Entering your client's employment income

Enter on the Employment screen details of your client’s employment earnings including salary, wages, commissions and bonuses. Other sources of income such as rental income, royalties, or income earned in a foreign country should be entered separately as Other Income.

Enter employment incomes in gross amounts – i.e. pre-tax, before the deduction of any retirement contributions. Voyant will do the tax calculations for you. Retirement contributions made from supporting salaries will also be deducted from this gross income. You may need to "gross up" income in cases where your client has provided a net income figure.

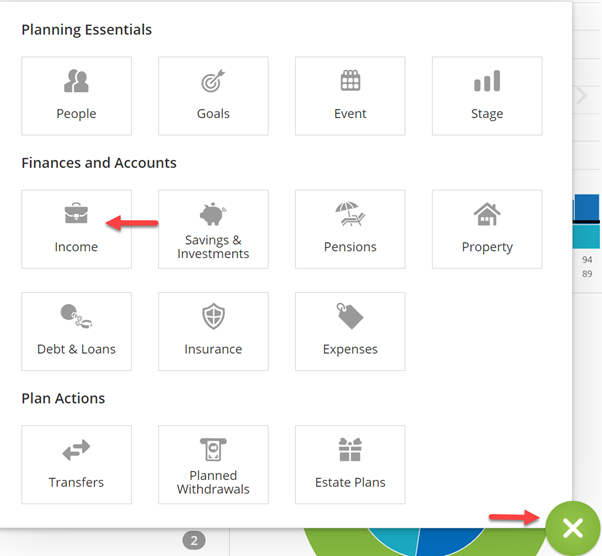

From the Dashboard click the (+) button then select Income.

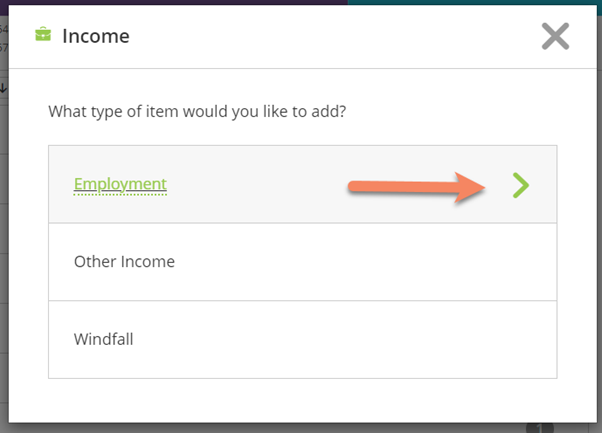

Then select Employment.

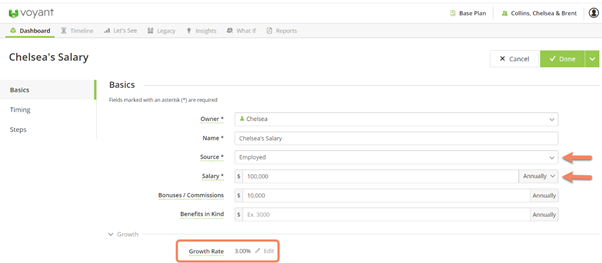

Enter your clients salary information on this next screen. A few things to note:

- If you select "Source" you will be given options for "Self Employed or Company Owner".

- Under "Salary" be sure that you select annual or monthly depending on the figure you are entering.

- Under "Growth Rate", the systems default is to increase the salary at a 3% growth rate but this can be adjusted here to your preference.

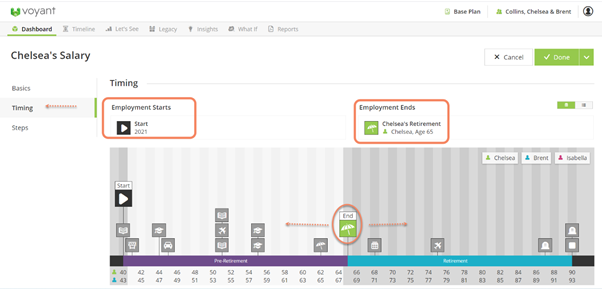

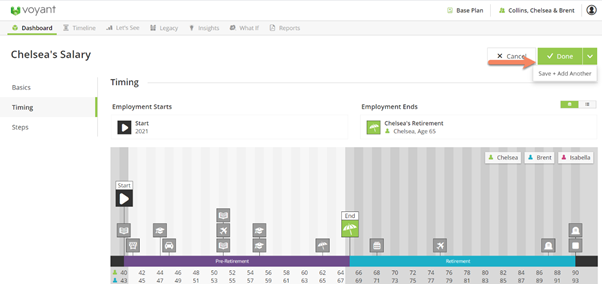

From the Timing screen you can see that the software will automatically end this salary at the person's designated retirement event. To move the expected retirement up or down simply click the retirement event icon and drag up or down the timeline.

From here you can click the green "Done" button or "Save and Add Another" to add an income into the plan.

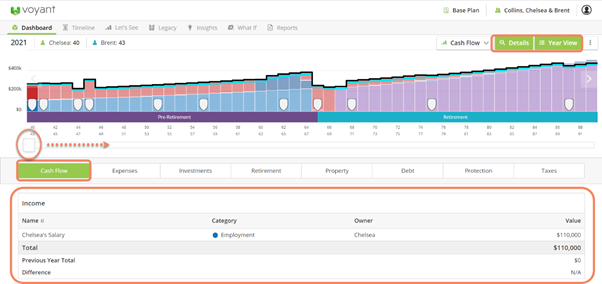

From the dashboard you will be able to see and access this income, double click the salary to open and make changes.

From the Details>Year View screen you will be able to see how the income changes over time on the Cash Flow tab. Use the slider to move up and down the Timeline and view different years.