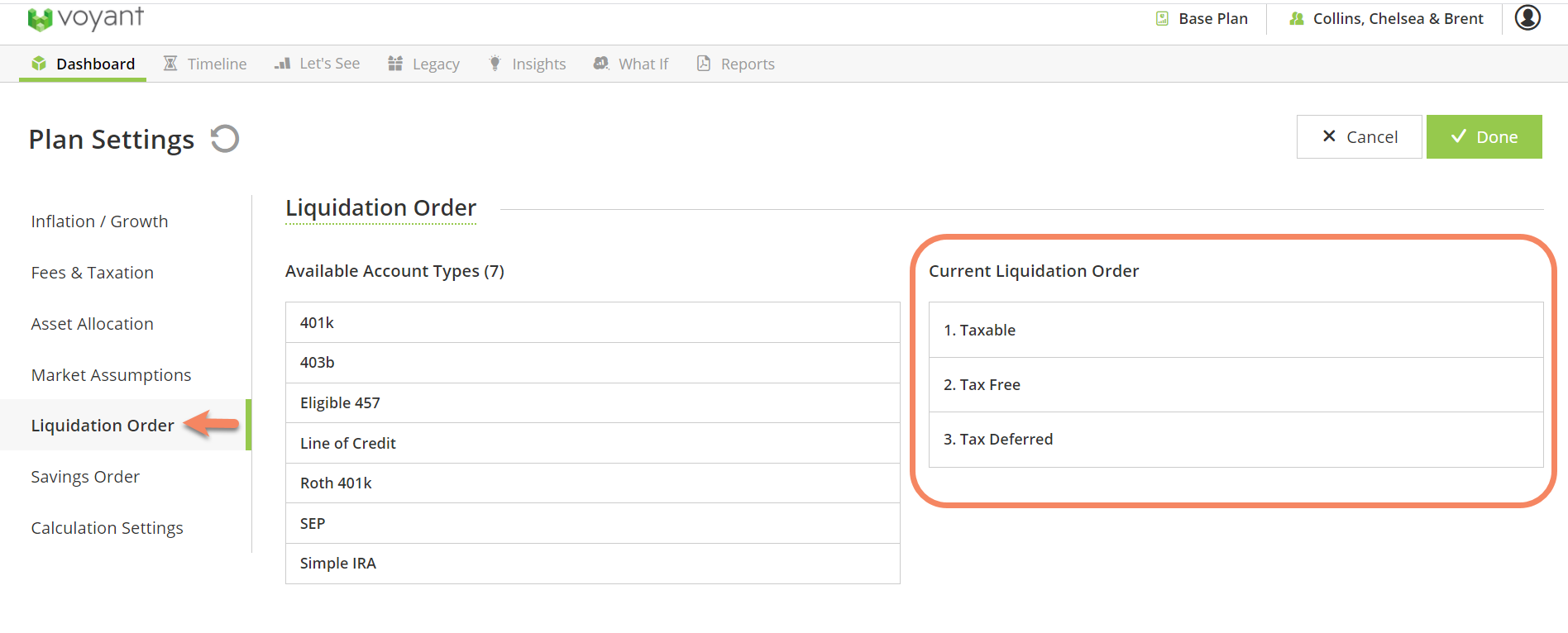

Voyant normally takes withdrawals as needed from liquid assets whenever your client’s future incomes fail to completely meet their annual expenditures. Whenever there is an income gap, assets are drawn upon automatically. The order in which assets are selected for top-up withdrawals is based on a default liquidation order which is set in the software’s Plan Preferences.

Since the software will attempt to cover future expenses automatically, you don’t have to specify payment sources for future expenses or even schedule future withdrawals from accounts. Voyant will handle this for you, which is enormous time-saver, allowing you to focus on presenting your advice rather than getting bogged down in minutiae of charting out future cash flow.

If however, you want to take a more hands-on approach to setting your clients’ future income strategy, Planned Withdrawals is a powerful tool to help you do so. Planned withdrawals can be used to illustrate the tax efficiencies of certain drawdown strategies, especially in retirement.

