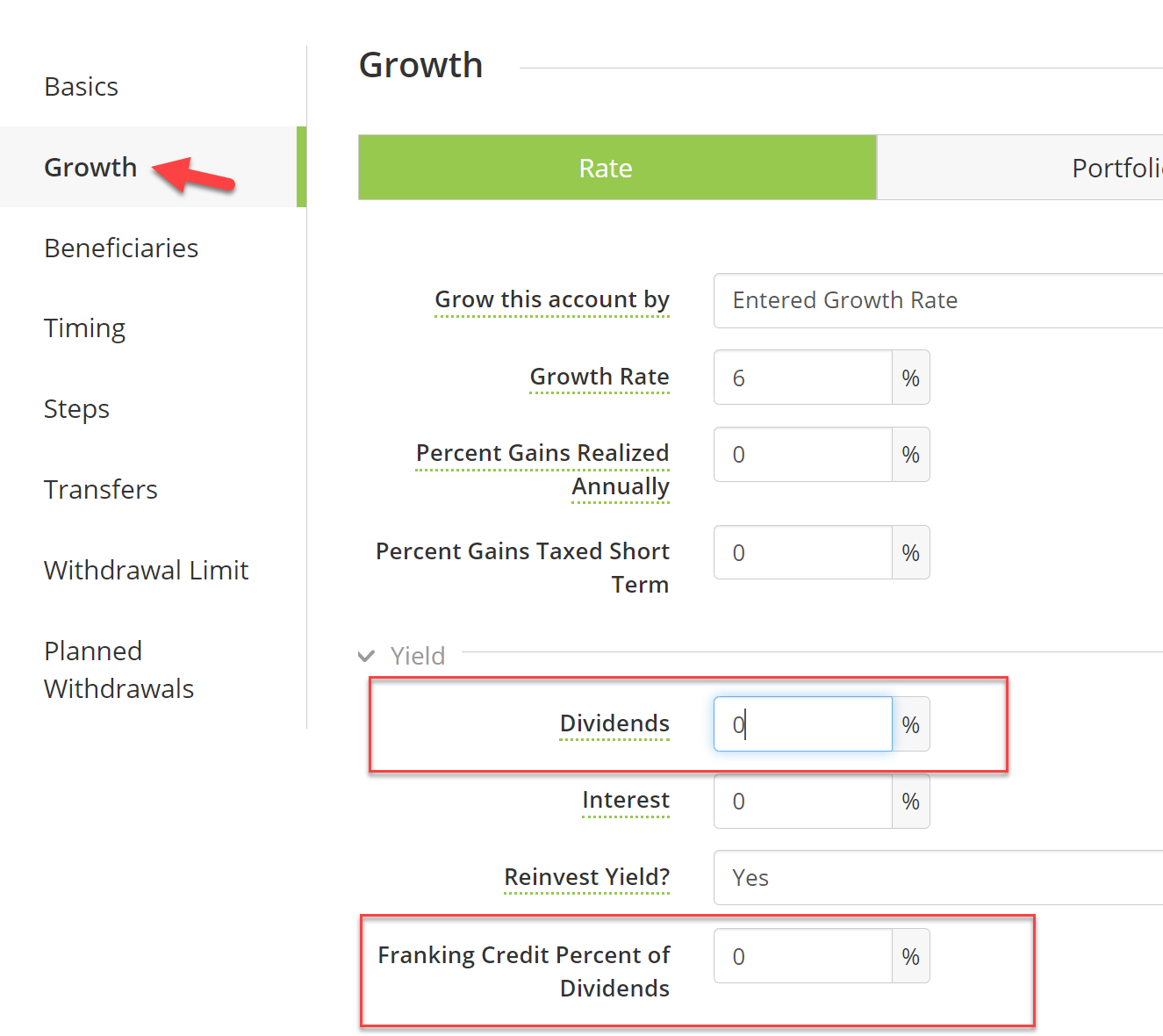

To apply Dividend Franking to the plan go to the Growth section of an Investment and you will see an option called Franking Credit Percent of Dividends

First enter a % value of Dividends.

Note: Dividend growth rates are in addition to the Capital Growth rate, for example if Growth Rate is 4% and dividends are 2% then the total growth is 6%. See Net Growth rates in Year View - Investments tab. Click on the name of the Investment to see more details.

Then enter the Franking Credit Percent of Dividends, which is a percentage of the dividends entered.

