View Expense Payment Sources on the Let's See Charts

Year View is a convenient tool for investigating how expenses are being fulfilled in a client case. Expense details show not only which incomes or assets were used to fulfil an expense; they also note when a preferred or exclusive payment source has been set for an expense.

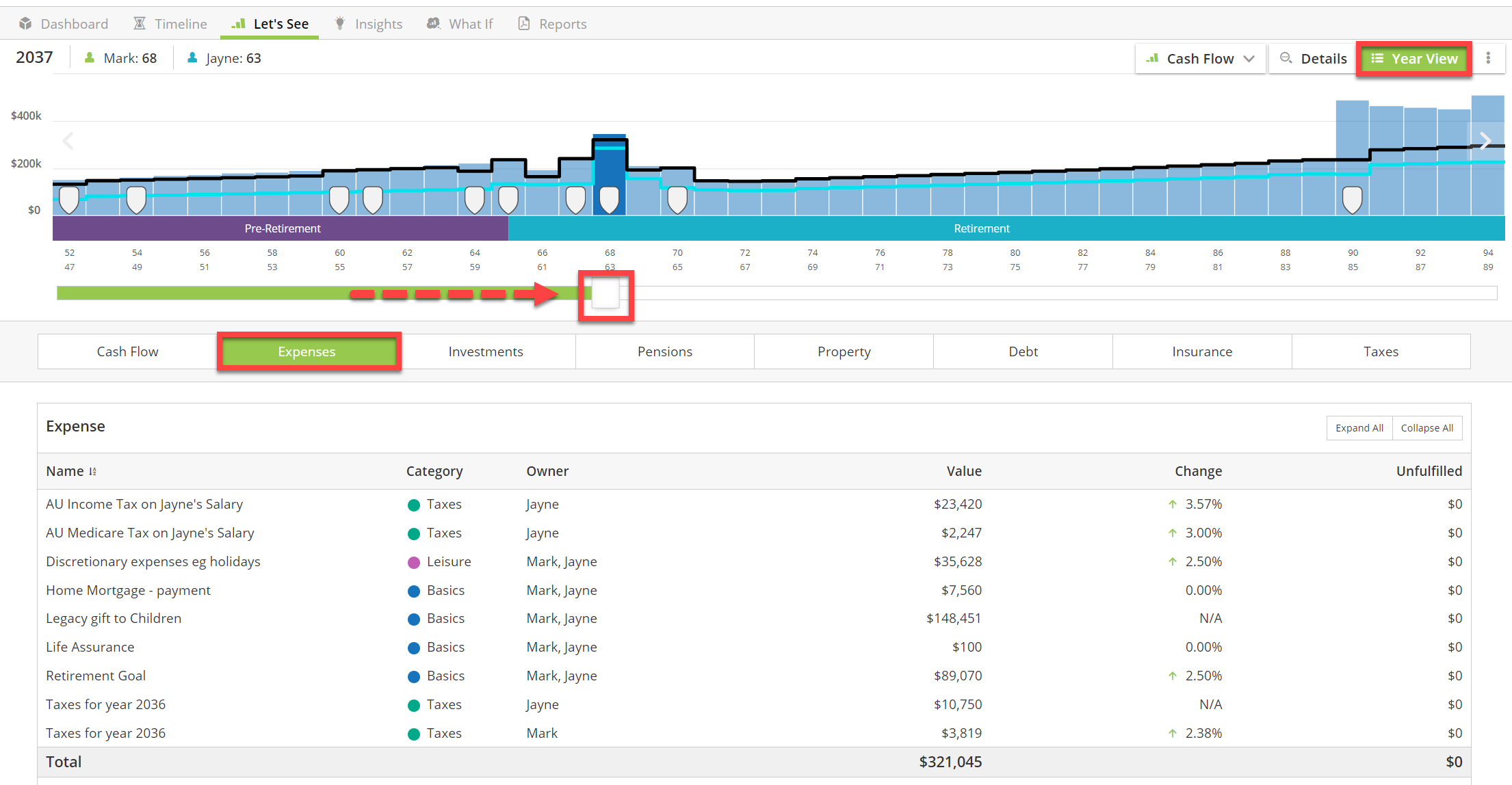

