About the Historic Insight in AdviserGo

The Historic insight is designed for mapping market volatility onto your financial plan. This simulation displays the performance of the S&P 500 index between 1950 and 2019 and allows you to select a timespan between these years. Every year selected represents a level of return for the Standard & Poor's 500 Index relative to the long-term mean, and it is this relative measure – specifically, the percentile value for each of the selected data points – that is then mapped onto your plan.

How to run the Historic insight

The Historic insight takes the Standard & Poor's 500 index's historic percentile averages for the selected set of years and then replaces our normal assumption for asset allocations (model portfolios), which is the 50th percentile return, with a percentile return that the market experienced in those years. This is applied to the entire asset allocation, omitting cash holdings.

1. To use the Historic insight, open your plan in AdviserGo and select Insights.

2. Scroll down and select the Historic insight.

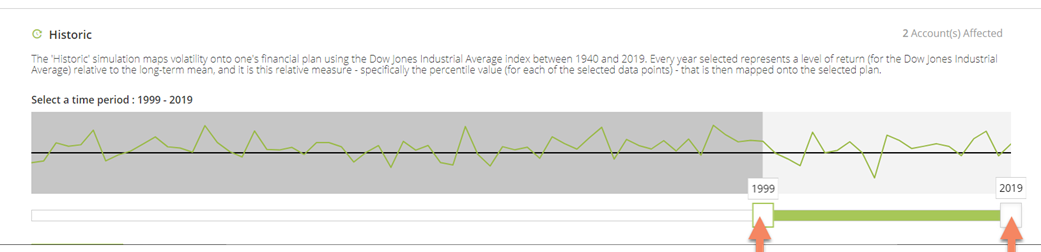

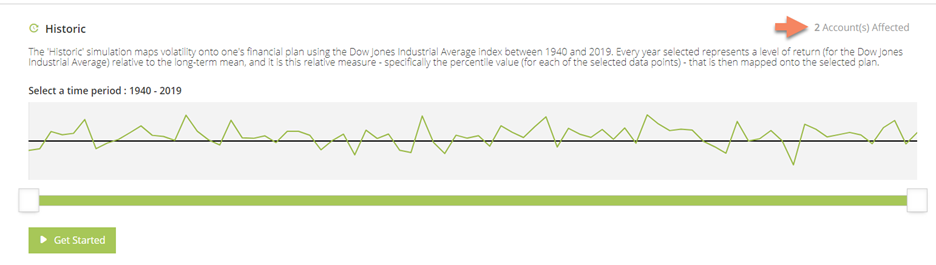

3. Use the slider handles to select a period of past market performance. for the Historic insight to apply to the future returns in your plan.

Tip – Move your cursor over the years in the historical timeline to see how the S&P 500 performed. This will give you some idea of the cycle the Historic insight will be modelling.

If the period you select is shorter than the timespan in your plan, as will likely be the case, then the market cycle will repeat. For example, if your financial plan is sixty years long and you select a ten-year period of past market performance, the insight will repeat the market cycle six times over the course of the plan.

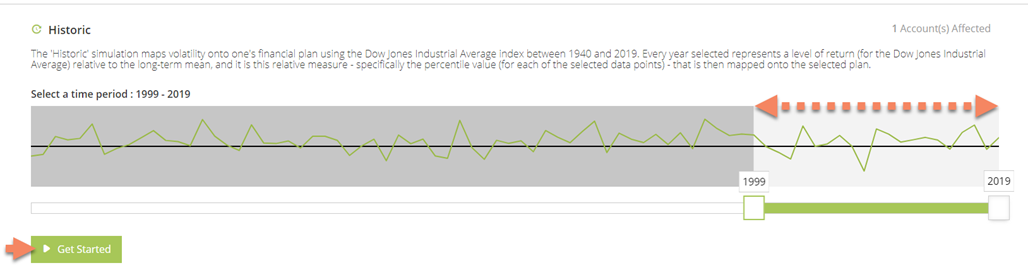

Tip – Click the space between the two sliders to move the selected time span up or down the historic timeline.