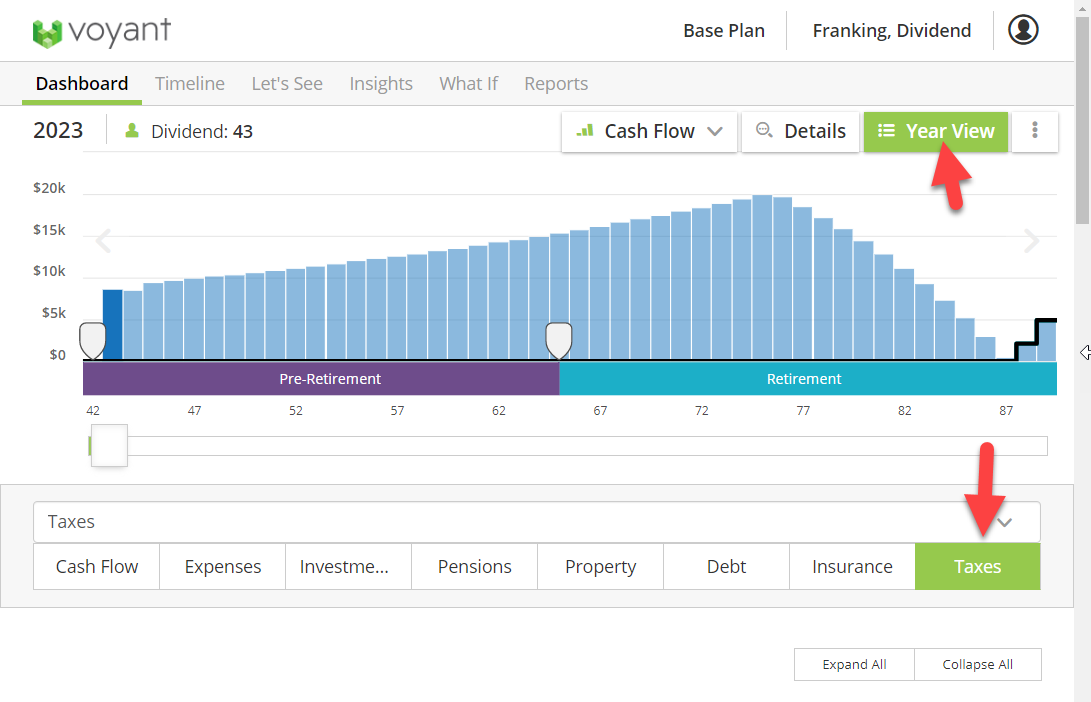

To see the Tax Credit go to the Year View - Taxes tab

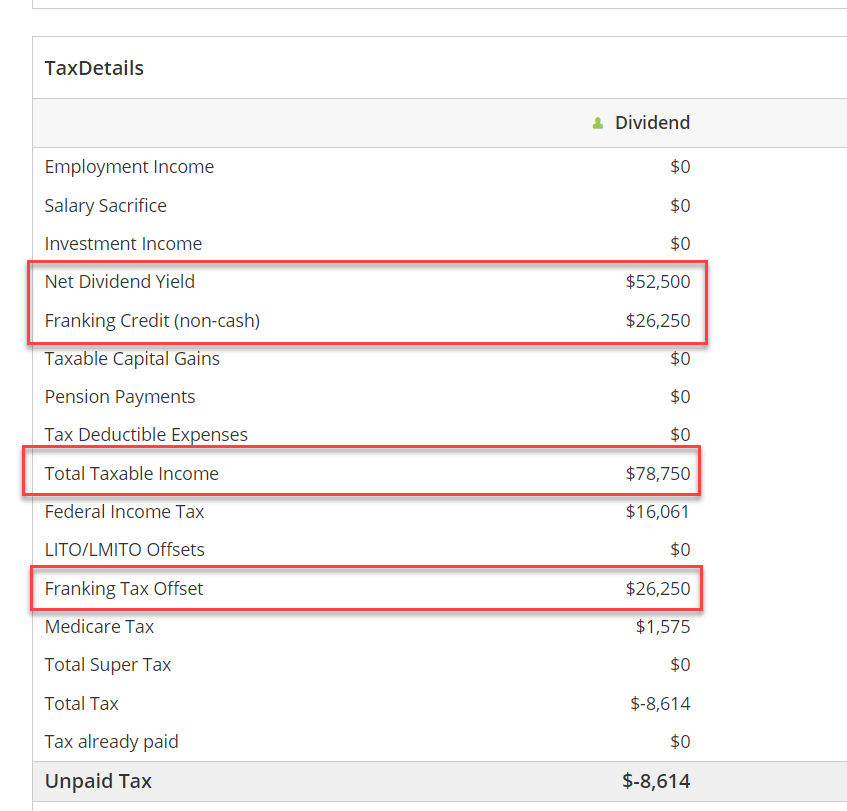

In the example below a 50% franking credit is set up. So the dividend of $52,500 has a franking credit of half that $26,250.

The Franking credit is taxable, but then the value of the credit is deducted as a Franking tax offset. See 'Franking credit' and 'Franking tax offset' in the image from Year view - Taxes below.