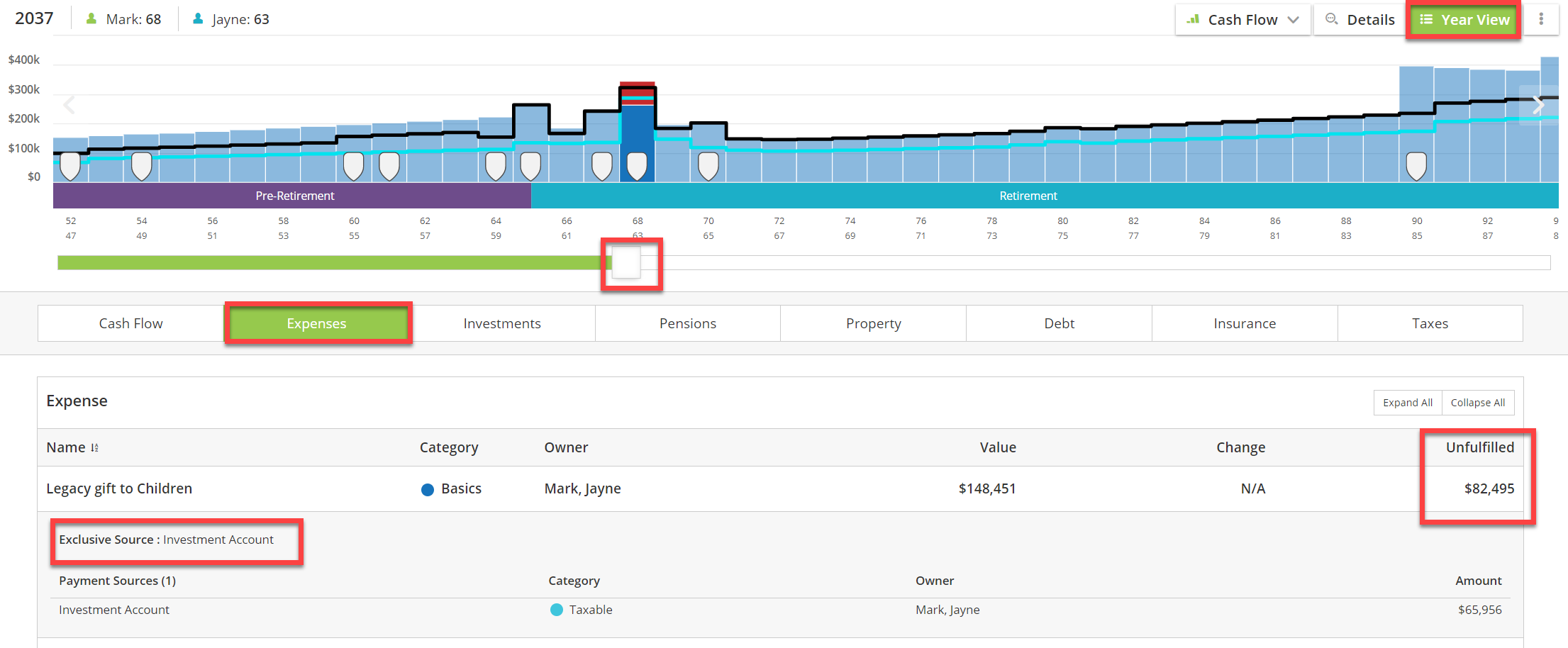

To view the details for any year in a plan, go to Year View and use the slider to select a particular year. The tabs along the top of the panel allow you to view different details for the selected year. Click the Expenses tab to view all of the expenses for the selected year, including taxes and contributions to savings, pensions and investments.

