Question

I notice that the total expenses in my client's plan (as shown by the black need line on the Cash Flow chart ) are considerably lower in the first of the plan than they are in subsequent years. Could this have something to do with my client being self-employed?

Answer

The cash flow chart shows what the software in fact does, which is that it makes no assumptions about what a self-employed individual's income was in the year prior to the plan's beginning (Start date).

Since self-employed individuals do not generally pay taxes via pay-as-you-earn (PAYE), the software assumes their taxes are paid at assessment in the following year of the plan.

Taxes on self-employment income from the first year of the plan would therefore be paid in the second year of the plan and so on.

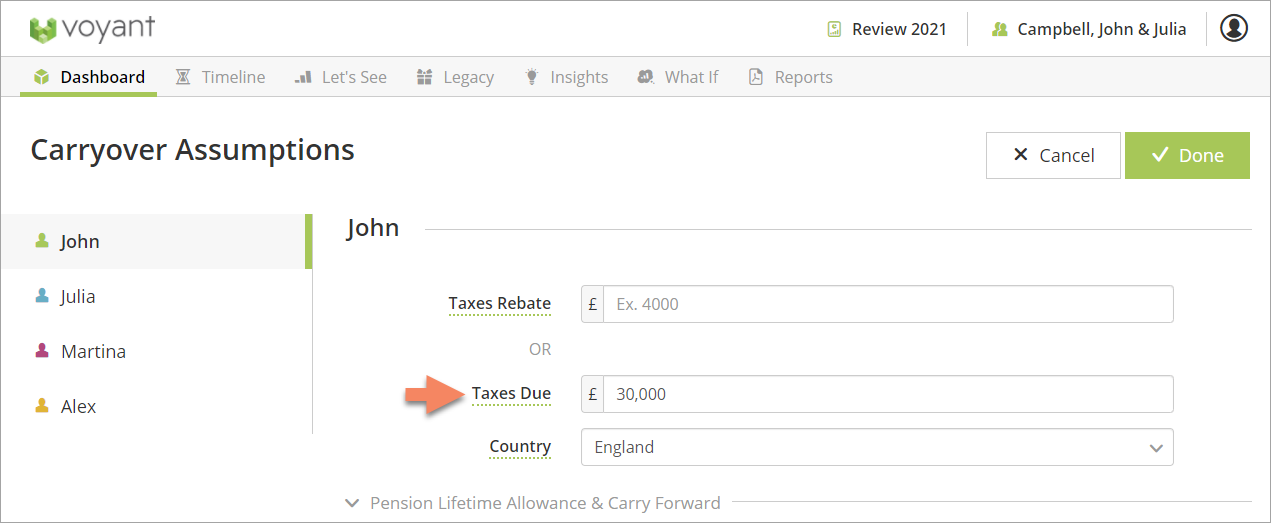

To capture any taxes due on self-employment income from the year prior to the plan's start, go to the Dashboard screen and select the Carryover Assumptions link, one of the bottom two links in the middle of the screen. Select the name of the earner to the left of the screen. Enter these taxes due from the year prior to the start of the plan in the Taxes Due field.

These taxes due will then appear as a first-year expense in the Cash Flow chart.

Related topics: