1. Open the existing client record, if it is not already open.

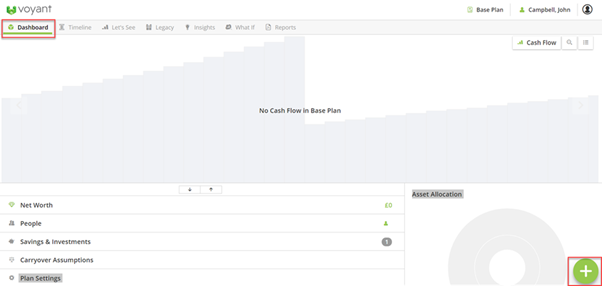

2. Click/tap the plus button in the bottom right of the Dashboard screen.

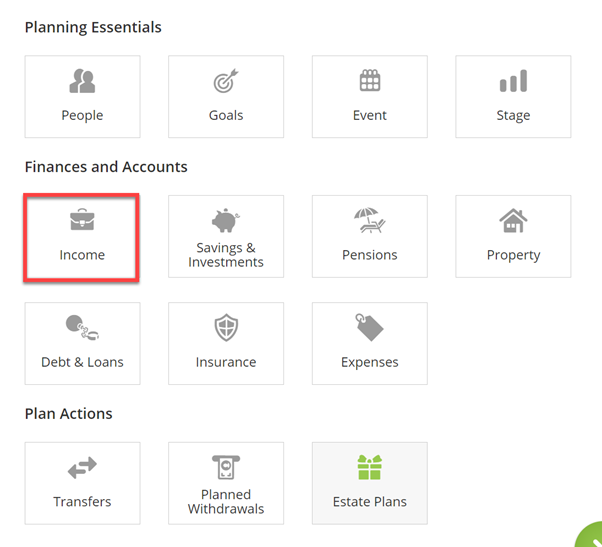

3. Click/tap Income in the Finances and Accounts section of the menu which appears:

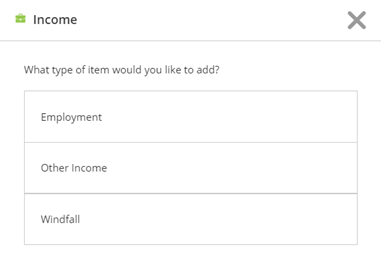

4. In the next screen click/tap the relevant option. Use Employment for earned income and Other Income for non-earned income such as rental income. Employment income is taxed as earned income, Other Income gives you the option of tax free or taxable, and if taxable, which type of tax should be applied. Windfall is used for one-off inflows such as an inheritance, click hereto read more about inputting windfalls.

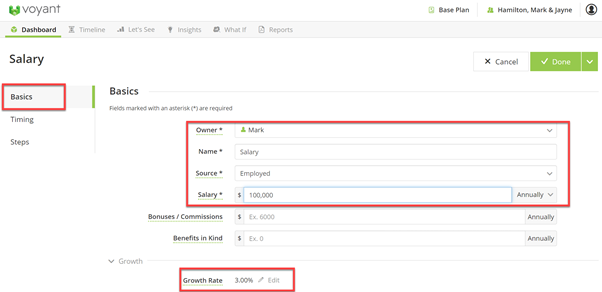

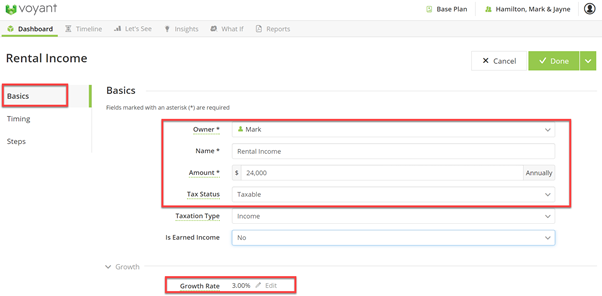

5. Complete the data entry fields which appear in the Basics screen (those marked with an asterisk are mandatory fields). Ensure you select the correct owner of the income so that the taxation is calculated for the correct person. The fields shown will depend on the income type and the source selected e.g. for employment income, if the source is company director there will be an additional field for dividend income.

The Growth Rate will show the default rate from the National Average Earnings assumption shown in Plan Settings. You can amend this growth rate by clicking Edit. Amending the growth rate here will only affect this income item, it will not affect any other items in the plan.

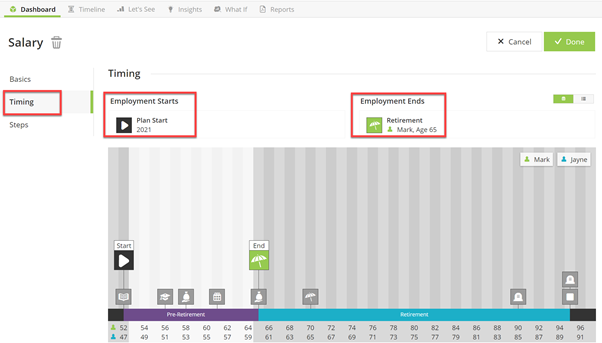

6. By default Employment and Other income items will default to start at the start event for the plan and end at the owner of the income's retirement event.

If you would like to amend the timeframe for the income, click/tap Timing on the left hand side of the screen to edit the start and end event for the income.

You can edit the start and end events by dragging and dropping different events into the item's Starts and Ends boxes.

7. Click the Save button, top right.

8. Repeat steps 2 to 7 for any other income you wish to add to the plan.

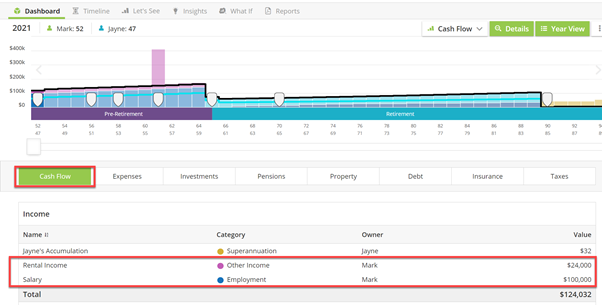

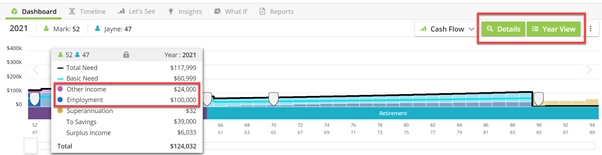

Where can I see the income in the plan?

The income can be seen in the Cash Flow chart in either the Dashboard or the Let's See screen.

Click the Detailed View button to see the source of the inflows. Click on a bar of the chart to see the headline numbers for that year.

Click the Year View button to see the detailed breakdown of the numbers behind the chart.