To see how expenses are being fulfilled in a client case, click on the expense in the list and further details will appear. Information will confirm whether a Preferred Payment Source or an Exclusive Payment Source was set for the expense. Expense payment sources are a strictly optional setting found on the Expenses screens.

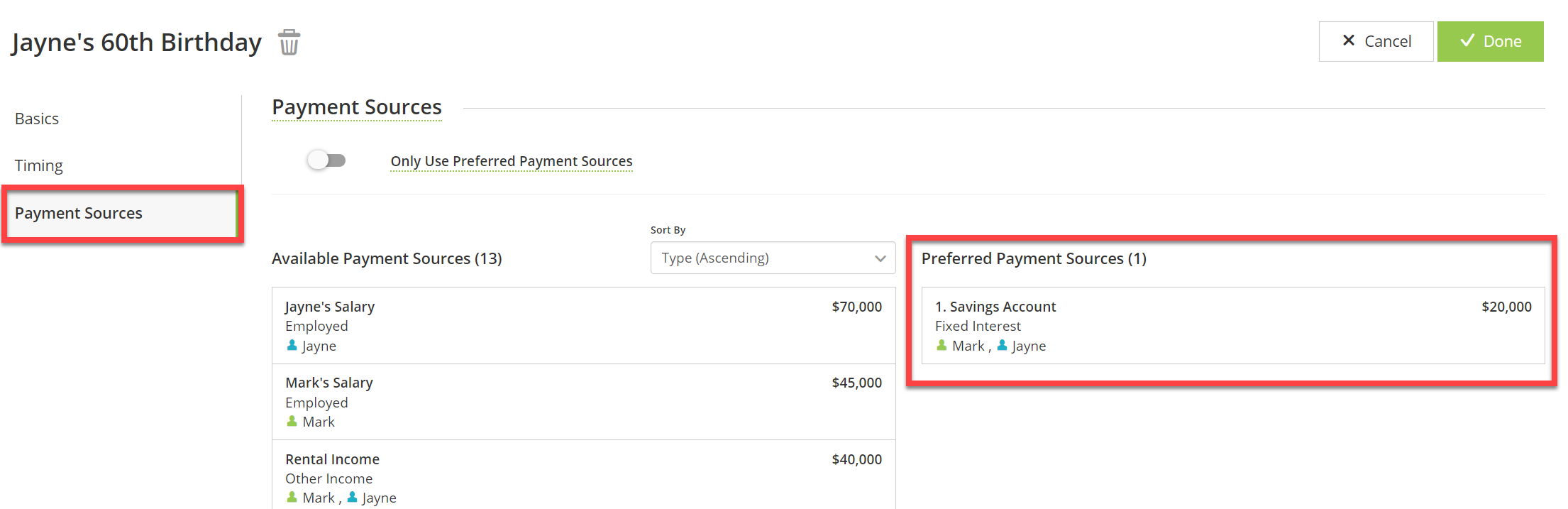

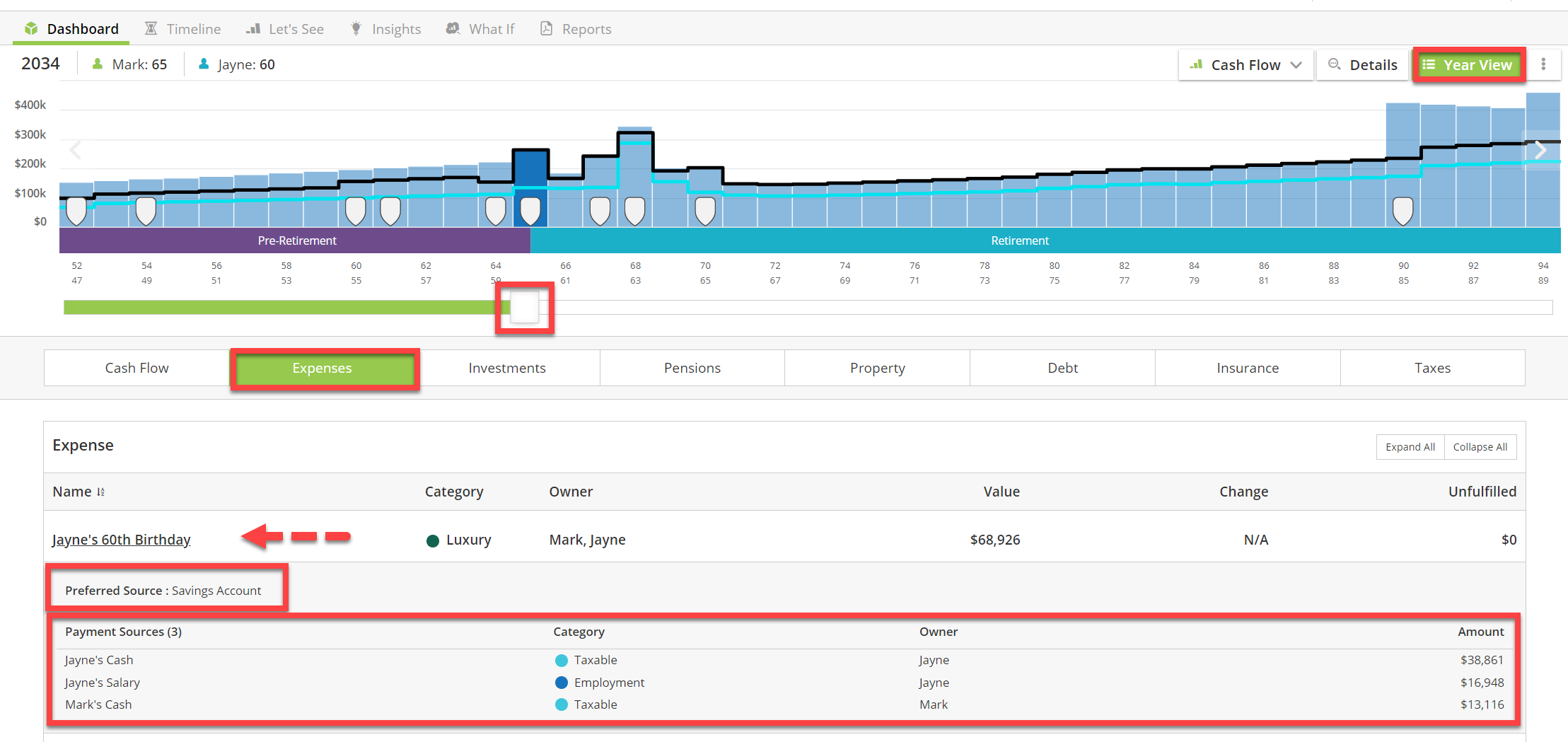

In the following example, the expense payment source section indicates that a preferred payment source was set for the expense.

Other payment sources might still be used to fulfil the expense but the software has been set to draw funds first from the preferred payment source. The preferred payment source and actual payment source(s) could be different if the preferred source does not have adequate funds to fulfil the expense.

By selecting this Expense in Year View, you can see the preferred payment source along with the actual payment source.

