Voyant limits Superannuation contributions to the Concessional and Non-Concessional contribution caps. See this guide for how to set up regular Concessional and Non-Concessional contributions within the Superannuation entry: How to Enter Superannuation Pensions - Australia

To use the Bring forward rule you instead need to set up the Contribution into the Super as a Transfer.

All transfers are treated as Non-Concessional Contributions. This will also let you use the Bring Forward rule. Steps on how to do this are below:

1. Money available to make the contribution

First you need to set up the source of the funds for the contribution. This could be Surplus Income/ Windfall/ Downsizing proceeds/ Another Account.

For example, here is a guide on how to downsize a house - Downsizing or Rightsizing a Home

2. Transfer this money into the Super

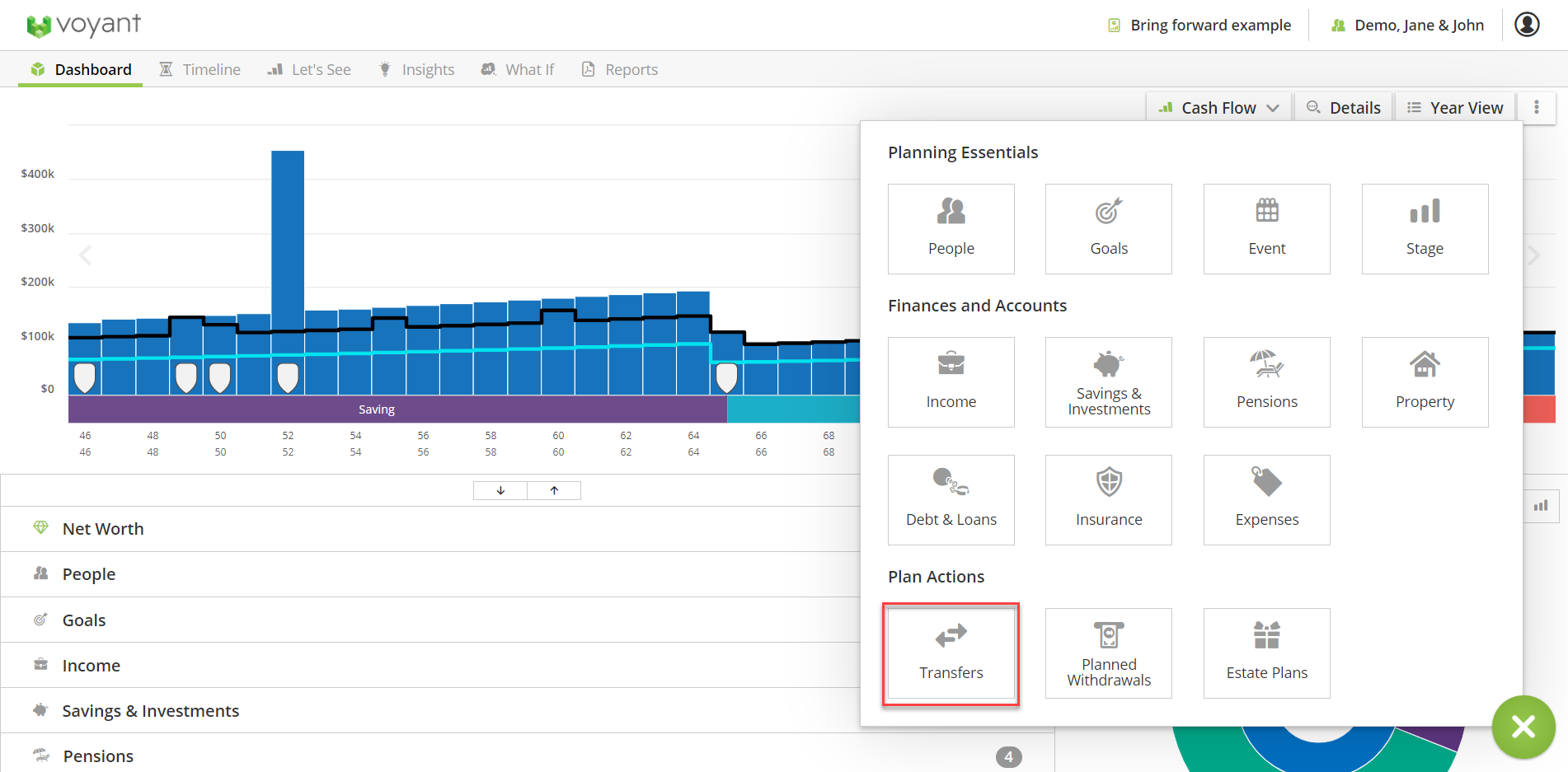

To move this money to the Super, go to Dashboard - + button - Transfers.

