Downsizing the current family home and buying a new, smaller one in the future is easy to model in Voyant AdviserGo. You will probably wish to model this in a What If, so your clients can see the potential outcome.

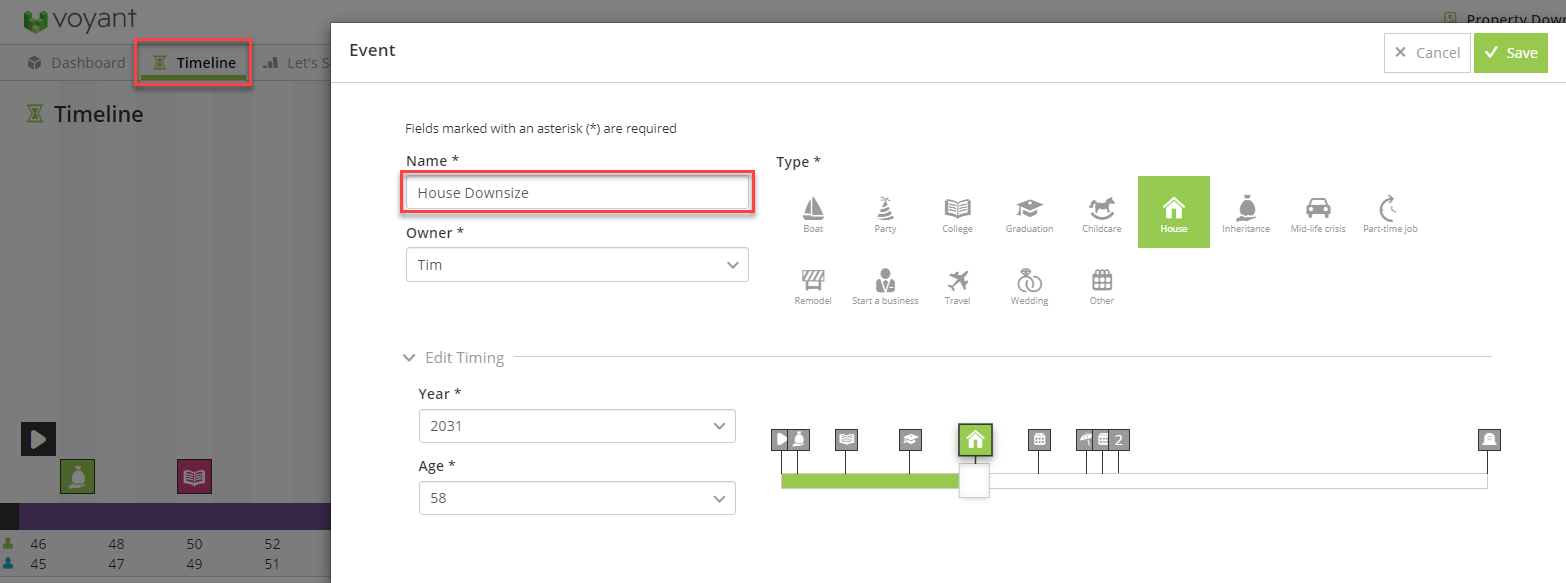

First create an event on to the timeline in the year your client wishes to downsize. To do this go to the Timeline screen > + button bottom right > Event:

