In this guide we walk through Super contributions entered in the Basics section when entering an Accumulation Super into Voyant and how to check it's set up how you would like in Year View. This guide focuses on contributions, see the guide linked below for how to enter Supers and the Transfer at retirement between Super Accumulation and Retirement Phases.

How to Enter Superannuation Pensions - Australia

Entering Contributions

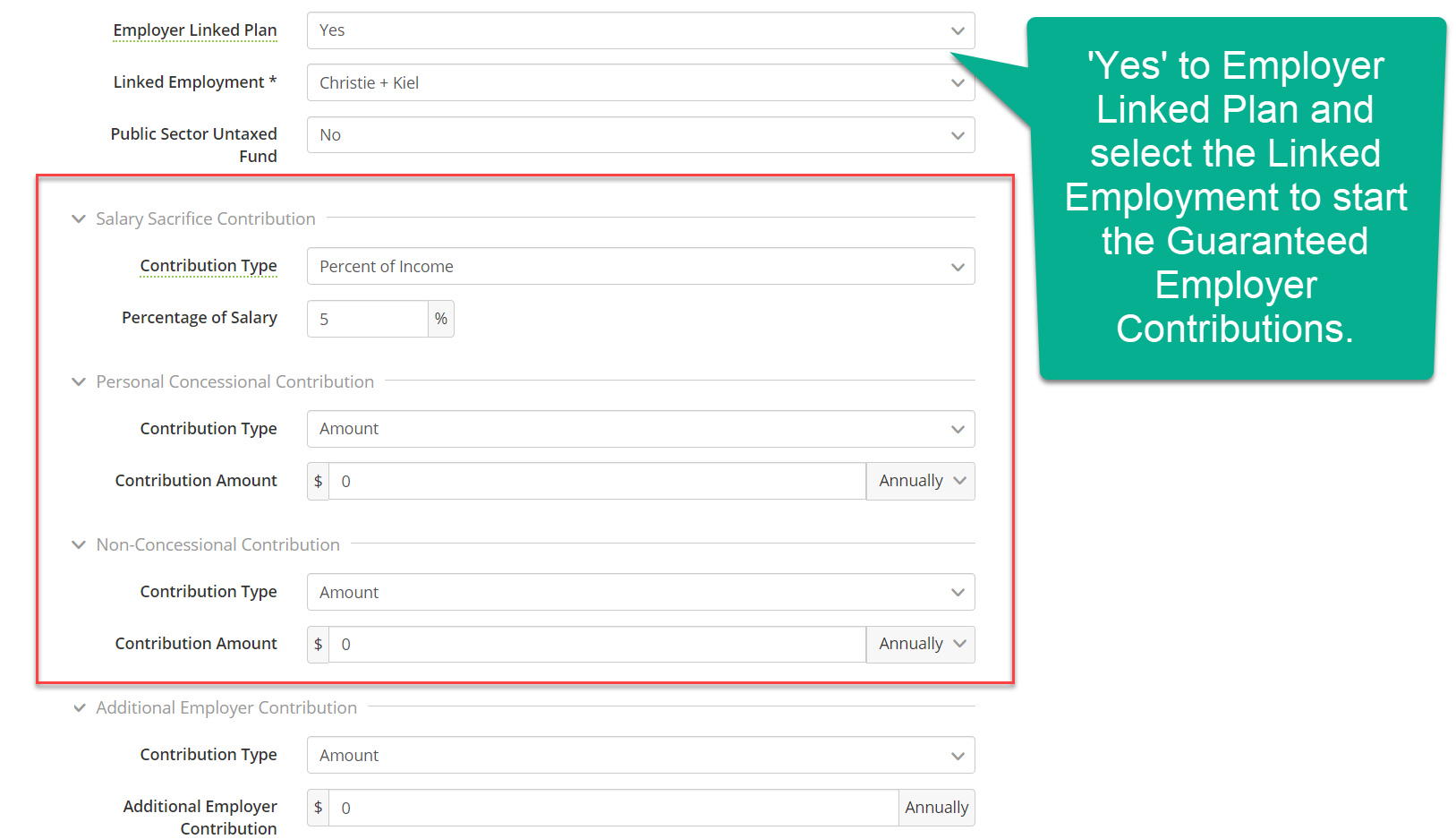

When you enter a Super into the plan you have the option to select Employer Linked Plan - Yes/No.

Selecting Yes and linking to an Employment you've entered into the plan will start the Guaranteed Employer Contributions.

The level of Employment Income in each year along with the required percentage the employer has to contribution in that year will determine the monetary payments.