How to Schedule Withdrawals Step-by-Step in a Retirement Account

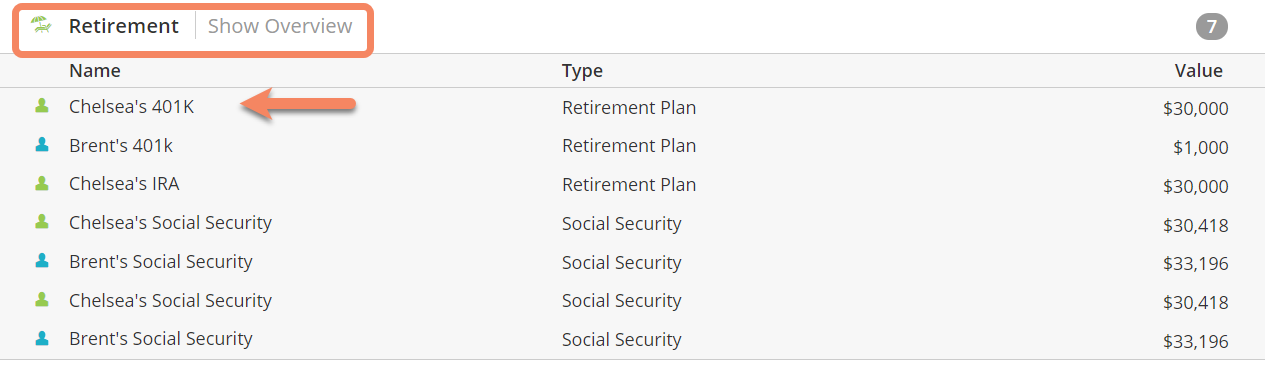

From the Dashboard go to the Retirement Section and select the account you would like to schedule Planned Withdrawals from.