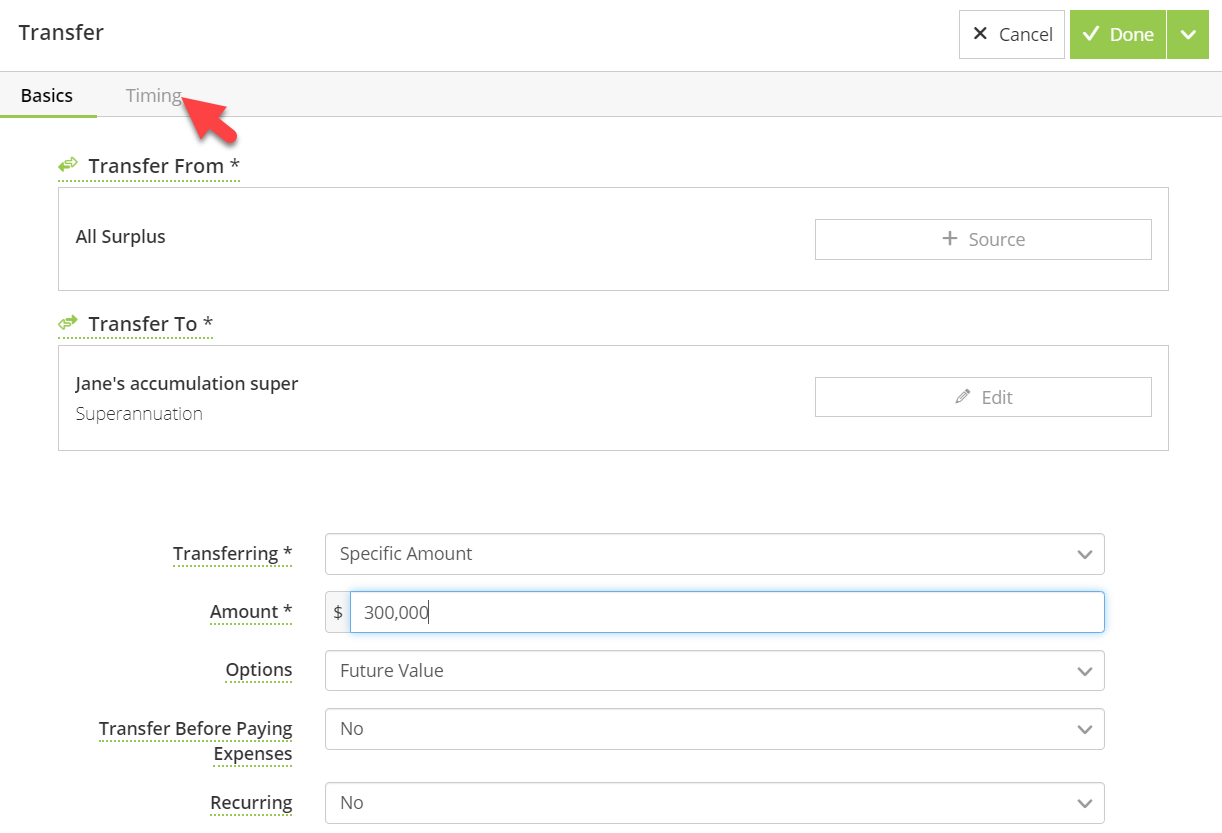

Set up a Transfer

From: All Surplus if you created a Windfall income or downsized a property in that year, alternatively

From: Another account - select the relevant account

To: Superannuation Accumulation with the specific amount from the lump sum.

