1. Open the existing client record, if it is not already open.

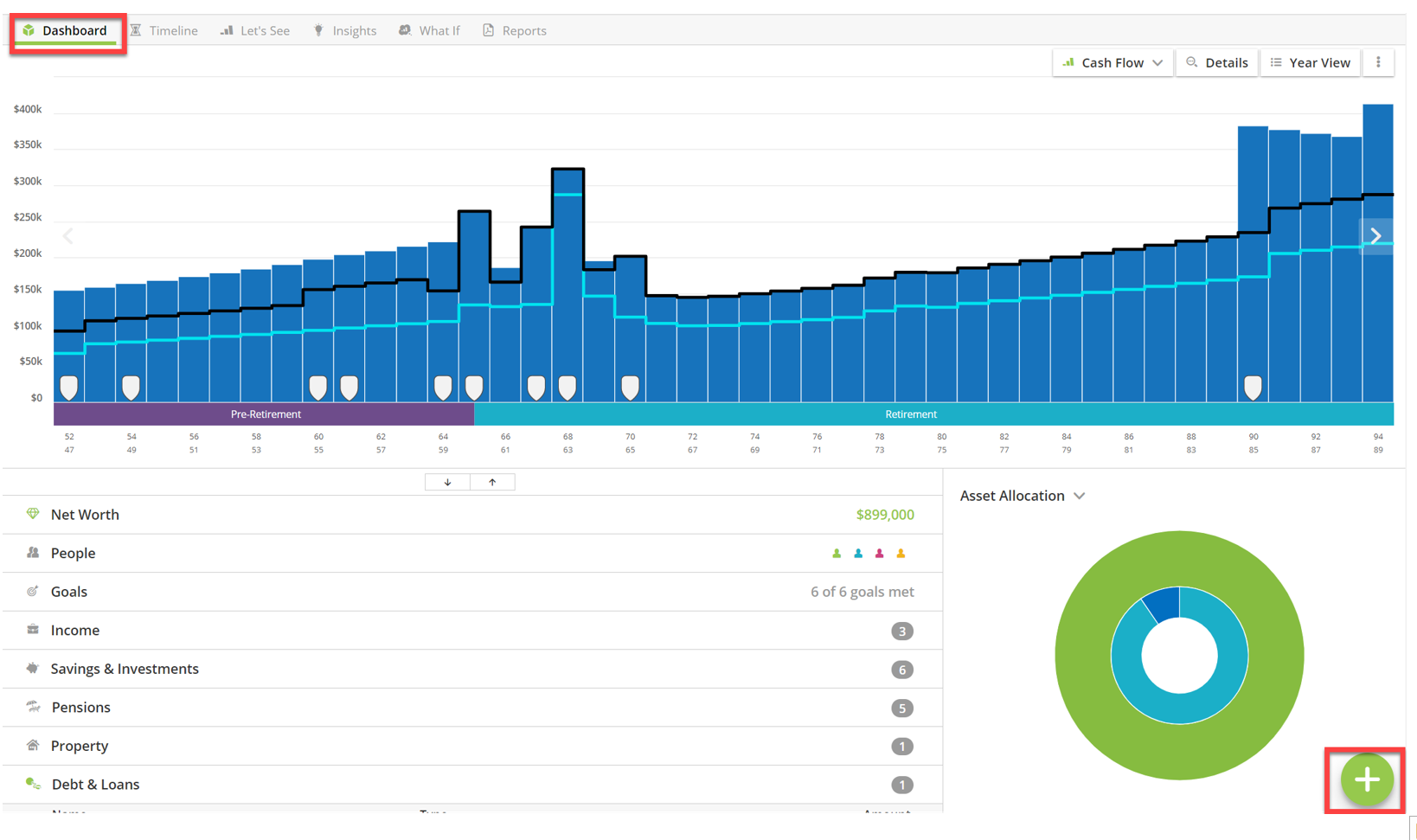

2. Click/tap the plus button in the bottom right of the Dashboard screen.

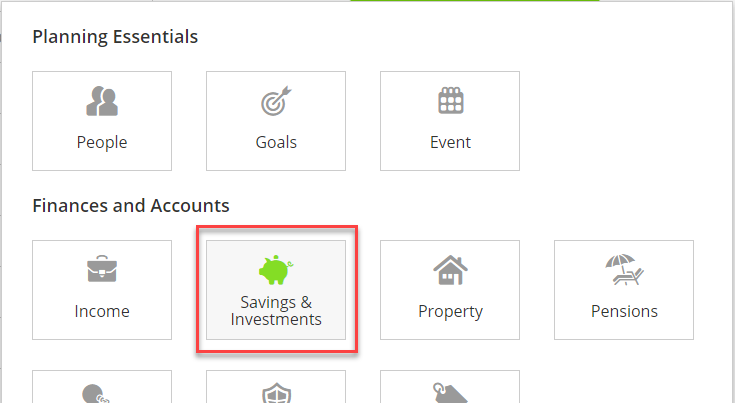

3. Click/tap Savings and Investments in the Finances and Accounts section of the menu which appears:

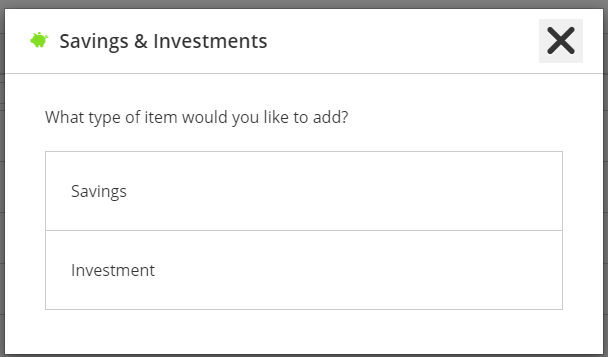

Choose either Savings or Investments.

As a general rule, use the Savings option for those types of accounts held with banks i.e. funds which are not invested.

Savings

4. Complete the data entry fields which appear in the Basics screen (those marked with an asterisk are mandatory fields).

NOTE: AdviserGo has an Inline help feature which provides relevant help topics as you build a plan in AdviserGo. Inline help will assist you with entering information into the fields, will give further information to help you understand how it works and provide access to further assistance. Inline help.

Sole ownership is assumed but you can amend this to joint ownership, where the account type allows.

Select the type of savings account you wish to enter. This is for tax and contribution rules purposes. The account type also determines when these assets will be accessed if needed in the plan.

Checking / Savings accounts

Fixed Interest accounts

For further information on how Voyant accesses liquid assets in the plan click here - Liquidation Order

Enter a Name for the Savings. The name you enter must be unique within the plan.

Enter the current Balance of the account.