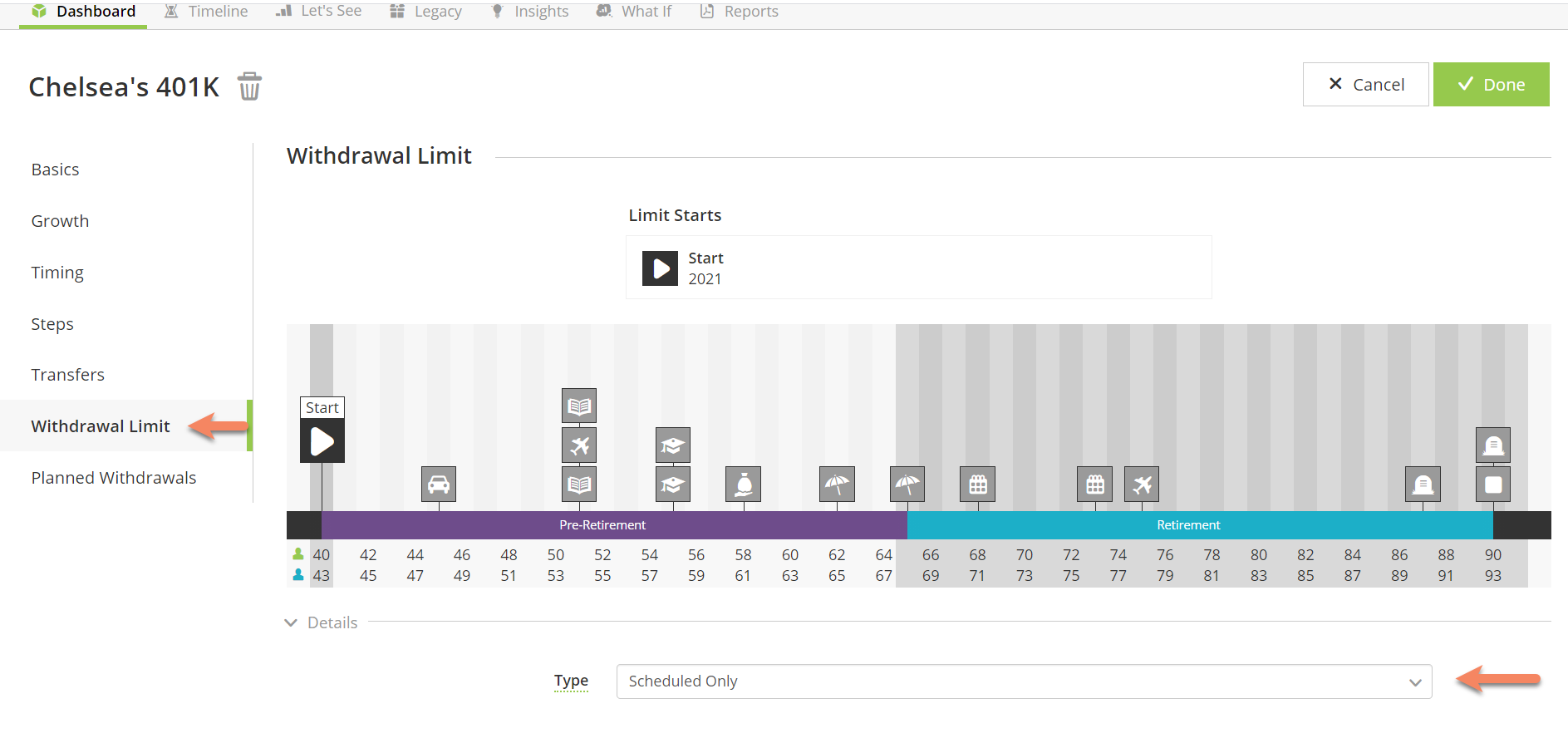

Go to the Withdrawal Limit section and change Type to "Scheduled Only" from "As Needed". This will ensure that the software only withdraws money from this account as directed rather than as needed.