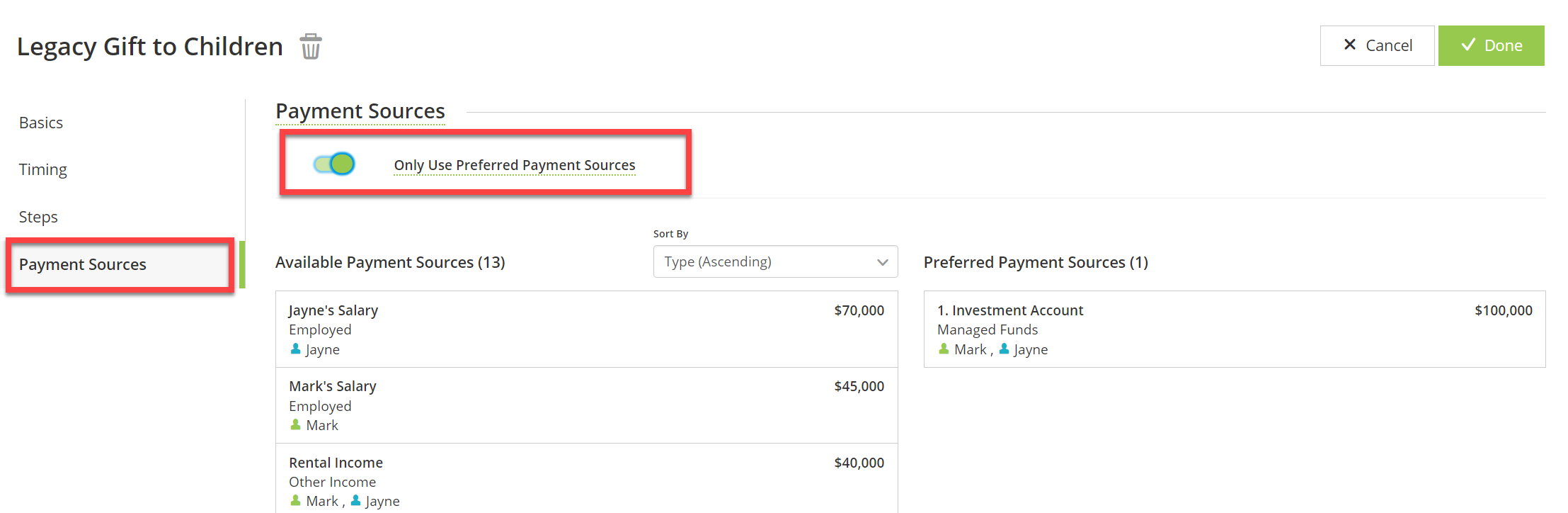

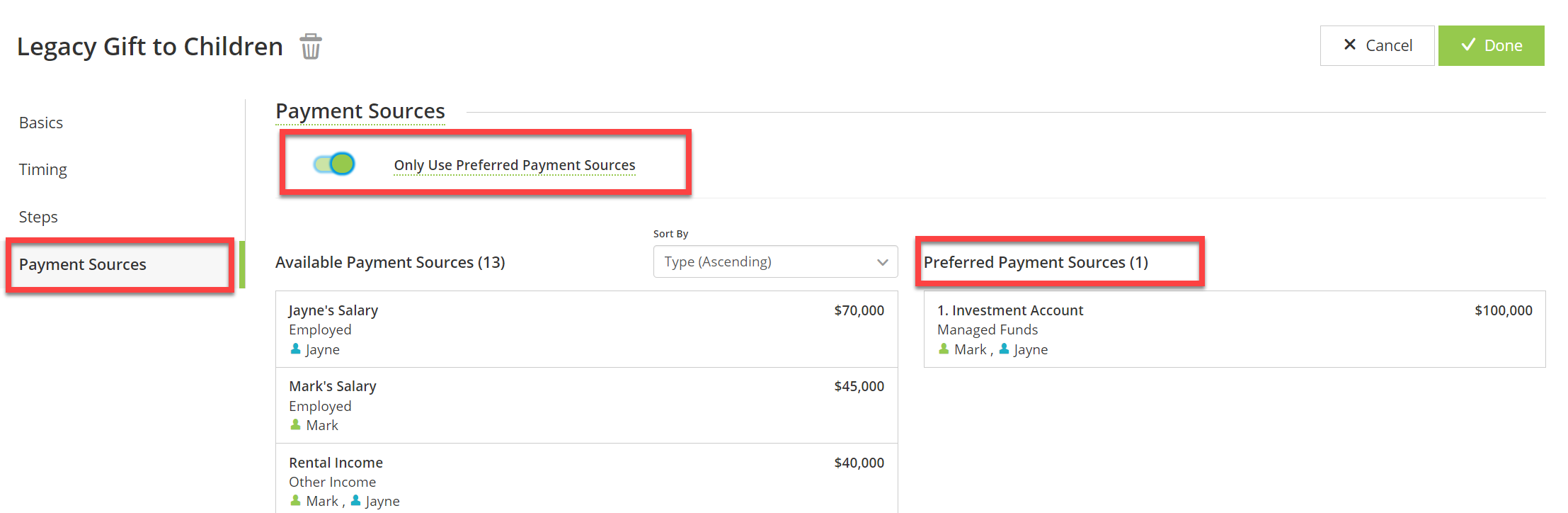

The following example shows what would be displayed if an exclusive payment source were set for an expense. Exclusive payment sources are also set using the Payment Sources section of the expense. A preferred payment source is selected and then made the sole payment source by ticking the "Only Use Preferred Payment Sources " option.

Be aware that this option is quite restrictive as it prevents the software from drawing funds from any other potential payment sources including income and ready cash. If the payment source is not adequately funded, the result could be an artificial shortfall. Such a shortfall might be intentional. Perhaps you have created a scenario and are testing whether your client is contributing enough or getting satisfactory growth on a particular investment earmarked for a specific purpose. A common example would be a child's