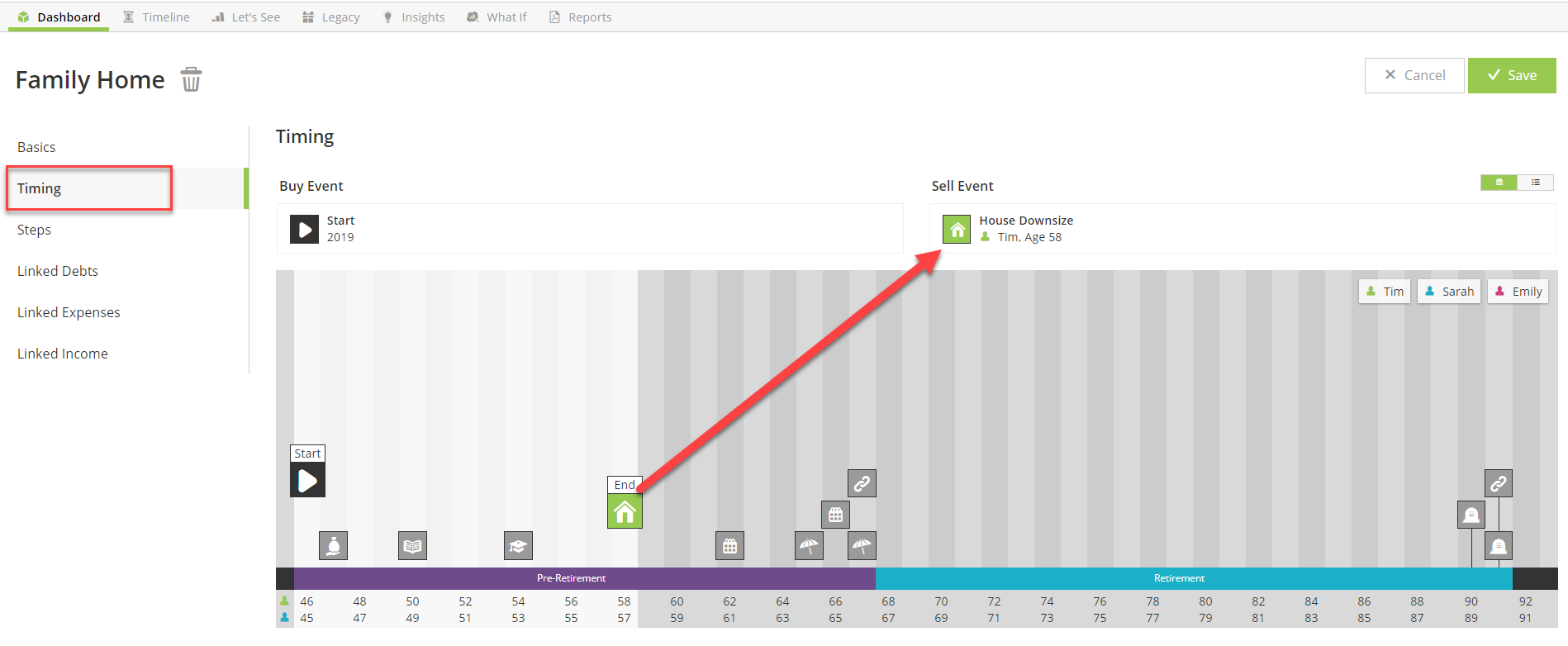

Then go to Property and select the existing home from the Dashboard view. Go to the Timing tab and set the Sell Event to the new Property Downsize event.

The software will sell the property at this event and the proceeds will show in Lets See>Cashflow. If it's linked to any mortgages these will be repaid at this point too, with the net sale proceeds swept into the default cash accounts.