The Growth Rate will show the default rate from the assumption shown in Plan Settings. You can amend this growth rate by overwriting it.

This will only affect growth rate of this item, it will not affect any other Savings in the plan.

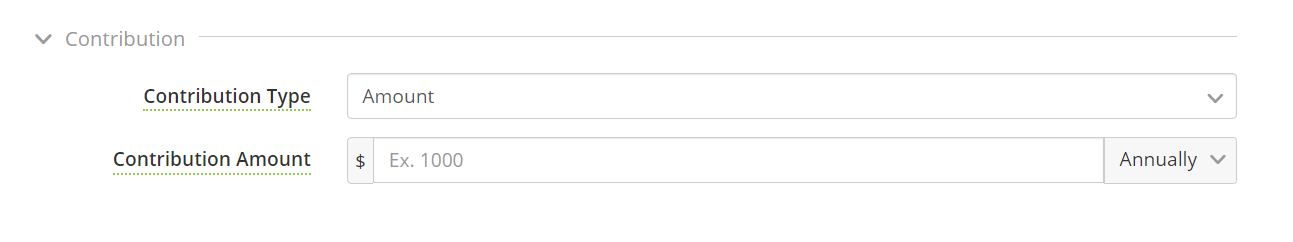

5. Regular contributions from income should be entered here

Further information on how to do this please click this link Contributions to savings and investments

6. Click the Done button, top right.

Investments

7. Repeat steps 3 to 6 for any Investments you wish to add to the plan.

At step 4, select the type of Investment accounts you wish to enter. This is for tax and contribution rules purposes. The account type also determines when these assets will be accessed if needed in the plan.

For further information on how Voyant accesses liquid assets in the plan click here Liquidation Order

Further reading

Transfers between accounts

Guidance on how to schedule one off or ongoing transfers between accounts or from surplus to an account can be found here

Withdrawal limits

Withdrawal limits are explained here

Planned Withdrawals

Guidance on how to schedule planned withdrawals from Savings and Investment accounts can be found here

Steps

Guidance on how to schedule Steps can be found here

Where can I see the Savings and Investments in the plan?

The Savings and Investments can be seen in the Assets chart in either the Dashboard or the Let's See screen.

You can also see a list of the Savings and Investment accounts for each year of the plan in the Year View screen from Dashboard or Let's See > Investments tab.