Withdrawal Limits – Minimum Balance

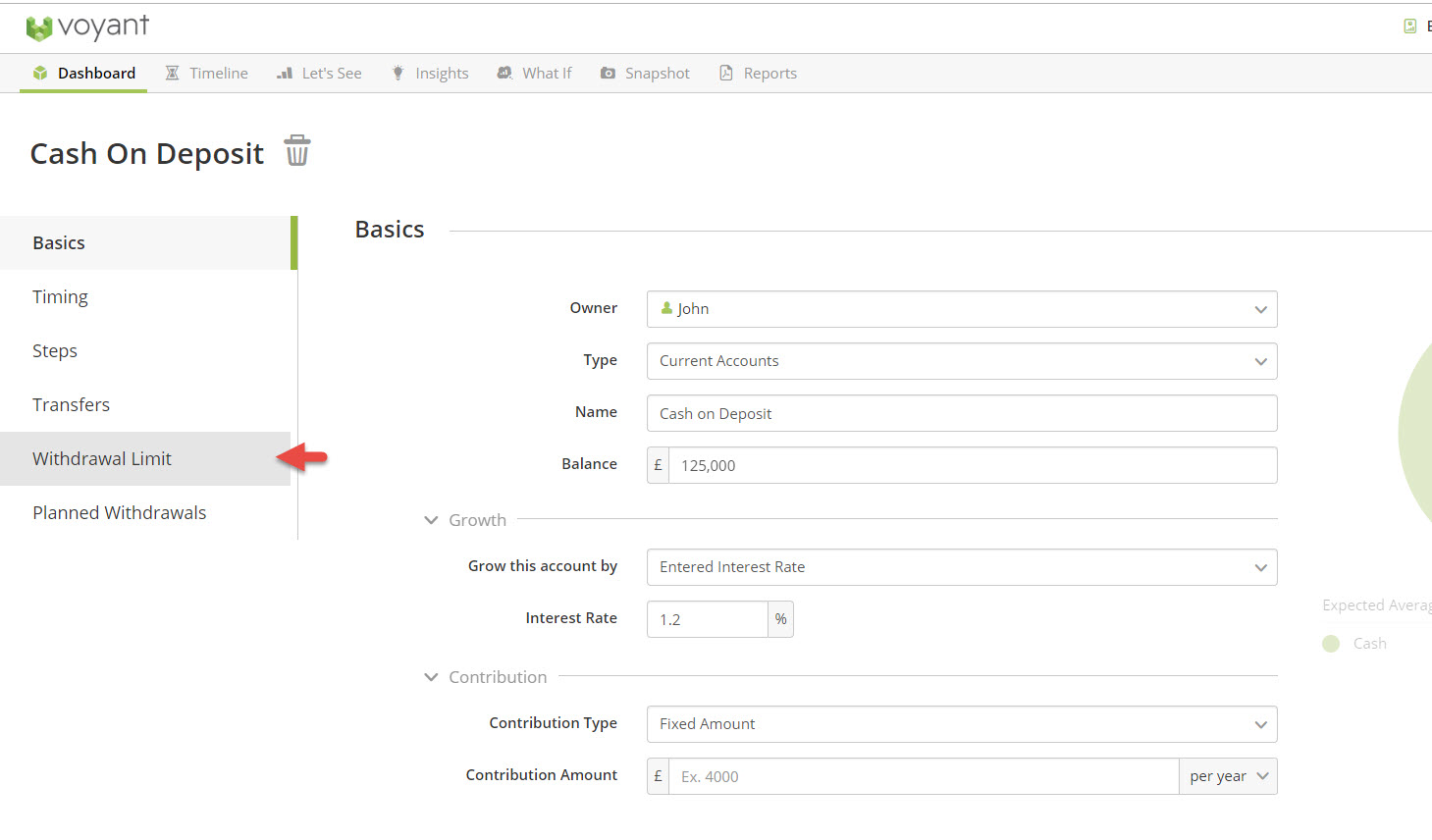

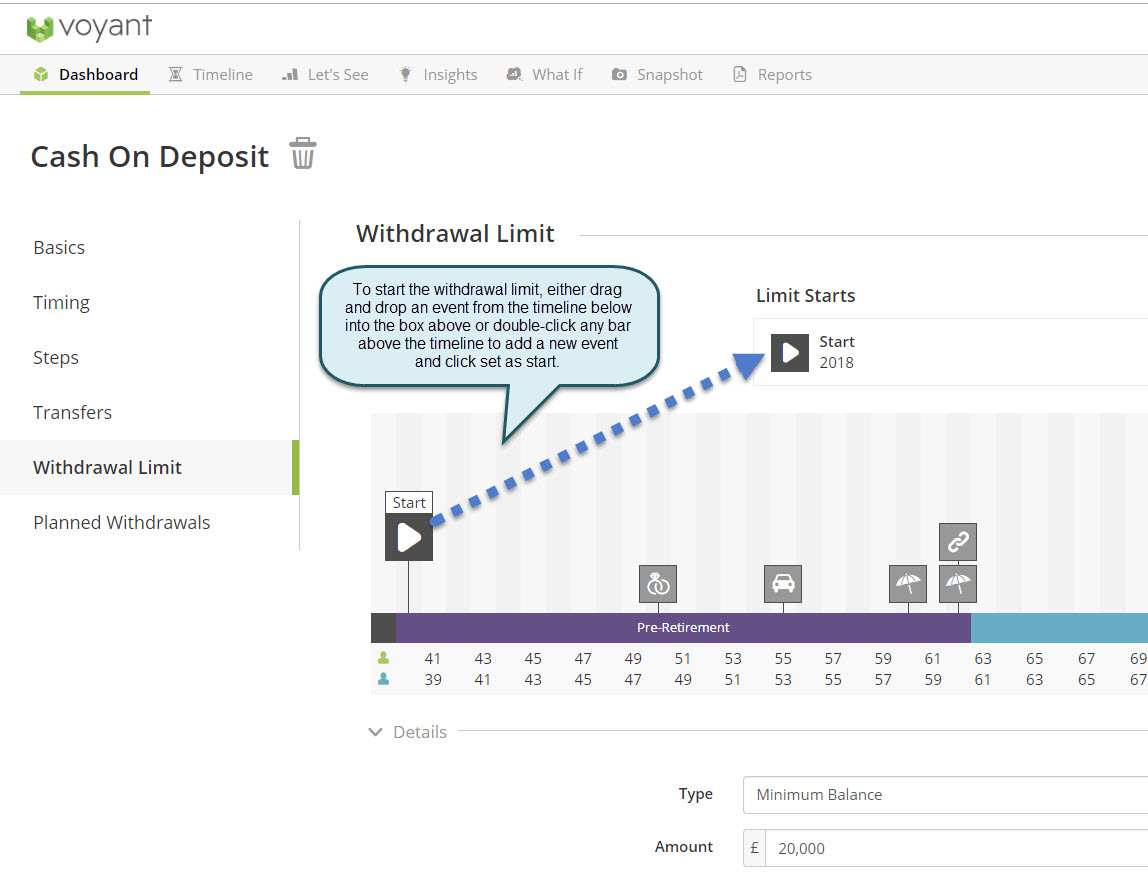

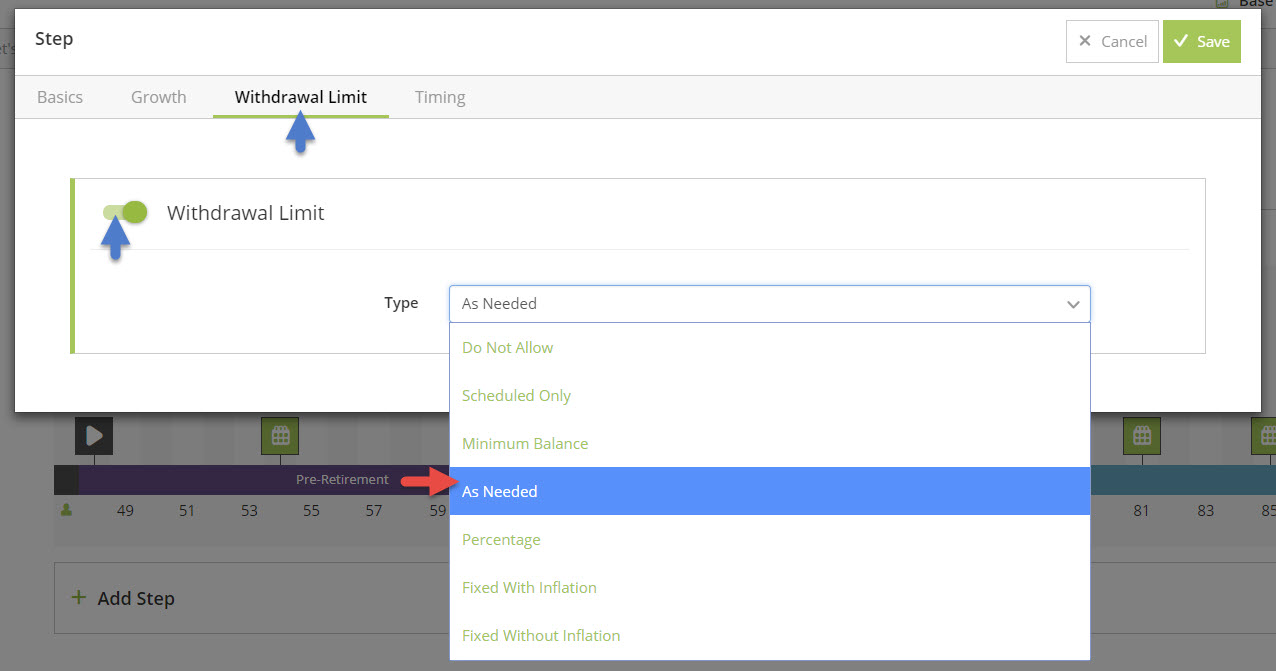

A new option is available on the Withdrawals Limit panel that allows users to designate a minimum balance on an account.