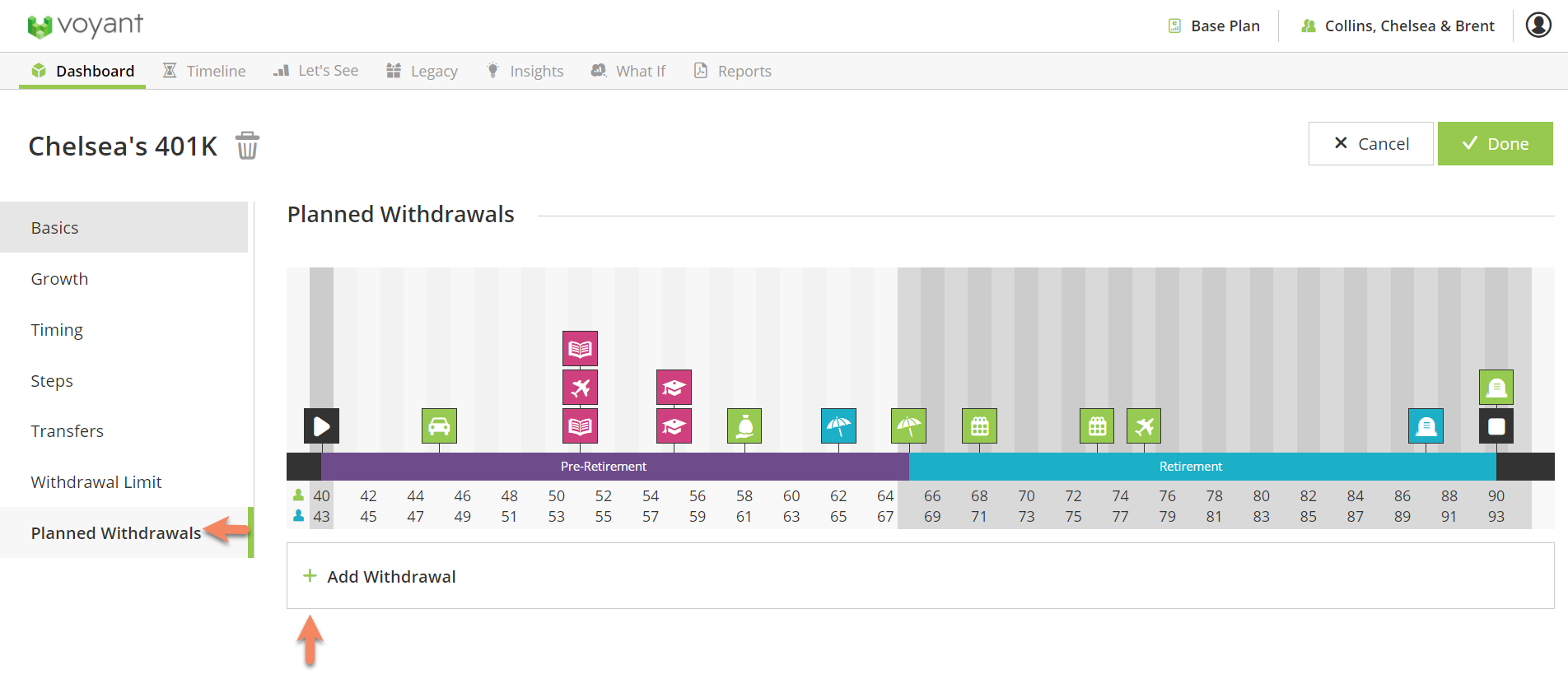

Now go to the Planned Withdrawal section and click the (+) button to add a planned withdrawal.

