In Voyant each client record has a base plan which should reflect your client's current situation. The base plan serves as the foundation for the client's case.

You can then set up any number of What-If plans to model different planning options for your client. These are copies of the base plan which can be amended to model different options your client wishes to explore and/or your advice to your client.

How to add a What If plan in AdviserGo:

- Click What If in the top menu.

- You will be presented with two options: Quick Plan Creation or Guided Plan Creation.

Quick Plan Creation creates an exact copy of the base plan which you can then amend as required.

Guided Plan Creation enables you to create specific scenarios and will take you through the steps to create them.

- The first option is Quick Plan Creation. Using this, you can create a copy of a plan in three steps.

Step 1. Select which plan you wish to create a copy of. The dropdown will default to whichever plan you have open when you clicked on What If however you can select a different plan from the dropdown menu.

Step 2. Give the plan a name which will mean something to you and your client when you look back on this plan in the future.

Tip: If you are creating several scenarios, number them for ease of future reference.

Step 3. Click the Create This Plan button.

You now have a copy of the original plan which you can amend without affecting the original. Changes to the original plan will filter through to the copy, unless you have already amended that item in the copy. Amending an item in a What If plan effectively 'breaks' the link to the base plan for that item only.

For example, the base plan has an inflation assumption of 3% and investment growth assumption of 5%. When you create a What If plan from this base plan, the What If inherits these assumptions from the original plan i.e. the base plan in this example.

- If you change the inflation assumption in the What If to 2%, this will not affect the inflation assumption in the original i.e. the inflation assumption in the base plan will stay at 3%.

- If you change the investment growth assumption in the base plan to 6%, and no changes have been made to the growth rates in the What If, the investment growth rate in the scenario will also change to 6%.

- However, if you change the inflation assumption in the original plan to 2.5% having already changed it to 2% in the What If, the scenario will keep the 2% inflation rate.

- An alternative to Quick Plan Creation is to use the Guided Plan Creation option. This will create a copy of whichever plan you have open. There are four options to choose from. Each option takes you through setting up the specific scenario chosen, step-by step.

Step 1. Click or tap on the What If you wish to set up. In this example, we've used Retire Earlier or Later.

Step 2. A screen will appear with items to edit. In the Retire Earlier or Later What If this will be the retirement events. Edit the items on screen, for example, click and drag the retirement event(s) to the year(s) you want to model your client(s) retiring in. Then click the arrow to the right of the screen to move to the next step.

Step 3. Some What Ifs may have more than one step of data input/editing. For example, the Buy a Home scenario will have steps to add a new home, set the timing, and add a debt. Complete these screens and use the arrow to the right hand side of the screen to move through them.

Step 4. Once you have been through all of the data input/editing steps, a review screen will appear. Check the details on screen and, if you are happy with them, click the arrow on the right hand side of the screen to move to the next step. If the details do not look right, click the arrow on the left hand side of the screen to go back to the previous step and edit.

Step 5. A message will appear asking if you wish to keep the plan. Click Yes.

As with the Quick Plan Creation, you now have a copy of the original plan. This copy has already been amended without affecting the original. Changes to the original plan will filter through to the copy, unless you have already amended that item in the copy.

You can make further changes to the What If if you need to i.e. you are not limited to just changing the items covered in the step by step process.

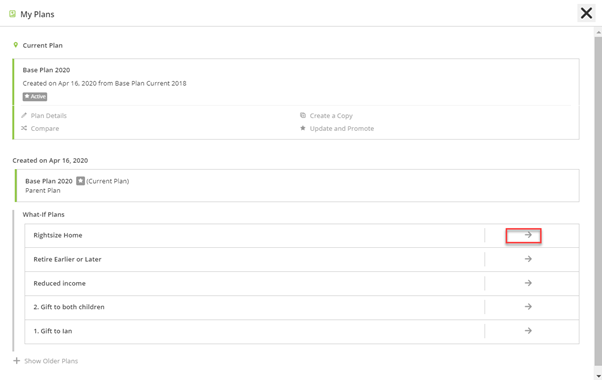

How to view What-If plans in AdviserGo:

To access What If plans which you have already set up, click the plan name in the top right-hand corner of the screen, next to the client name.

This will bring up a list of the plans in the client record. Click the arrow to the right of the plan name to open that What If plan.