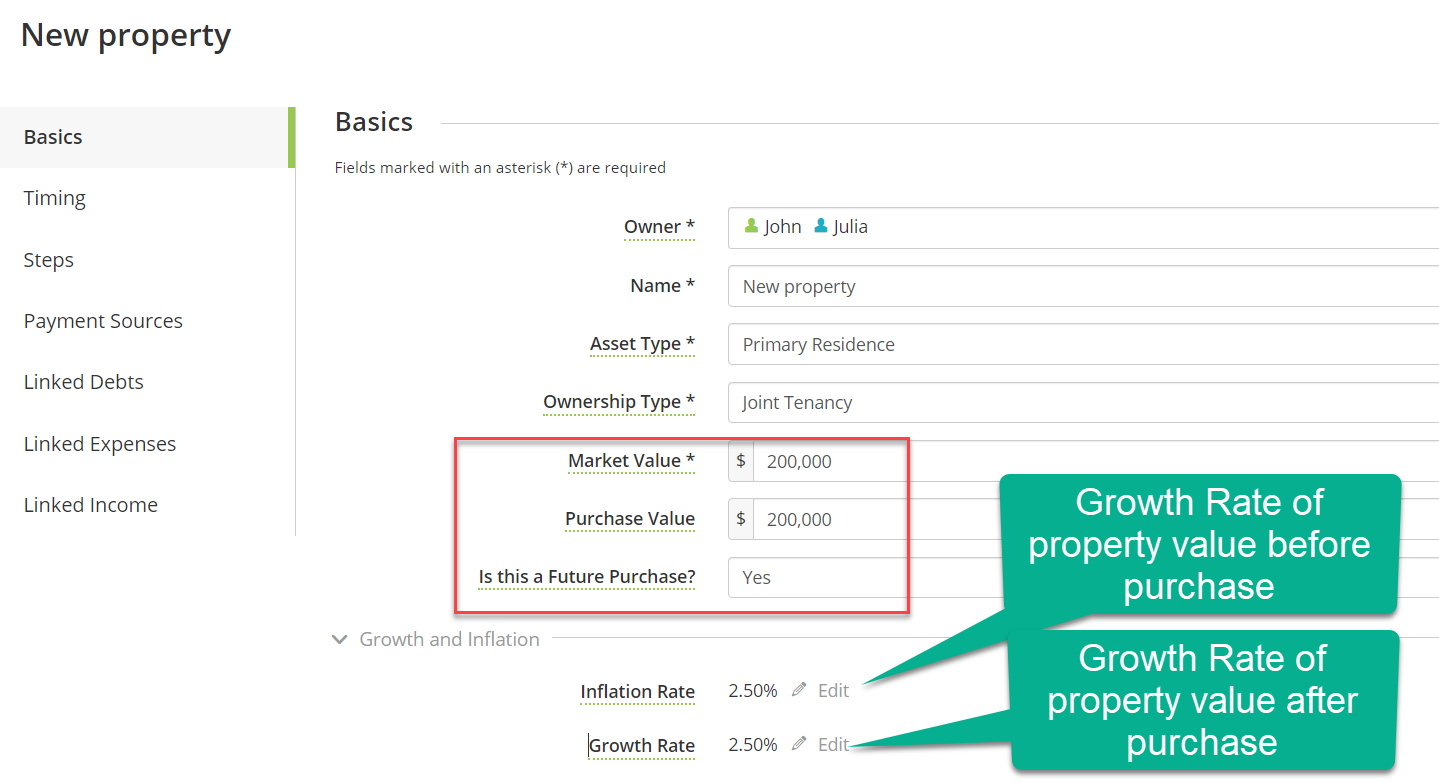

Now, create a new property to buy. To do this go to the Dashboard view > + button bottom right > Property. It is important to mark 'Is this a Future Purchase' as 'Yes'.

Note for non-Primary Residence properties add a Purchase Value. This will be used if the property is sold in the plan for Capital Gains calculations.

The amount entered in market value will escalate by the Inflation Rate until the property is purchased. Once purchased the property will increase in value by the Growth Rate.

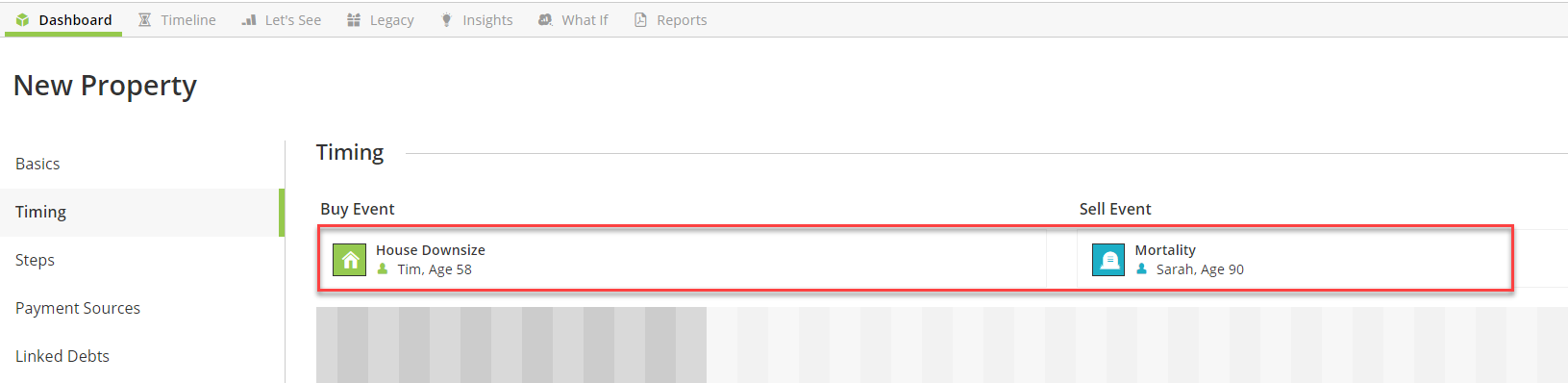

Then in the Timing section, select the Downsize event as the 'Buy Event' and Mortality as the 'Sell Event'. The new home will be purchased at the Downsize event and only liquidated at mortality.