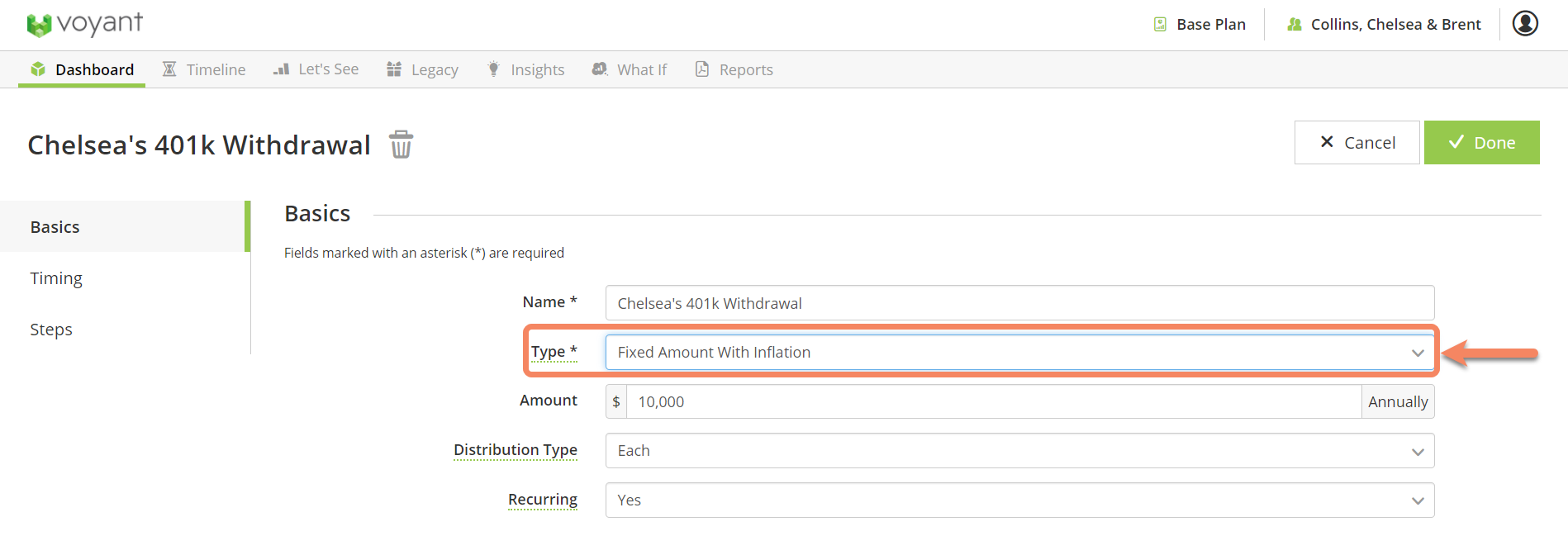

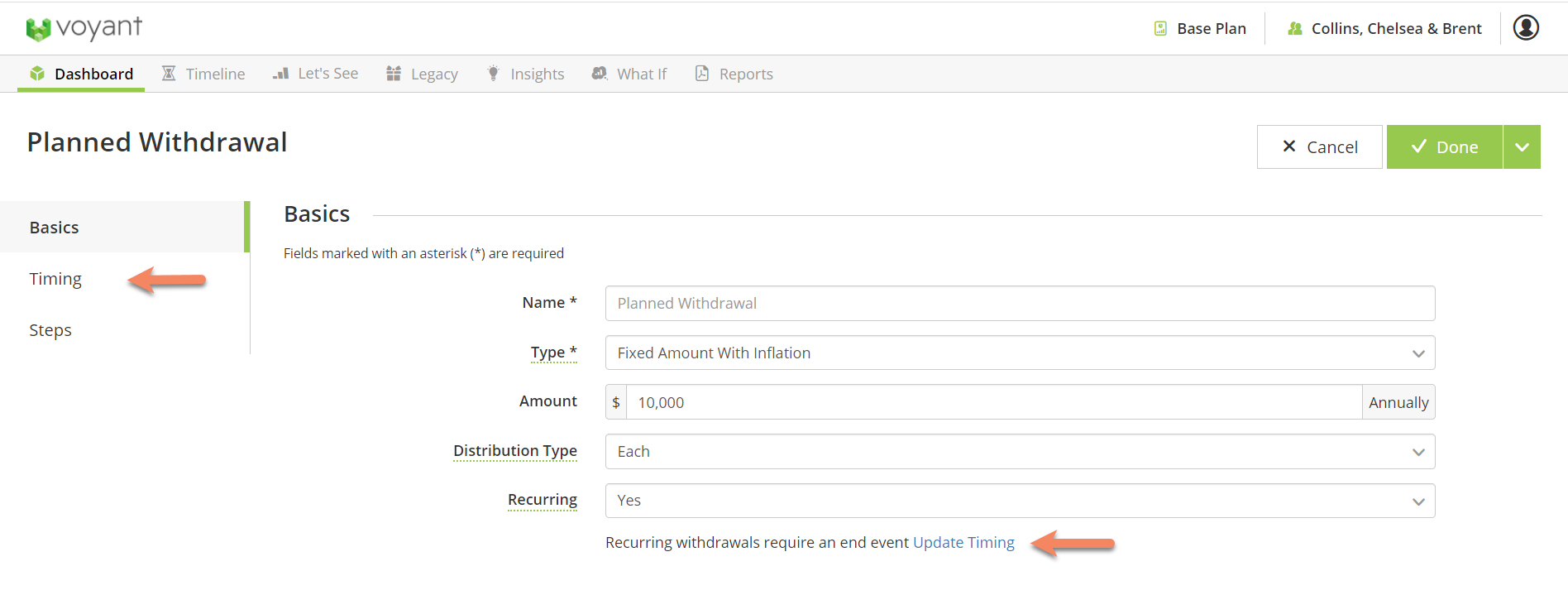

Enter the basic information for your scheduled withdrawals here. If you set this to recurring withdrawals an option will pop up to "Update Timing" click on this to schedule when these withdrawals will occur.

Note- If you are scheduling a one time only withdrawal you can simply click on the Timing section.