For example, the following savings account has a starting balance of 100,000. We are advising the client always to retain a rainy day fund of 20,000.

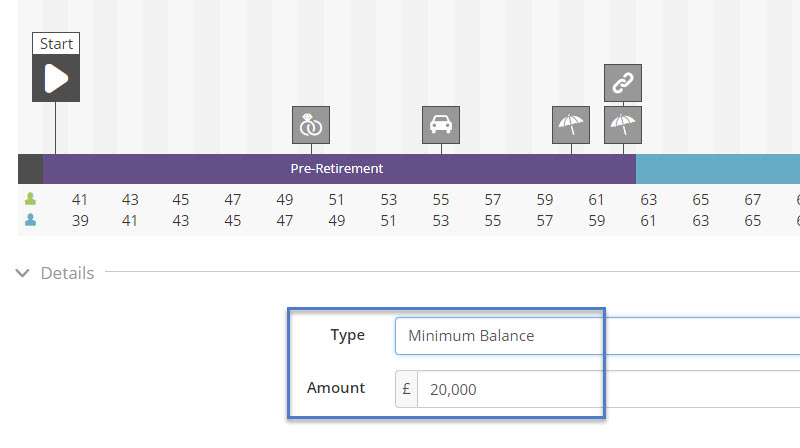

This 20,000 reserve will be set as the account’s minimum balance.

Note that the 20,000 reserve doesn’t necessarily have to be present in the plan at start. You could build up a reserve through regular savings and account growth. Any funds in the account above the minimum balance could be spent when needed.

