Let's review an example of entering a Registered Retirement Savings Plan (RRSP) into our Canadian software. We will use a client named Ryan, this is only an example of how you might enter an RRSP, be sure to customize your entry to fit the needs of your client.

Example:

Ryan makes regular contributions from his salary into a personal retirement account. Ryan is currently contributing 4% of his income annually.

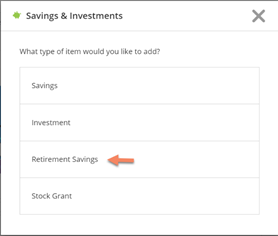

- Click the plus sign from the dashboard.

- Select Savings & Investments.

- Select Retirement Savings.

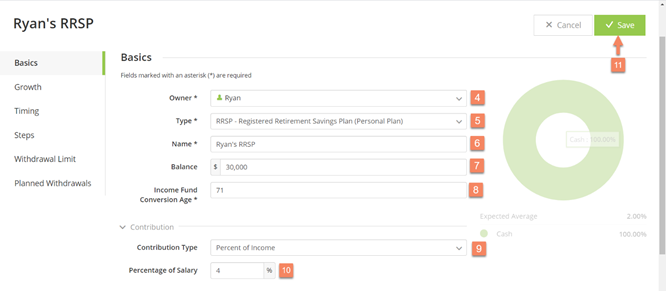

Enter the following details about Ryan’s RRSP and schedule his future contributions to it.

4. Owner: Select Ryan.

5. Type: From the drop down menu Select Registered Retirement Savings Plan (RRSP)

6. Account Name: Enter “Ryan’s RRSP”

7. Balance: Enter $30,000.

8. Income Fund Conversion Age: Leave as “71”.

9. Contribution Type: Select Percent of Income

10. Percentage of Salary: Enter 4%

11. Click Save. Note the software will automatically assume that Ryan will stop contributing to his RRSP at 65 when he is scheduled to retire.

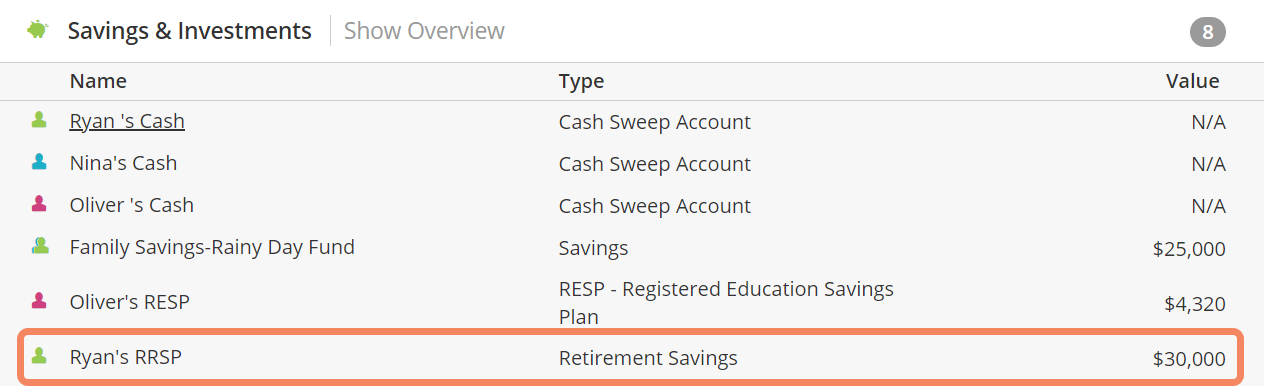

You will now be able to access Ryan's RRSP from the Dashboard in the Savings and Investments section.