4. With your historical period selected, click Get Started to run the insight.

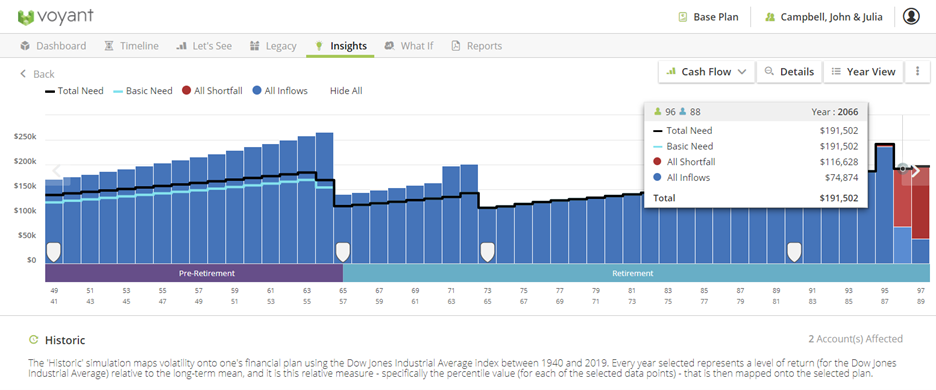

The results of these variable returns will be shown in the charts above. A once very sound looking future Cash Flow chart – one that previously showed only blue inflows and no red shortfalls – might now display some red after the peaks and valleys of the market are applied to investments in your plan.

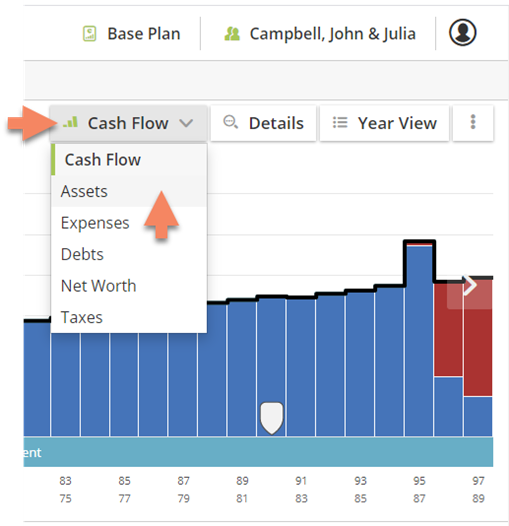

Switch to the Assets chart and you may find that the once smooth line of growth has now become jagged due to the now variable returns.

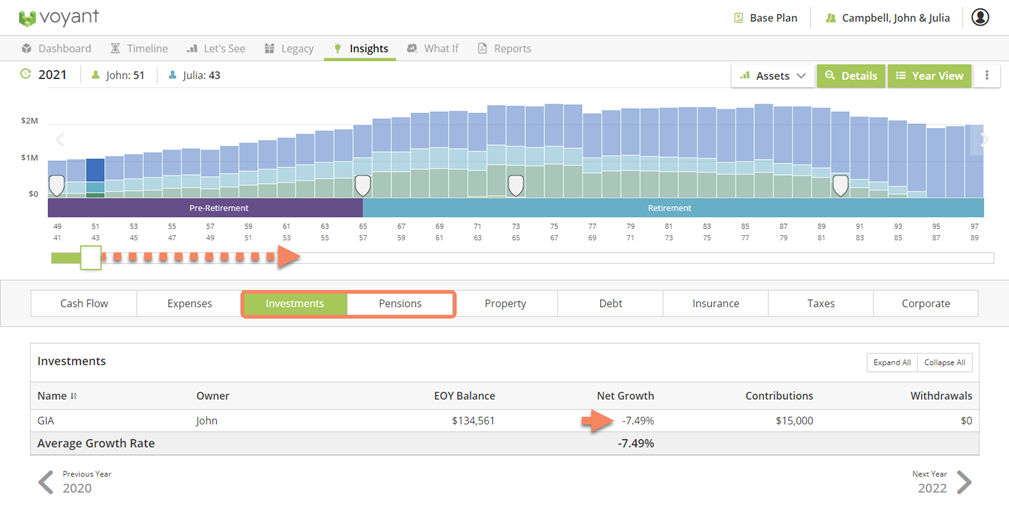

To view the year-to-year variable growth rates, click the Year View button.

Select either the Investments or the Pensions (Retirement) tab.

Use the slider to view the growth details for your accounts in future years in your plan. You should see variable returns when moving year to year in the plan.

How substantial a loss or gain your investments will experience in these future years will depend on the amount of risk inherent in your investment’s model portfolios or more specifically, the size of each portfolio’s standard deviation.

Click the Year View button again to toggle off this view of the yearly details and return to the Historic insight screen.

Why aren't my investments showing variable returns when I run the Historic insight?

