Family income benefit insurance policies are added to financial plans on the Protection > Term & Endowment screen. Premium payments and benefit payouts from these policies can then be tracked on the Let's See > Cash Flow chart.

FIB cover will come into play, together with term life and whole life policies, when doing contingency planning. Plans can be tested for adequate protection by modelling an earlier than expected mortality either in comprehensive what-if scenarios or by using Voyant's quick and easy-to-use Life Insurance Need Analysis Insight.

How to Enter a Family Income Benefit

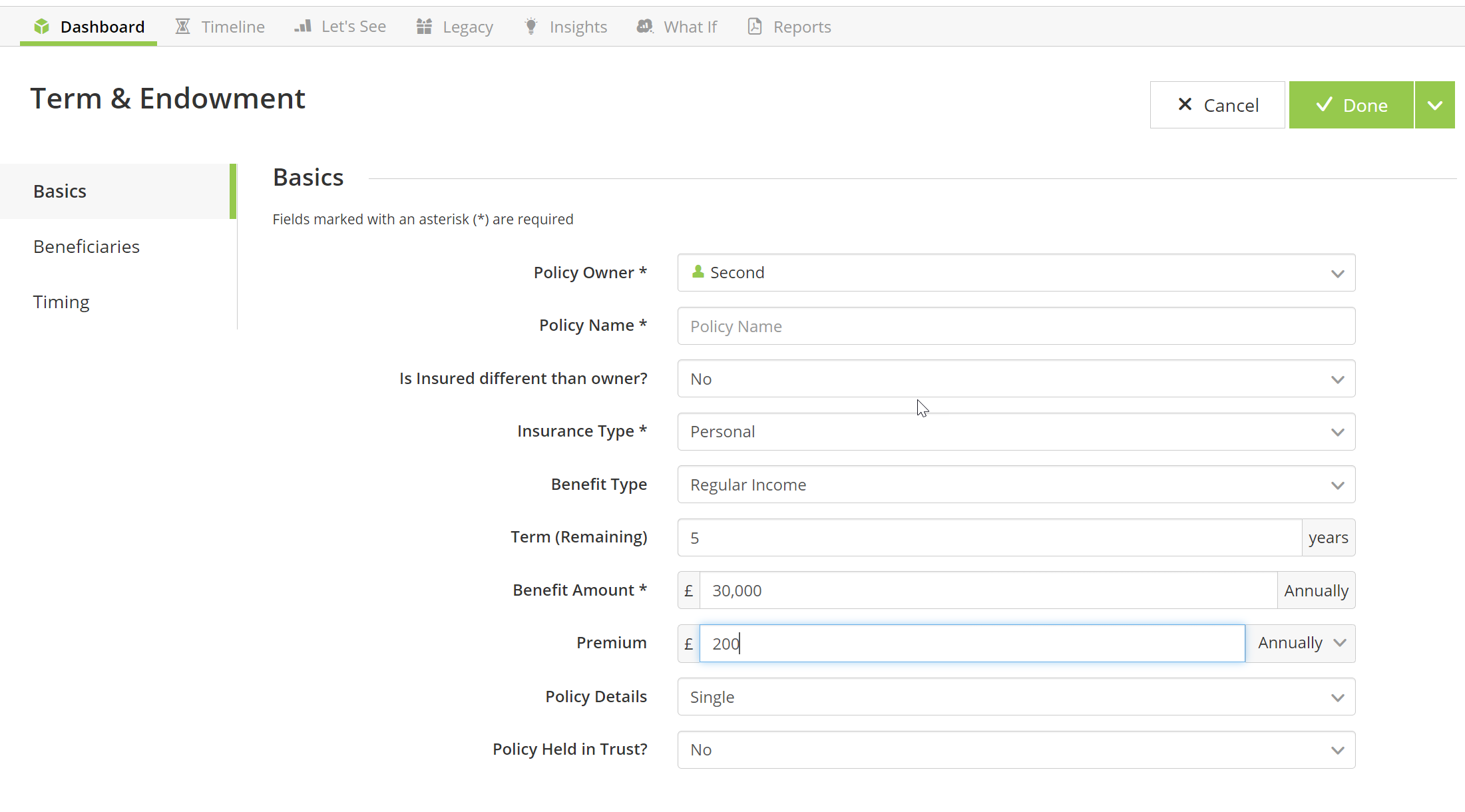

1. Go to the + button in Dashboard and select Protection > Term & Endowment.

2. In the Type drop-down, select Personal Policy .

3. Enter a name for the policy in the Policy Name field.

4. In the Timing screen - Protection Starts, select the Event when premiums are to begin on the policy.

How you set the beginning of family income benefit coverage will depend on whether the policy is an existing one, already in force or if this is possible future coverage under consideration.

Is the Family Income Benefit currently in force?

If so, click on the Start Event and 'Set as Start Event'.

Will the Family Income Benefit go in force later in the plan?

Select a future Event on the Timeline. Double click on the Timeline to add a new event in this screen.

5. In the Benefit Type drop-down, select Regular Income.

6. In the Benefit Amount £ field, enter the annual benefit amount.

7. In the Term (Remaining) field, enter the remaining term of the policy. If the policy is in force at the beginning of the plan, enter the term remaining. If this is policy is to go into effect in the future , enter the full future term.

Note: The Protection Starts Timing and the Term (Remaining) will be used together to determine the coverage period.

8. In the Annual Premium £ field, enter the amount that will be paid annually in premiums whilst the policy is in force.

Note: An expense will be created automatically and linked to the family income benefit. Premium payments will be made until either the term of the policy ends or until benefits are in payment.

9. If the policy is Joint select this under Policy Details and whether it pays out on First or Second death. Select the appropriate Policy owners in the top field.