education fund. Is your client saving enough into the fund to fully fund the child's future education expenses? The "Only Use Preferred Payment Sources" setting could help determine whether one's planned savings are satisfactory. Generally this setting would be used only in What If scenarios, not in a base plan.

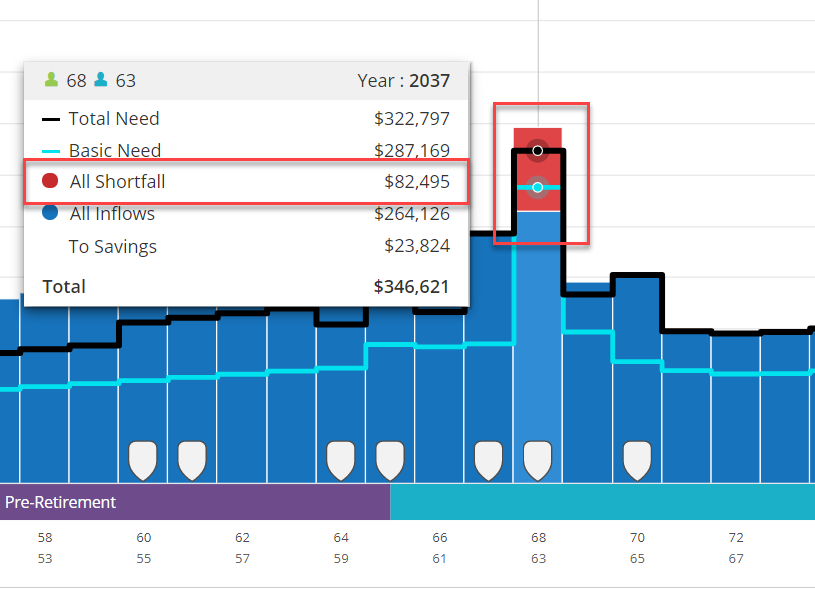

Artificial shortfalls are indicated by a red shortfall shown above the need line.

If the Cash Flow chart shows red above the need line, an artificial shortfall has occurred and the expense payment source tool tip should serve as useful resource for investigating the cause. Look for any expenses with a shortfall that have an exclusive payment source displayed on the window.

If you didn't intend to be so restrictive on the payment source, go to the Expenses screen, select the expense, go to the Payment Sources section and deselect the "Only Use Preferred Payment Sources" option.