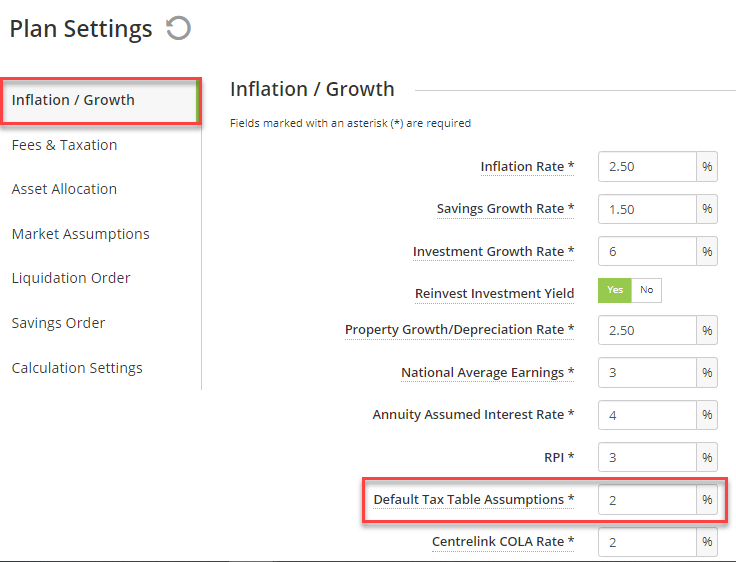

The Default Tax Table Assumption is found in the Plan Settings and can be used to edit and apply an across-the-board annual escalation to the future tax related assumptions such as tax brackets.

Other growth related assumptions, such as inflation, can be edited at the plan level, in Plan Settings or at the individual item level on the various data entry screens, in Advanced Settings, on the Growth, Inflation, or Details panel, depending on the screen.

Any rate set at the item level will override the initial defaults set in Plan Settings.