10. Click the Done to save the policy to the plan.

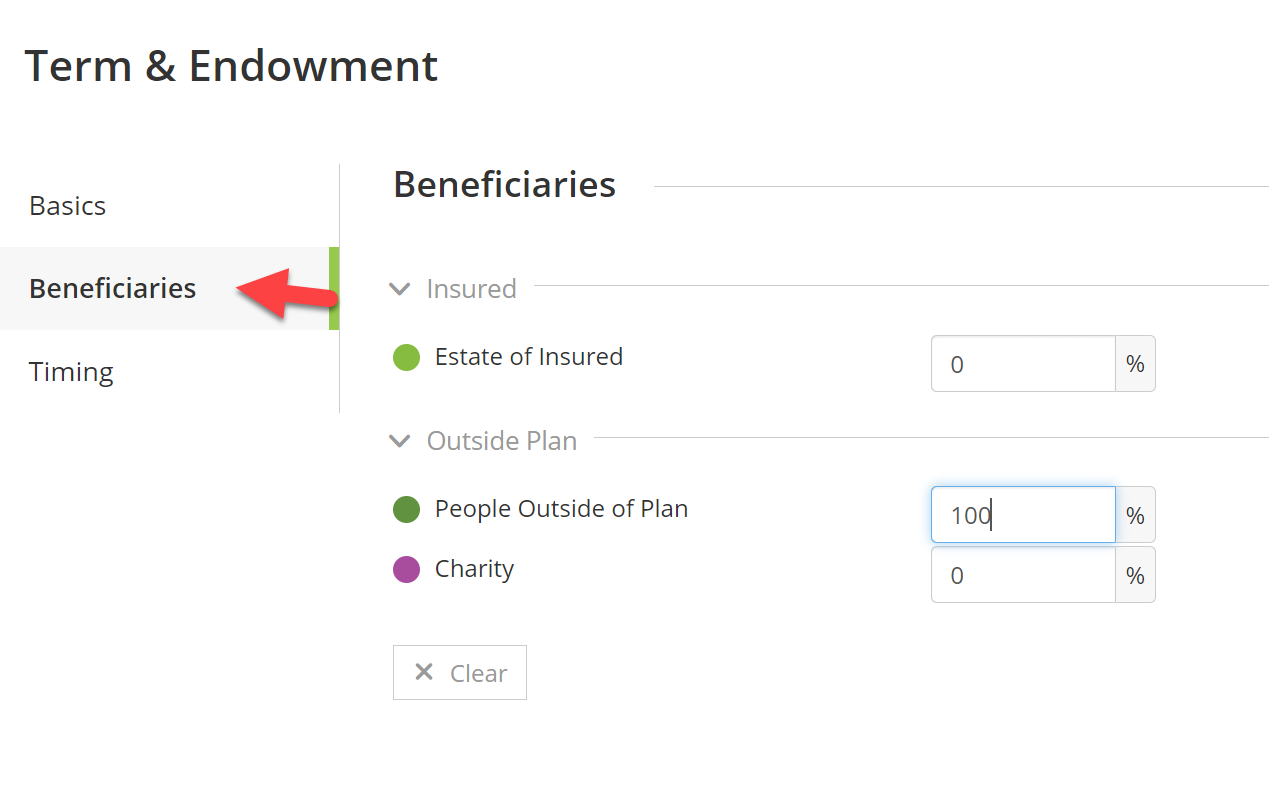

Beneficiary Designation

Benefits are assumed to be paid to the policy owner's spouse or partner. Alternative or additional beneficiaries can be specified in the Beneficiaries section. Advanced Settings > Inheritance Details panel, if necessary. Beneficiaries can include the spouse, estate of the insured, surviving insured (for joint policies), other people within the plan, persons outside the plan, and charities.

Let's See Charts

Family Income Benefits will appear in the Let's See charts, primarily in the Cash Flow chart when a benefit is received as an inflow after the death (Mortality) of the policyholder.

Inflows from FIB payouts will be categorized as Protection in the detailed view of the chart.

Specifics about the policy can be found in the chart details by clicking on Year View.

Policy premiums are listed on the Expenses tab, categorised as Basic expenses. Premium payments and the potential annual Benefit Amount, as of the selected year, are tracked on the Protection tab.

When the policy is in payout, payments will be shown as inflows on the Cash Flow tab. The Protection tab will also list policy Payouts .

Insights - Life Insurance Need Analysis

The Life Insurance Need Analyser can be used to easily model payouts from life insurance policies, endowments and family income benefits, provided the policyholder is the primary client, the client's spouse or partner, or in the case of joint policies, both.

When running an analysis, payouts from family income benefits will occur at the policyholder's death only if the policy is in force in the year of death. Benefit payments will continue for the term remaining in the policy and will be deducted from any coverage shortfall identified by the analyser.

Notes on Payouts to Persons and Entities Outside of the Plan

Payouts from family income benefits will only be displayed as inflows in the Cash Flow chart if these funds can be considered as an income accessible to the individuals who are active participants in the plan. Benefits are by default assumed to be paid to the policyowner's spouse or partner. Alternative beneficiaries can be specified, however, on the Term & Endowment screen's Beneficiary Designation panel.

If the policy beneficiary is set to be a charity, persons outside of the plan or adult children/dependants who are past the age child owned accounts are available in the plan, the benefit will not appear in the Let's See Cash Flow chart and will not be considered when analysing life insurance coverage needs.

Notes on Displaying Payouts on Second Death

If the joint policyholders are the primary client and a spouse or partner, setting the policy Payout to Second Death effectively removes the benefit from the purview of the plan. Since the benefit is an annual payment, the payout on second death will not be shown on the Legacy screen (the estate plan overview) nor will it be shown in the Let's See charts since the planning timeline has ended.