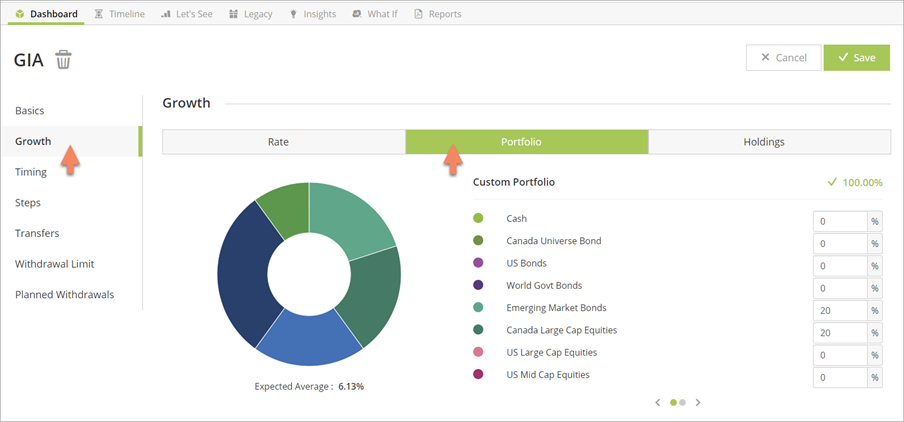

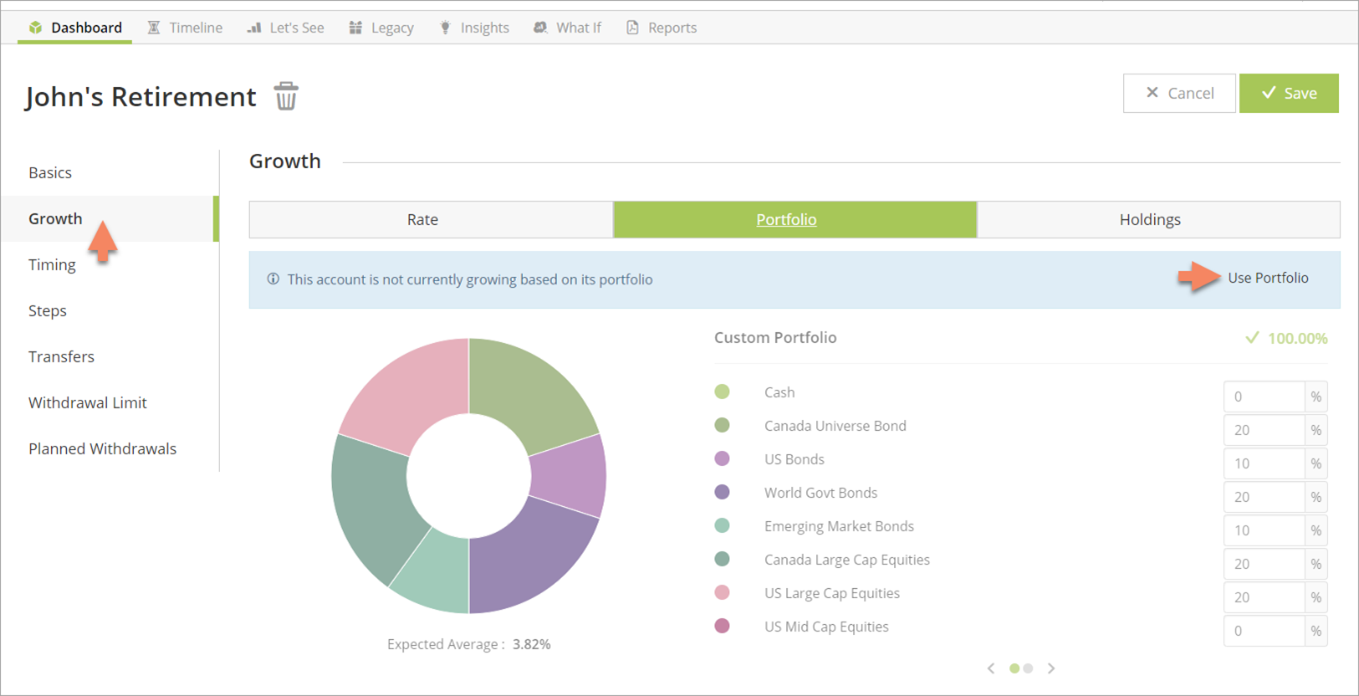

If the Historic insight is not causing the growth rate of your accounts to fluctuate yearly, first check which accounts are set to be grown using asset allocation.

To use this insight, at least some of the investments in your plan must be set to be grown using asset allocations (model portfolios), not fixed growth rates. This is because asset allocations provide the software a range of potential returns, a standard deviation, that fixed growth rates do not.

The Historic insight will only apply variable returns to accounts that are set to be grown using asset allocations (model portfolios).

