This document explains the software's default settings, with regard to money purchase and pension drawdown benefits.

Towards the end of this guide, you will find a list of some common retirement planning scenarios; each item links to a separate, individual guide with details of how to model that particular scenario. Collectively, these guides are intended to help you navigate the software, with regards to a variety of common retirement planning scenarios. Please identify the option that looks most similar to the scenario you are attempting to model, and follow that link.

Default settings:

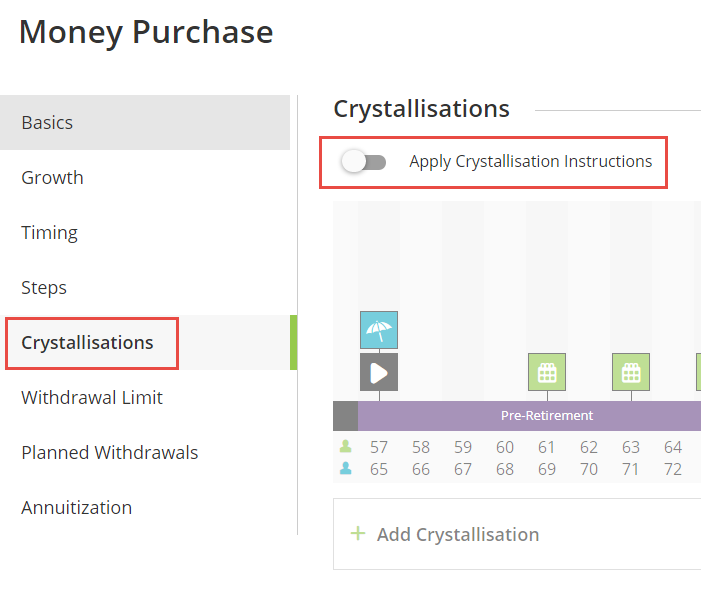

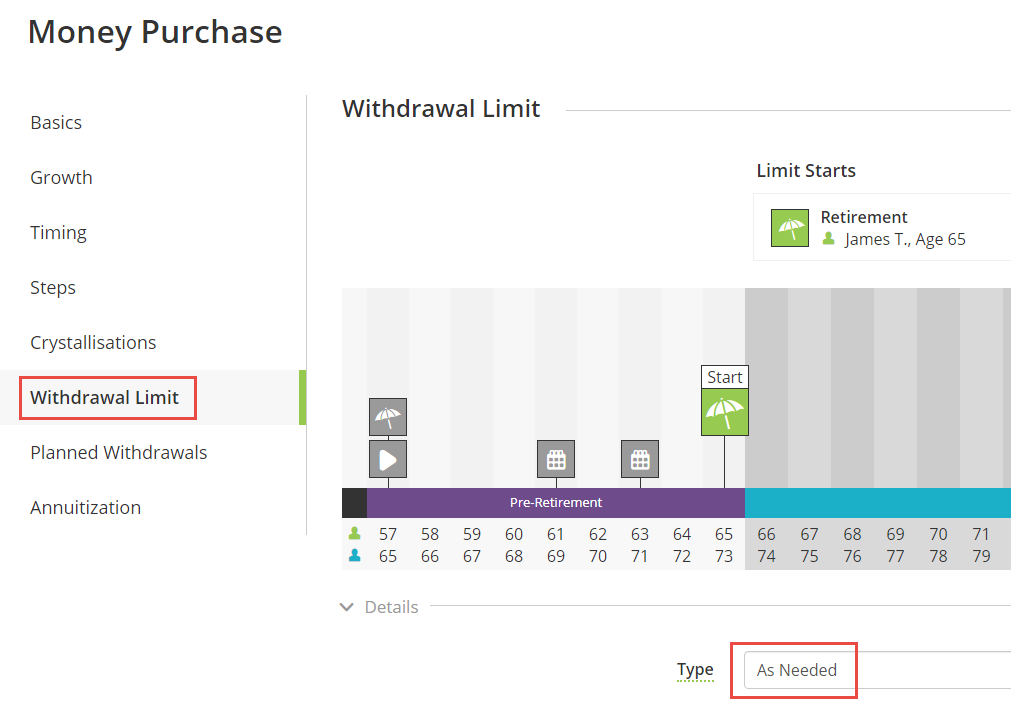

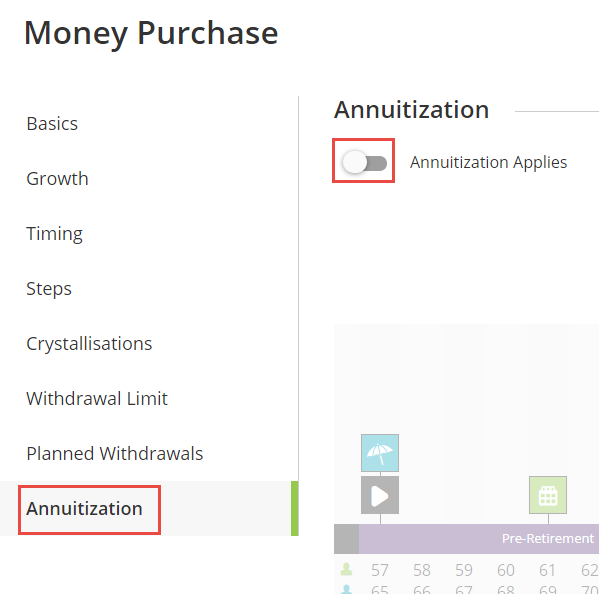

To view and/or amend these settings, go to a money purchase pension account and review the following 3 menu items:

1. Crystallisations

2. Withdrawal Limit

3. Annuitization

The software's default retirement planning assumptions are as follows:

1. 'Apply Crystallisation Instructions' is toggled off

2. Money Purchase benefits will be retained within the existing money purchase wrapper for as long as possible.

3. Withdrawals will be determined by the software on an As Needed basis, i.e. sufficient only to meet outstanding expenses.

