Let's run through an example of how you might enter an Exit Tax account.

Note: You can customize any Exit Tax Account you enter to fit the needs of your client. This is simply and exercise to demonstrate how you might enter one.

Tom and Linda contribute €5,000 per annum into their daughter Chloe’s Exit Tax account and intend to continue doing so until she turns 18 and starts University.

Chloe’s Exit Tax Investment Account

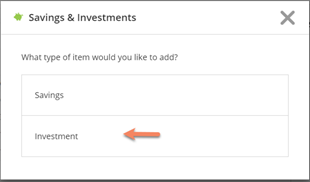

Click the + button on the dashboard and select the Savings & Investments select Investments.

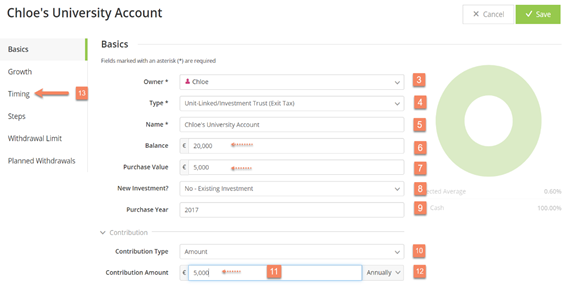

Owner: Select Chloe, deselect Tom

Type: Select Unit-Linked/Investment Trust (Exit Tax)

Name: Enter Chloe’s University Account

Balance: Enter €20,000

Purchase Value: €5,000

New Investment?: Select No-Existing Investment.

Purchase Year: Enter 2017

Contribution Type: Select Amount

Contribution Amount: Enter €5,000

Frequency: Select Annually

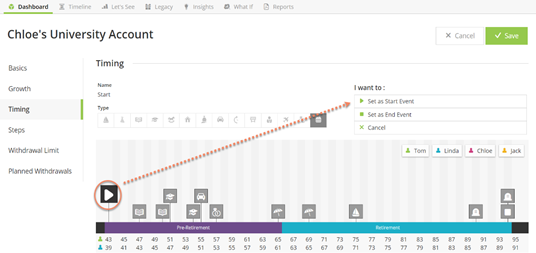

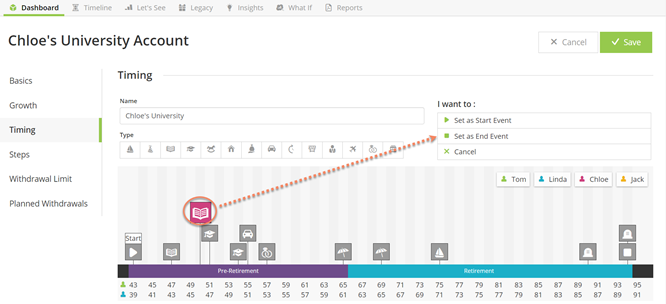

Select the Timing tab in the left navigation.

Your selection on the Timing tab will be used to schedule when contributions to this savings account are to begin and end. Tom and Linda plan to make deposits to this account from now until Chloe goes to university. Let’s begin with the start event.

Contributions Start: Select from the timeline an event to schedule the start of these contributions.

Click the plan “Start” event icon and select “Set as Start Event”

Contributions End: Next, select an event to schedule the end of these contributions.

Either – Click the icon for "Chloe’s University" event and select “Set as End Event”

Or – Select the event icon for the "Chloe’s University" event in the timeline and drag and drop the icon into the Contributions End box above the timeline (as shown below).

Select the Growth tab in the left navigation.

Grow this account by: Leave the default Entered Interest Rate

Interest Rate: Leave the default value of 6% in place.

Capital Gains Realised Annually, Dividends, Interest and Reinvest Yield: Leave these fields blank or in the case of Reinvest Yield, set to its default of Yes. These fields will become important later as we enter a taxable investment. Exit Tax investment accounts are tax-free investments, so their underlying income/growth components do not need to be set.

Click This will save Chloe’s University Savings Account into the plan and allow us to continue entering additional investments.