Entering your client's non-employment income

The Other Income screen is used to capture all manner of income aside from earnings. You could use this screen to enter rental income, income from royalties or even employment earnings if they are not subject to the regular income tax code. Earnings from savings and investments should generally be entered on their respective screens in the software.

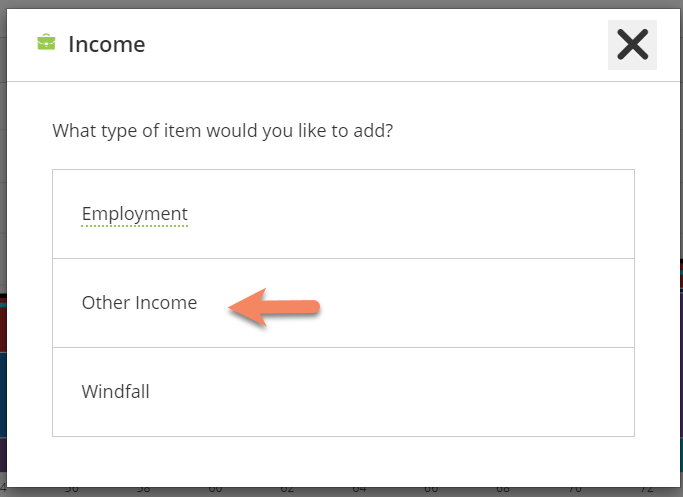

From the Dashboard click the (+) button and select Income.

From this window Select "Other Income".

From here you will enter the basic income information. Things to note:

1. Other income can be entered a taxable or non taxable (net of taxes).

2. Taxation type can be set to Income, Capital Gains or Dividends.

3. The growth rate will be set to 3% but can be edited here to meet your needs.

From the Timing Screen this income will be linked to the income owners retirement and if joint this will default to the primary client.

To change this you can assign it to a different event by clicking on another event icon or you can double click anywhere on the timeline and create a special event setting it as "end event". Click Done to save.

From the Dashboard you will be able to access this item under the Income section.

To link this to a Rental Property, Dashboard>Property navigate to the rental property.

Click 'Linked Income' on the left hand menu.

If you have entered the 'Other Income' already you can click on 'Link to an Existing Income'

This will show you the details of the rental income that you have already entered previously.

Click on the Rental Income link and select 'Done'

If you have not entered the income previously as 'Other Income' navigate to the Rental Property, Dashboard>Property.

Click 'Linked Income'. This will give you the opportunity to create and link a new income.

Enter the details of the rental income;

Things to note:

1. Other income can be entered a taxable or non taxable (net of taxes).

2. Taxation type can be set to Income, Capital Gains or Dividends.

3. The growth rate will be set to 3% but can be edited here to meet your needs.

Click Done. Click Done again

To see how this income changes over time go to the Year View > Cash Flow tab. Move the slider up and down the Timeline to see how this changes over time.