Enter Salary sacrifice, Personal Concessional Contributions or Non-concessional Contributions in the appropriate fields shown above.

Here are other relevant guides on these:

Personal Concessional Contributions into a Super - Australia

Superannuation Contributions - Setting up a Transfer to use the Bring Forward Rule

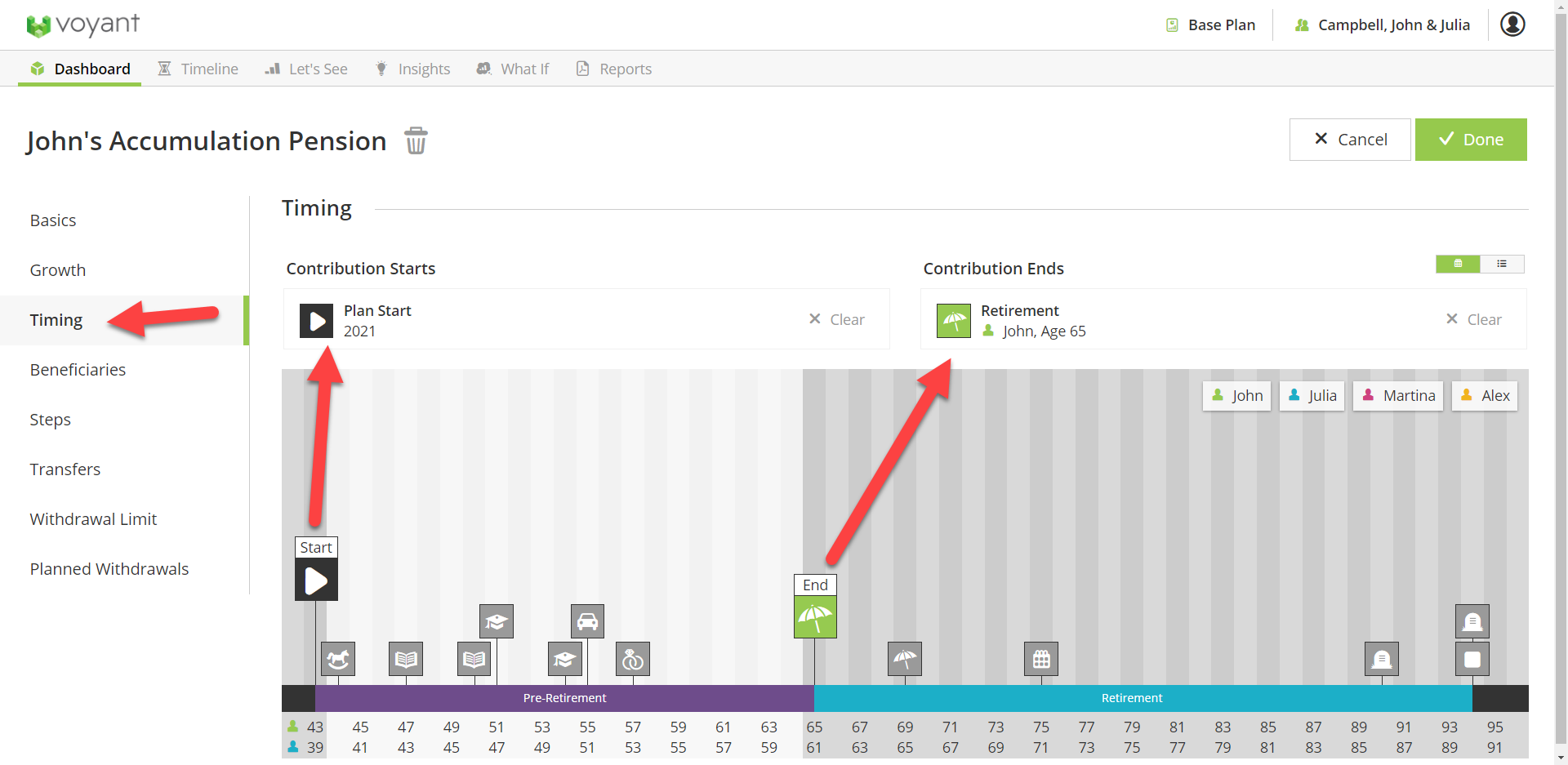

Timing

Set in Timing when you would like these contributions to occur. Note Employer contributions are treated separately as these will continue whenever the linked income is in the plan.