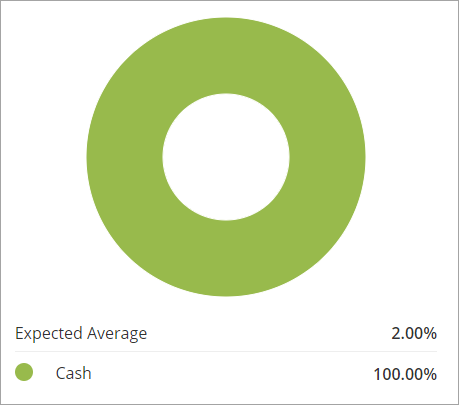

For variable returns to be applied, model portfolios must also be set to an asset allocation of other than 100% Cash. The asset class for Cash is omitted from the simulation in much the same way that the growth of cash accounts is assumed fixed when running other insights such as the Market Crash and Performance slider.

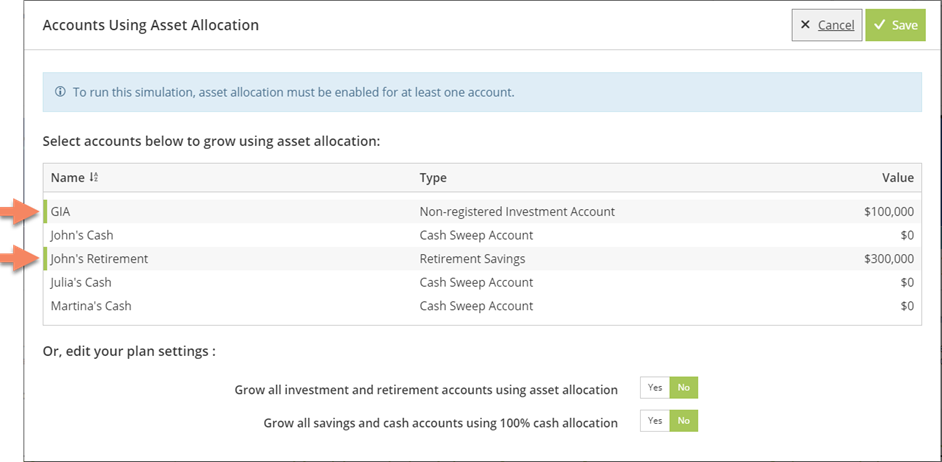

To view the accounts that will be affected by the Historic insight, click the Account(s) Affected link top right above the historical timeline.

The accounts highlighted will be subject to variable returns when running the insight, provided they are grown using an asset allocation that is not 100% Cash.

If none of the accounts in your plan are set to be grown using asset allocation (all accounts are set to be grown using fixed growth rates), a prompt will display asking you to select at least one account to be grown using asset allocation before running the Historic insight.

Options are also available on this dialogue to change your growth settings globally, in the Plan Settings, by switching on the option to “Grow all investment and retirement accounts using asset allocation”.

Switching on the additional option to “Grow all savings and cash accounts using a 100% cash allocation” would have no effect on the Historic insight since cash holdings are not adjusted by this simulation.

It is important to understand that by switching asset allocation on or off for accounts on this dialogue will alter how accounts are set to be grown in the plan itself. If you switch on asset allocation for an account via this dialogue, a model portfolio will be used to set the selected account’s growth rate; that is, at least until you either deselect the account on this dialogue or edit the account’s Growth settings on the Dashboard screen.

Note - If the default asset allocation is 100% Cash, as it is in the regular release of AdviserGo, you would still need to set an asset allocation / model portfolio for accounts individually for the simulation to apply variable returns.

Which types of asset classes experience variable returns when running the Historic insight?

The Historic insight uses historical returns from the Standard & Poor's 500 Index. Does this mean variable returns are applied only to US large cap equities or only to equity holdings in general?

The Historic insight is intended only to be used as a method for introducing some variability into the software’s projected returns. This applies not only to equities, but to the entire asset allocation, excluding cash holdings. Variable returns are applied to the entire model portfolio, only omitting cash.

Also, only capital growth is adjusted by the simulation, not dividend and interest yields.

Granted, the percentile derived from historical S&P 500 index data may not be an ideal approximation of the percentile return for all categories of assets. But Historic insight is intended to be used as a simulation tool to bring a level of market fluctuation to what is an otherwise deterministic projection provided by the software. Some items, such as bonds or possibly property, might correlate to move up against a down equities market but that is out of the scope of this insight.

Related Articles

A primer on using Voyant software's market-based functionality