4. Benefits will be taken as (a series of) 'Uncrystallised Funds Pension Lump Sum' (UFPLS) withdrawals.

5. Any income tax arising from 'as needed' UFPLS withdrawals will be assumed payable in arrears.

6. Annuitization Applies is toggled off.

Default Setting – Taxable Pension Drawdown Income:

Having looked at the default settings relating to the 'crystallisation' of benefits, it remains only to reiterate that, since 'UFPLS' withdrawals (the software's default mode of operation) are an alternative to drawdown, benefits will not get deposited into pension drawdown without the software being given an instruction to do so.

(There are now a couple of ways by which one can move benefits into pension drawdown, as desired).

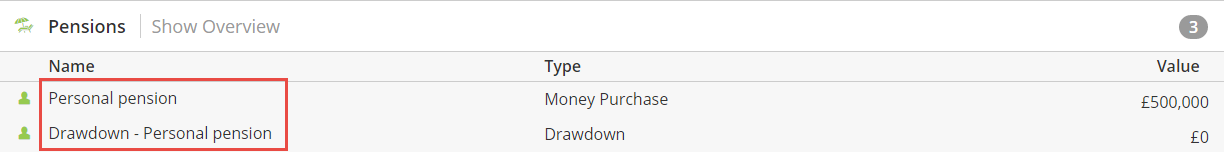

It remains the case that the software will create an empty 'Pension Drawdown' account, corresponding to (and linked to) the respective money purchase account, into which crystallised benefits will be deposited, as instructed. As a result, in the list of pensions, you will see a related Drawdown pension account prefaced 'Drawdown'

By default, the drawdown account will appear as having an account balance of £0 (representing the balance at start-of-plan).

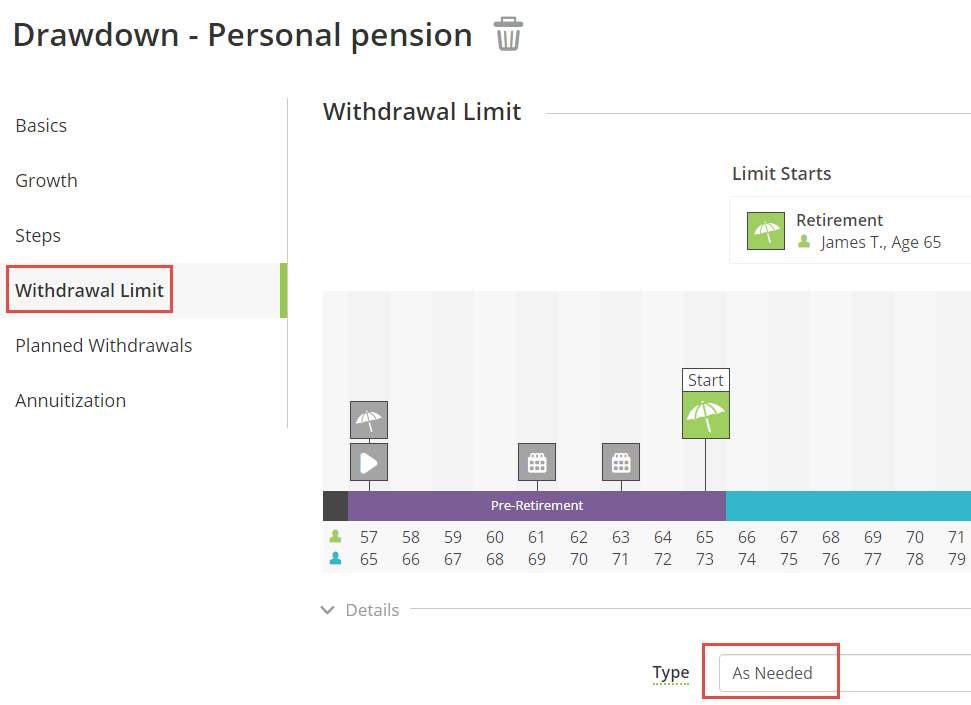

As with un-crystallised 'money purchase' benefits, the software assumes - in the event that taxable benefits have been deposited into pension drawdown - that benefits are to be used on an As Needed basis, starting from the individual's (default) Retirement event. This will be the case unless one instructs the software otherwise, via the Withdrawal Limit section as illustrated below:

Retirement Planning Scenarios:

Having reviewed the software's default settings, please take a look at the following common retirement planning scenarios – please note that this list is not intended to be exhaustive! As you can see, each one presents a link to a separate document, with further detailed instructions:

1. Withdraw full tax-free cash - with or without deferral of taxable income. Read more >>

2. Schedule regular tax-free income - with or without deferral of taxable income. Read more >>

3. Schedule regular withdrawals as combination of taxable income, and tax-free cash (UFPLS). Read more >>

4. Use money purchase benefits to buy an annuity. Read more >>