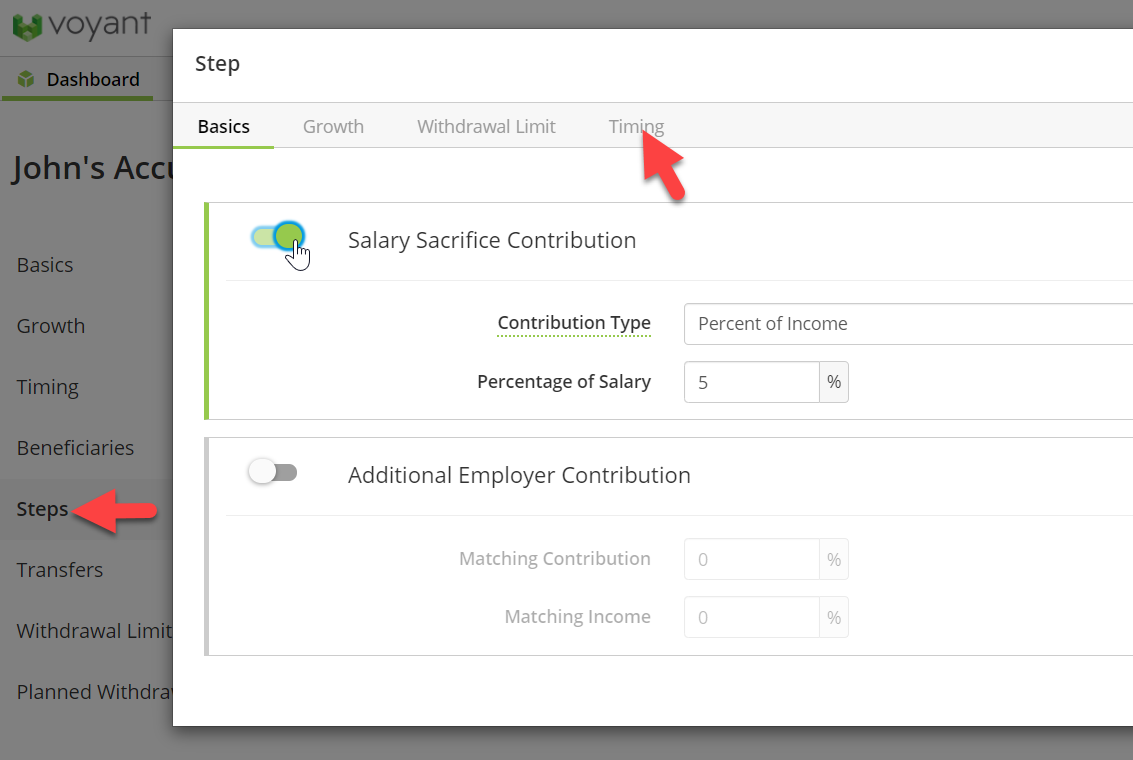

Steps

You can step up and down salary sacrifice contributions and additional employer contributions in the Steps window