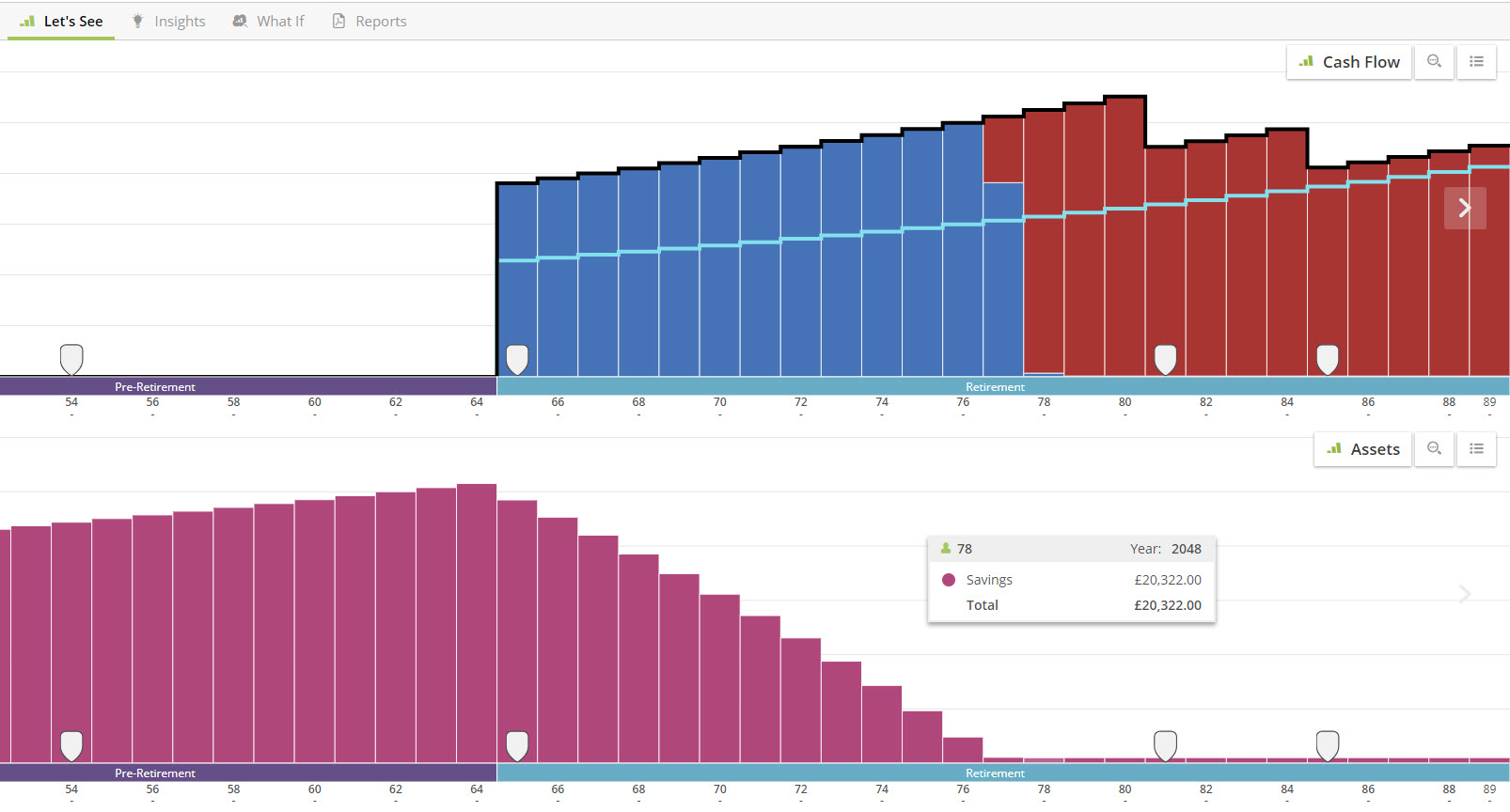

The result in this example would be as follows. Notice how once the account is spent down to its reserved minimum balance, the end of year balance may be slightly higher than the stated minimum of 20,000. This is caused by the software applying interest to the unspent balance, which is added to the account’s end of year balance. The interest from the current year would be paid out in the following year, if needed.