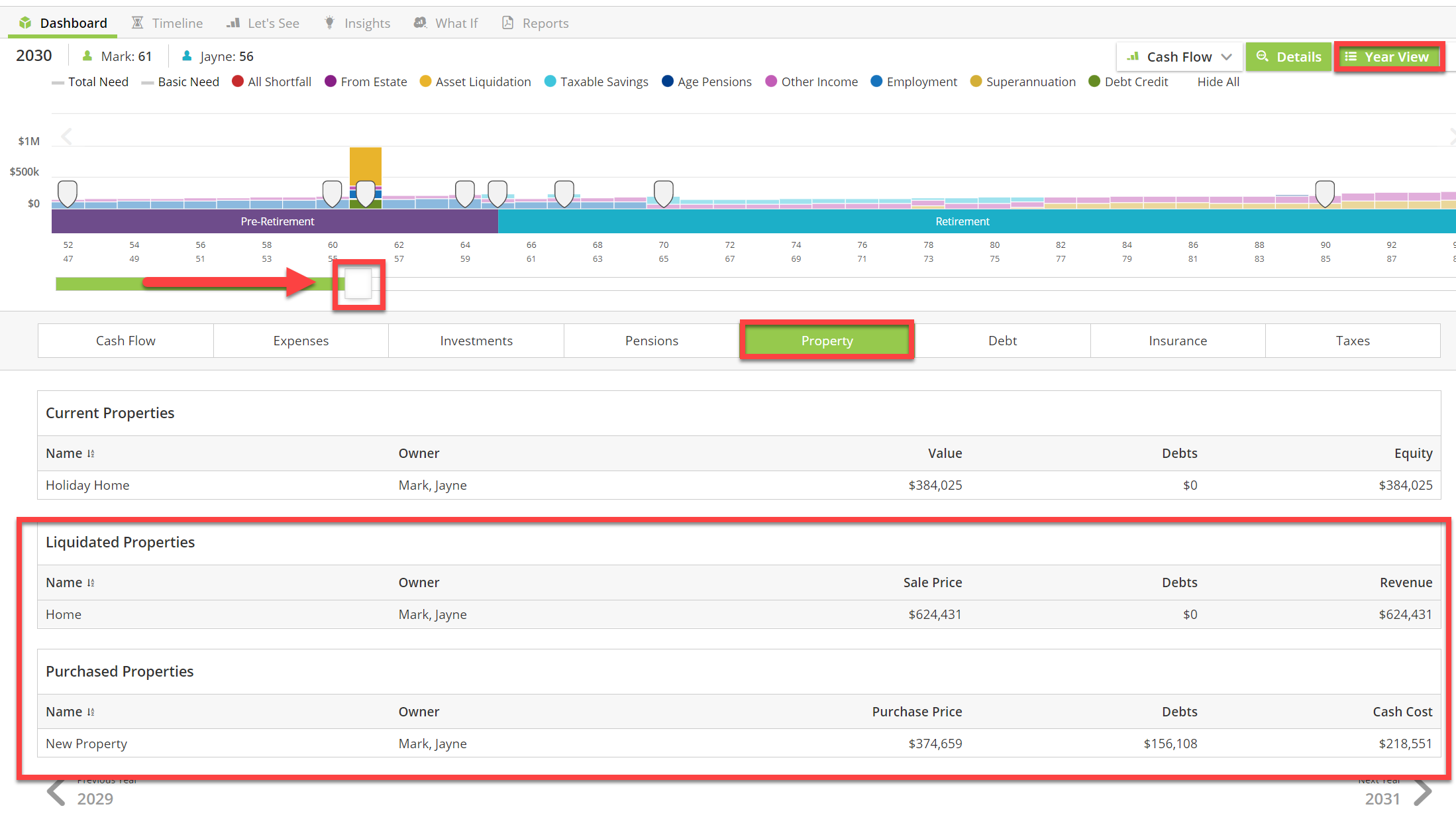

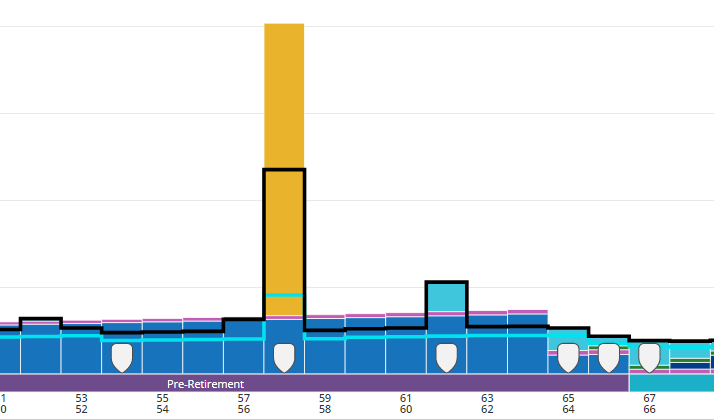

This is how it is represented in Lets See>Cashflow. The spike being the sale proceeds of the first home and the black total need line including the new purchase.

Double click on this bar to see the details of the Property liquidation and purchase.