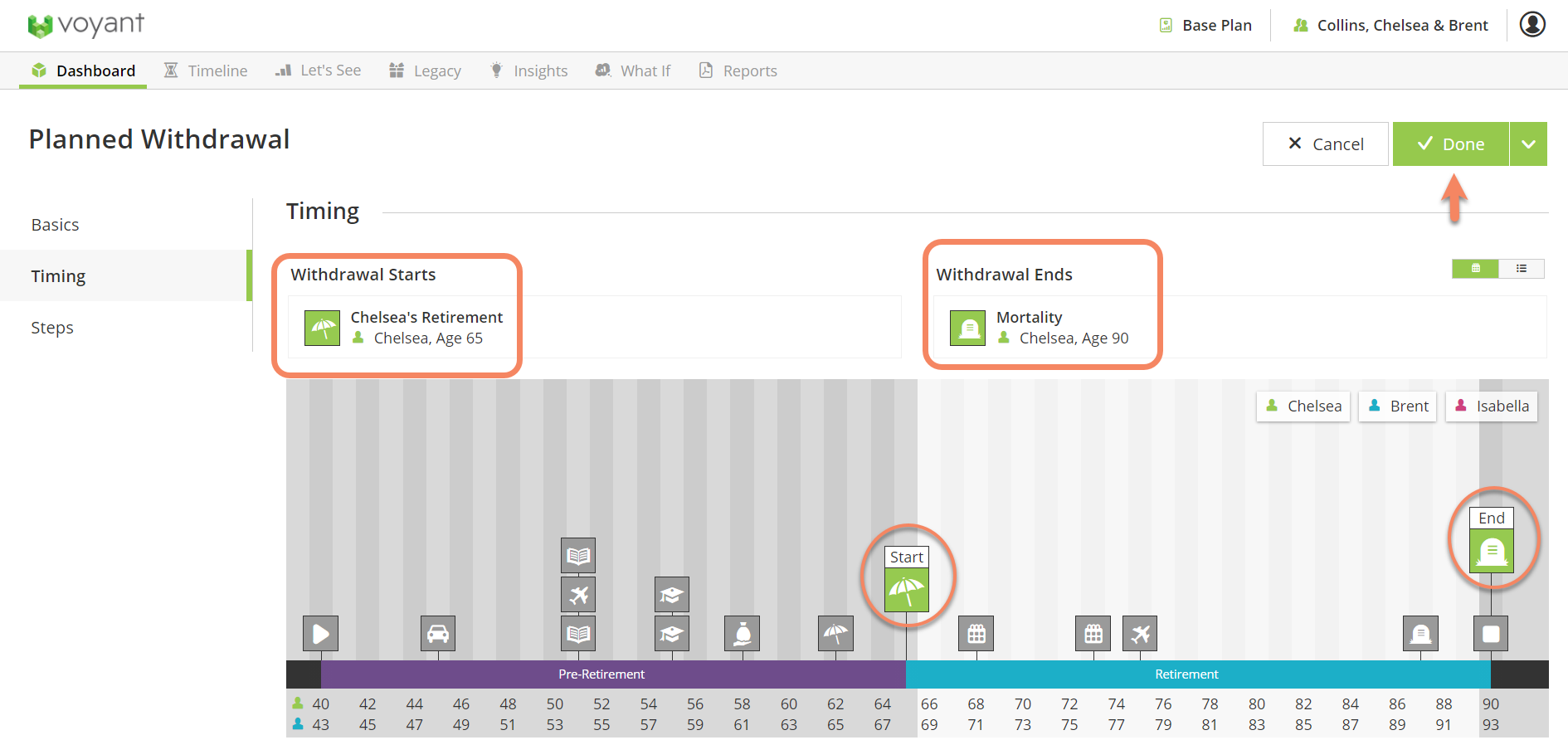

Next you will need to select the Start and End events for these withdrawals. In this example I have used the Retirement and Mortality events but you can also click anywhere on the Timeline to create a new event if you need to customize it.

Note- If you are scheduling a one time withdrawal you will only be prompted to select a start event.

Click "Done" to save.

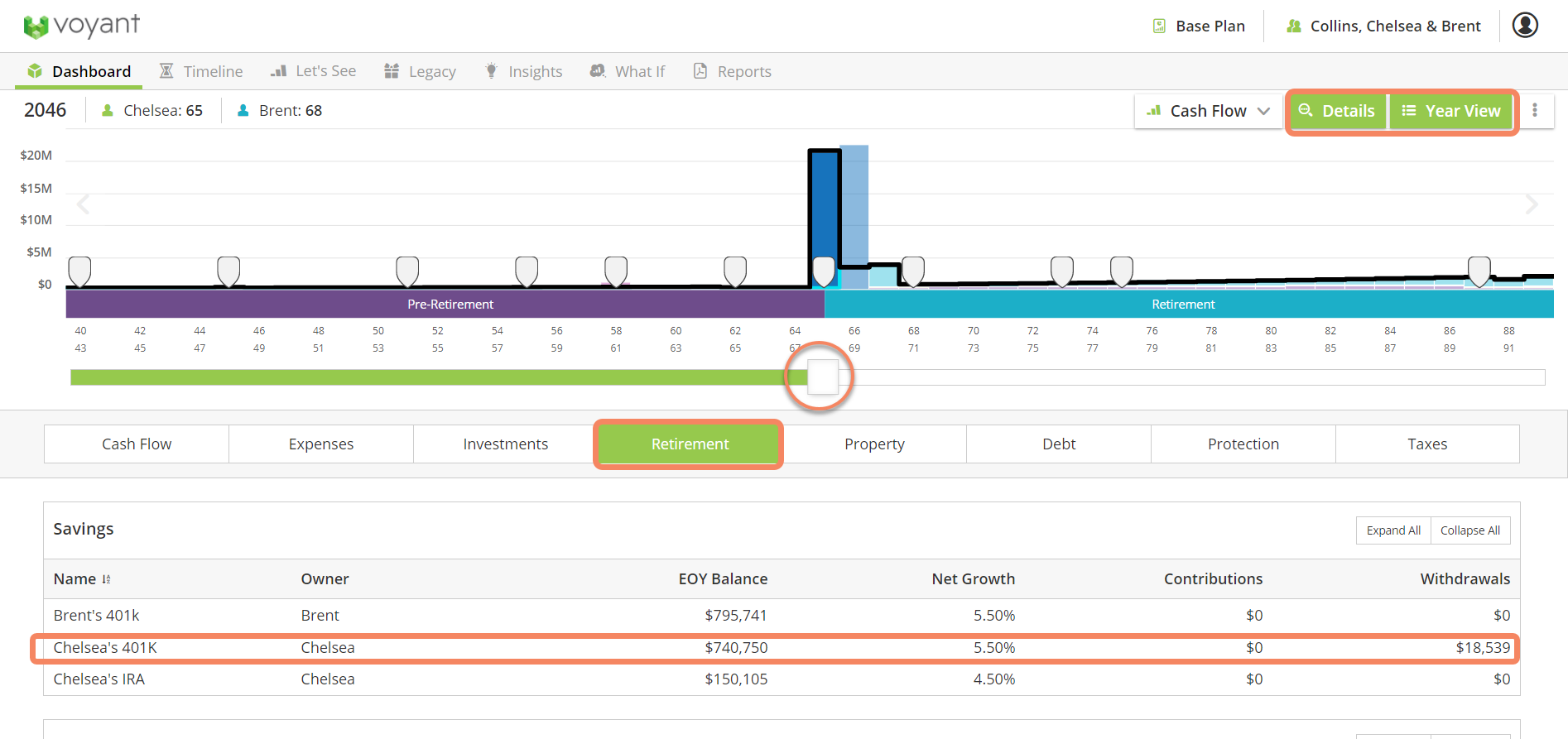

If you would like to check to make sure these have been scheduled correctly go to the Details>Year View screen. Use the slider to go to the year you've scheduled the withdrawals to begin and go to the Retirement Section.

Note: When the withdrawals where scheduled they were set to Type: "Fixed Amount With Inflation" you can also schedule a "Fixed Amount Without Inflation" if you prefer to have it be an exact dollar amount.