If the growth is coming from an interest and the account is set up as an unwrapped investment with an Interest Yield, you could opt to have the interest paid annually to the client, which would leave you with the stated minimum balance.

Bear in mind that Withdrawal Limits not only limit withdrawals taken as needed by the software. They also apply to any withdrawals scheduled form the new Planned Withdrawals screen.

As is the case with all withdrawal limits, when a minimum balance is set on an account:

1. It protects reserve balance not only from withdrawals being taken as needed by the software but also from planned withdrawals scheduled on the new Planned Withdrawals screen.

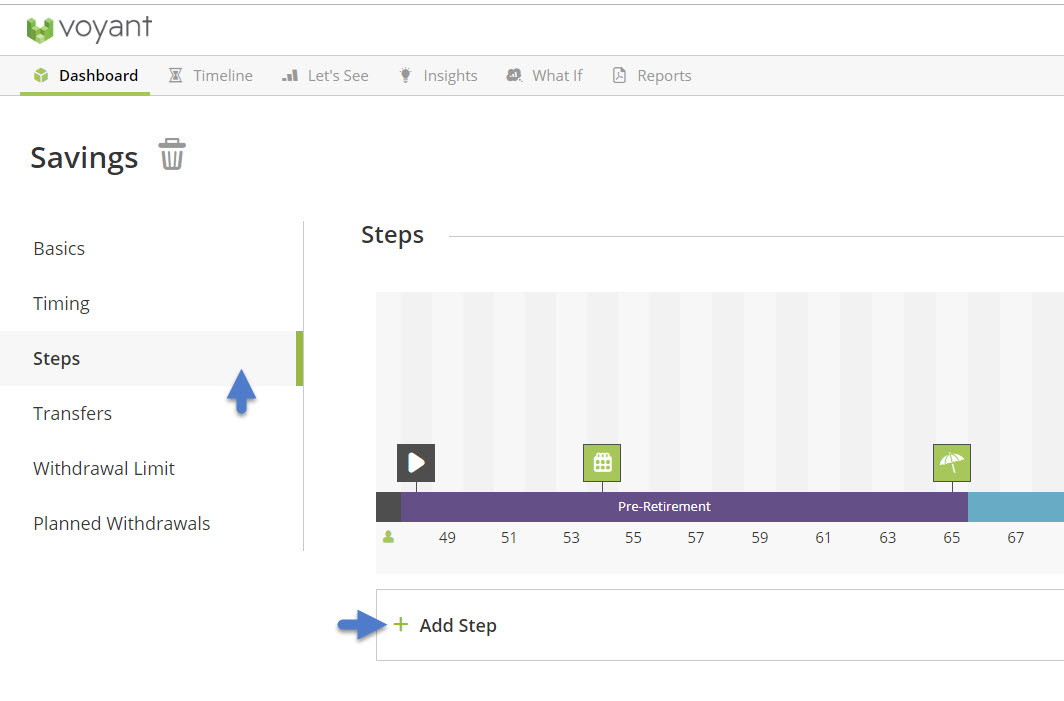

2. A minimum balance could be added to an account, changed or removed in the future, if necessary, using the Step Up / Step Down panel.

3. An account’s minimum balance can still be transferred out of the account using the software’s Transfers / Additional Contributions panel. Withdrawal limits to not apply to transfers.

Minimum Balances and Transfers

Withdrawal limits apply only to as needed and planned withdrawals. They do not limit scheduled transfers from an account, which are scheduled on the Transfers panel.

You could have a withdrawal limit set to “do not allow” on an unwrapped investment and still use the account to fund an ISA via recurring transfers.

The same holds true for a minimum balance. Don’t expect a minimum balance to be applied if a transfer is scheduled that would dip into this reserve. The software will still allow the minimum balance to be transferred out of the account.

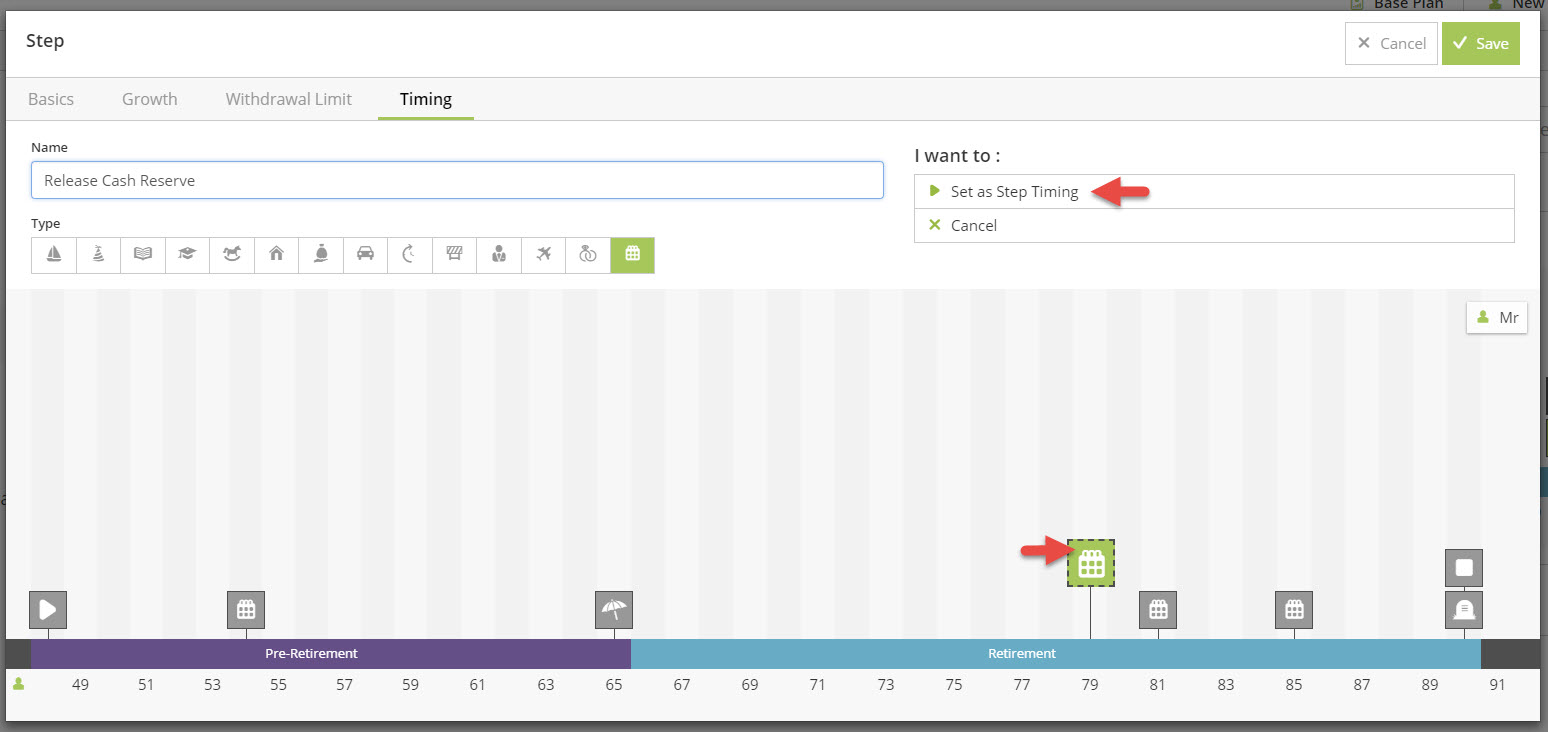

How to Schedule the Release of a Minimum Balance

If at any point a minimum balance needs to be released, use the Steps feature to schedule a future change in this withdrawal limit. At any given event, a withdrawal limit could be changed to “as needed” (the software's default), making the minimum balance available to pay for expenses.

Note - Another option for releasing a minimum balance would be to transfer the balance into another account that allows withdrawals to be taken as needed.