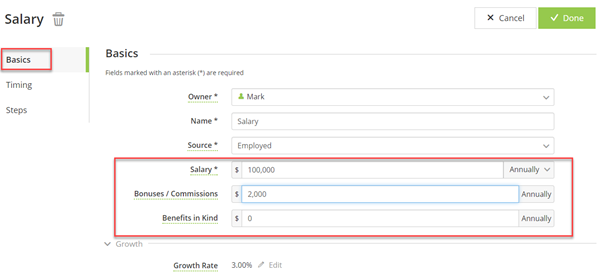

The Employment Income screen is used to enter income from earnings and any related bonuses and benefits in kind.

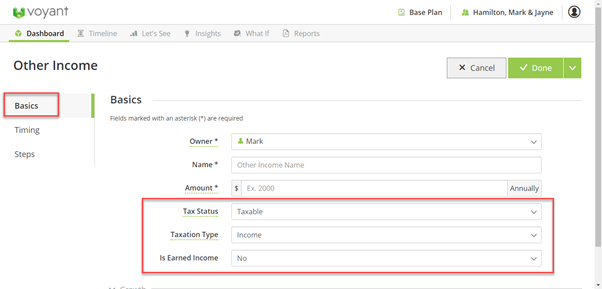

The Other Income screen is used to capture all manner of income aside from earnings. You could use this screen to enter rental income, income from royalties or even employment earnings if they are not subject to regular income tax. Earnings from savings and investments should generally be entered on their respective screens in the software.

Perhaps most importantly, the Other Income screen can be used to tag these income sources as Taxable or Non-Taxable.

Both Employment Income and Other Income can also be adjusted using the Steps functionality, find our more here.