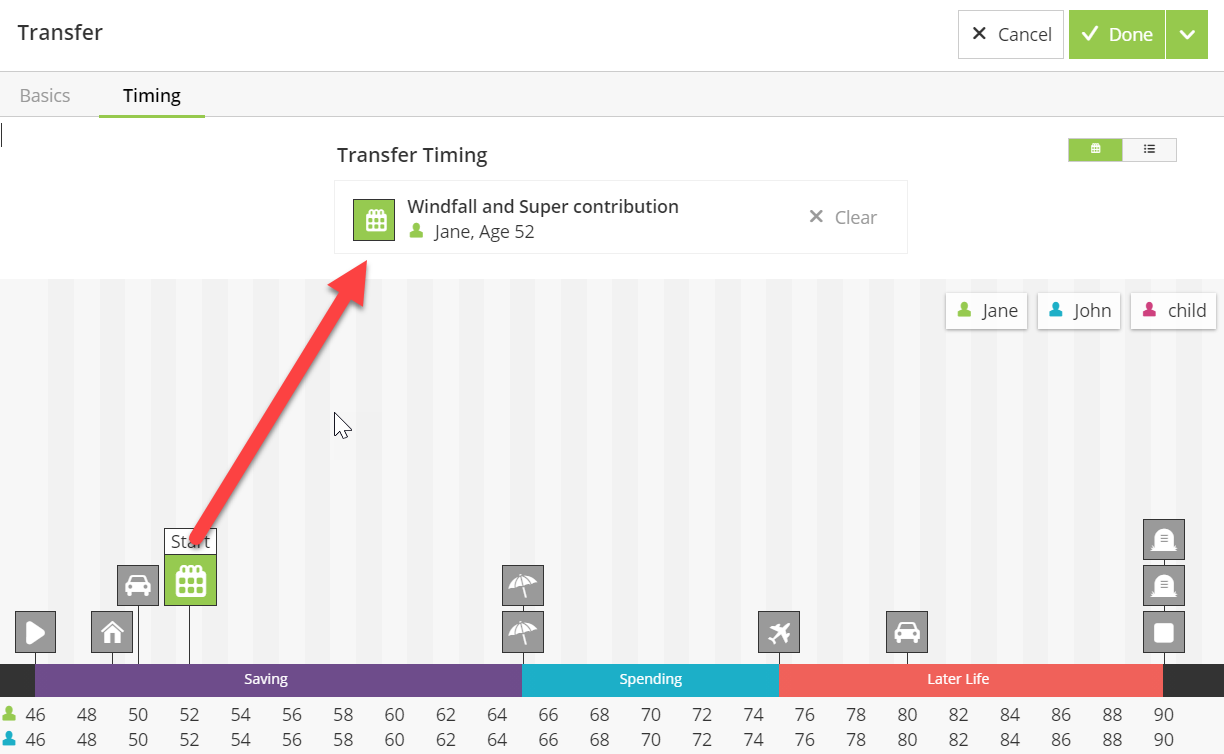

Go to Timing at the top of the Transfer screen

Click Done to save.

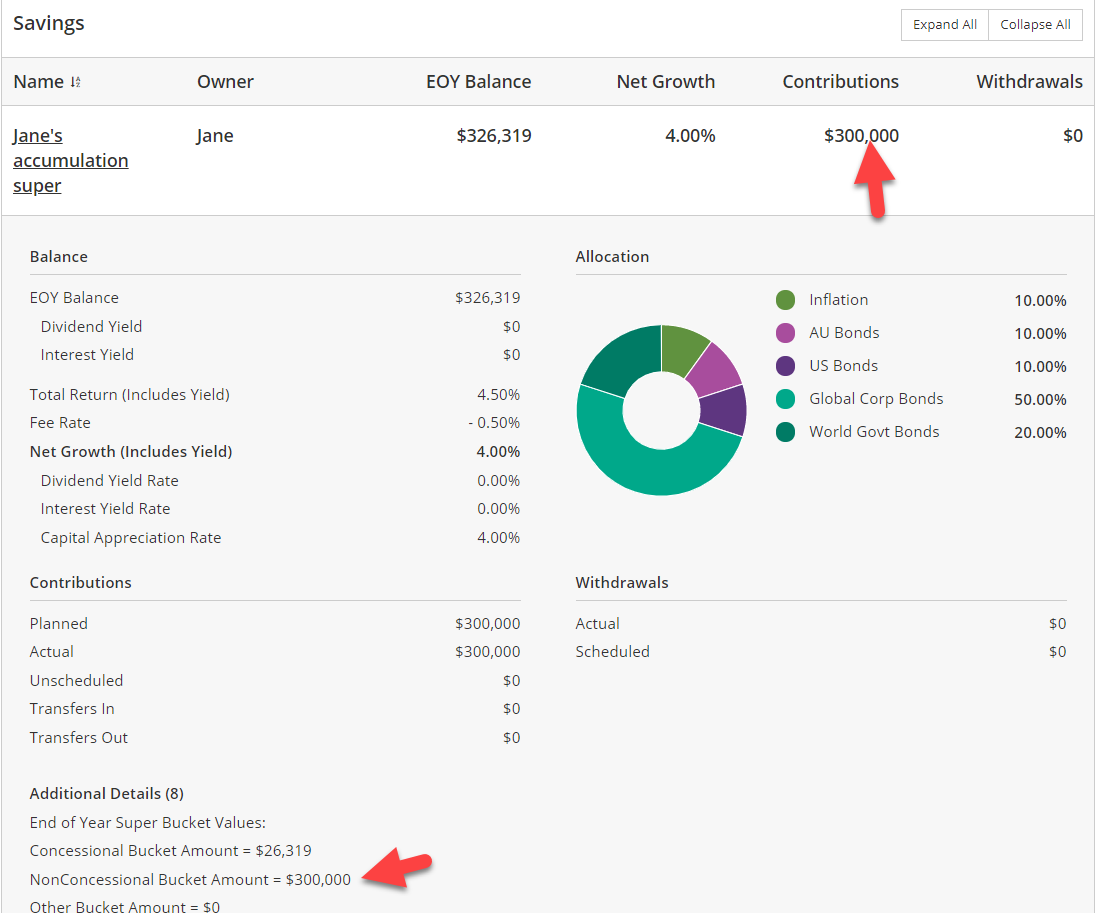

Now go to Year View (top right of the chart) - Pensions tab to check the contribution amount. Click on the name of the account to see further details and to check it is set up how you would like.

Any questions please contact support@planwithvoyant.com