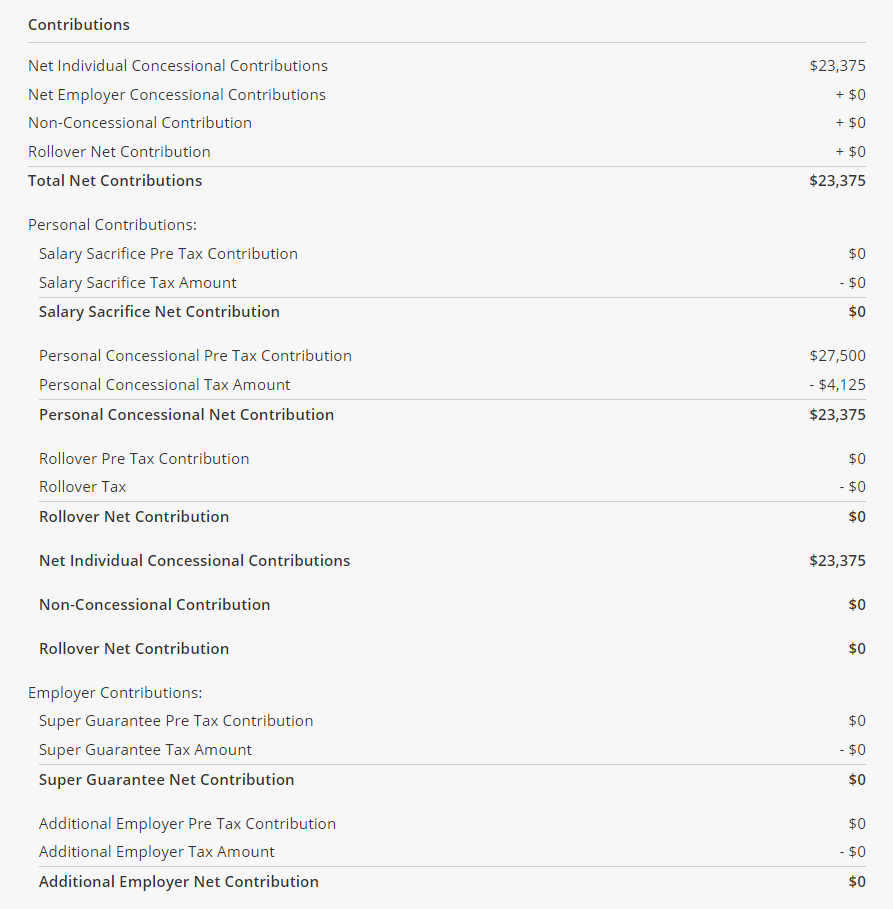

Checking the Contributions

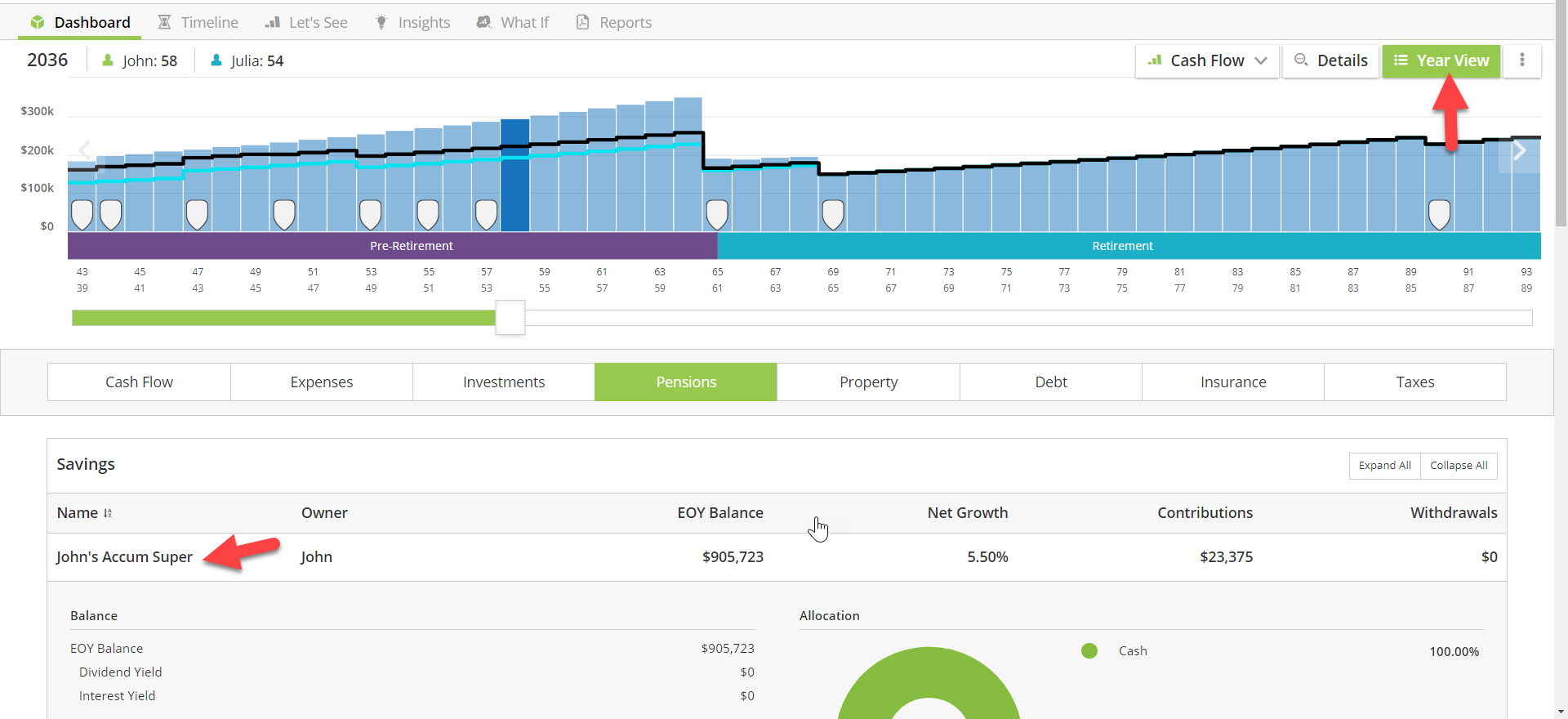

Go to Year View top right of the chart - Pensions tab. Click on the name of the Super to show the details.

See details of the contributions made into the Super.