Stock shares in a stock grant can go through four different stages in its lifecycle: Granted, Vested, Exercises, and Liquidated. The example below will show you have to change to different stages in this lifecycle and the output on the chart showing credit/ debit for each stage.

Example: Jason’s firm provides Jason with stock options. His current stock options granted this year (2021) allow him to buy 1000 shares at $1.50 per share 5 years in the future. They therefore vest in 5 years’ time, and then he has a maximum of 4 years after this point to purchase them or they will expire.

The current price of the shares is $1.60 and this value is expected to increase at about 4% on average per year.

Jason intends to purchase the shares when they vest in 5 years’ time using his Savings account money.

He would like to liquidate the shares in 2048 to fund a nice holiday in his first year of retirement.

To Model this:

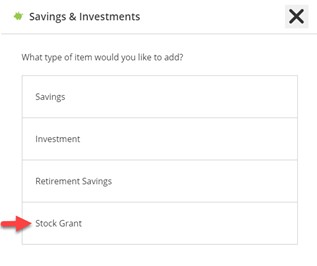

To add an Employee stock option go to Dashboard > + button bottom right > Savings & Investments

Select Stock Grant

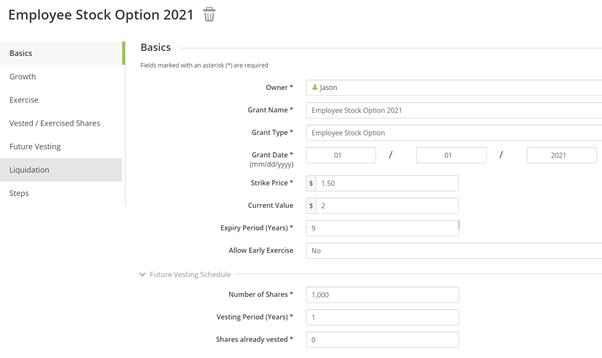

Select Grant Type: Employee Stock Option

Basics

The Strike price is the future purchase price agreed for the option i.e. $1.50 in the example above.

The Current value will be $1.60 and it is this value which will grow by the percentage in the Growth screen, which we will look at in a moment.

Expiry Period is the time window for purchasing the shares. Any purchases attempted outside of this window will not occur in Voyant.

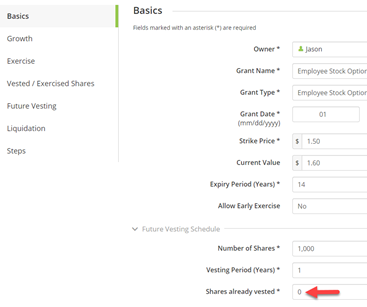

Select Grant Type: Employee Stock Option

Basics

The Strike price is the future purchase price agreed for the option i.e. $1.50 in the example above.

The Current value will be $1.60 and it is this value which will grow by the percentage in the Growth screen, which we will look at in a moment.

Expiry Period is the time window for purchasing the shares. Any purchases attempted outside of this window will not occur in Voyant.

Number of shares. This is the total number of shares and would include in this number any shares already vested. In this example the total number of shares is 1,000

Vesting Period. Here we will enter 1 year. As all the shares vest at once in 1 year of the plan, but in 5 years’ time. We will specify the timing in a moment in the Future Vesting tab. If shares vested over multiple years enter the appropriate time period here.

The screen shot below shows the fields in the Basics tab completed for this example.

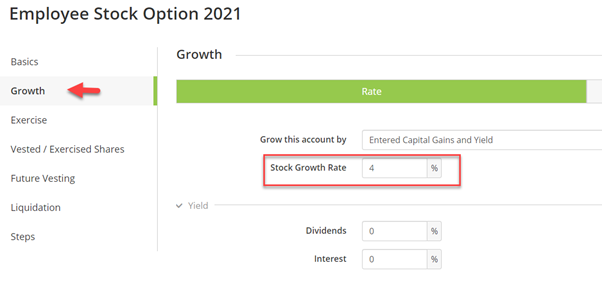

Growth

Now go to the Growth screen and change the Stock Growth Rate to 4%. The current value of the shares will increase by this value until liquidation.

Exercise

In the Exercise tab we would like to Exercise Shares: At Vested. This means that when the shares vest, they will be bought (also called exercised). If you wanted to purchase the shares at a different date then when they vest, then select ‘At Event’ and specify an event in the timeline.

Once the stock shares are exercised, they are counted as assets of the owner. They also earn dividends and interest, calculated with entered dividend yield and interest yield rates.

The future stock price growth is modelled according to the entered growth rate shown above.

In Funding Method we Fund the shares via a Purchase for this example. Below is each option explained:

Loans

We assume the user will take a loan from the employer; The loan amount is calculated as:

Strike Price x shares, with a 0% interest.

Voyant will automatically pay off the loan when the exercised stock is liquidated later. Find the Loan in Year View > Debts tab.

Purchase

Other funding items will be used to complete the purchase. In this case cash in the plan will fund the purchase.

Sell to Cover

Voyant will exercise the shares and immediately sell enough shares at the fair market value to meet the strike price. To see the details of this calculation, go to Year View for the year they are Exercised > Investments > click on the Employee stock option name > See the details under Stock Grant Details.

Note: When an RSU is vested, one immediately receives the vested shares, so there is no Exercise tab shown above and there is no cost. For ISOs and NSOs/ESOs, if there are sufficient funds to purchase the vested shares, the user can do so at the strike price.

Vested/ Exercised Shares

We do not in this case have any existing Vested share or exercised shares i.e. shares that have already vested. If you do you would enter this in the basics screen shown below and complete the details in this Vested / Exercised Shares tab.

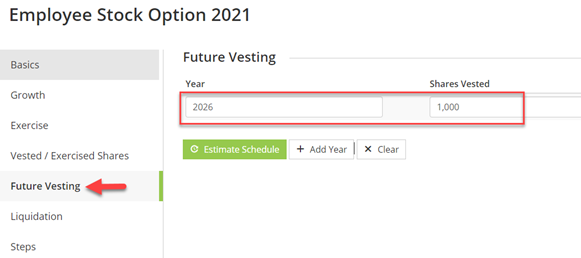

Future Vesting

In Future Vesting press the ‘Estimate Schedule’ to show the current estimation. In this case we would like to change the year to show 2026, as the shares vest in 5 years’ time, but keep the total number of shares vested in that year at 1,000, as they all vest in one go.

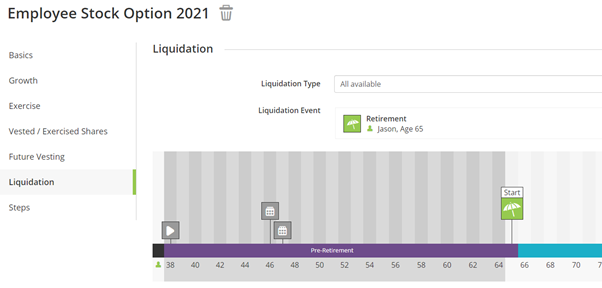

Liquidation

In Liquidation specify when you would sell these shares. You can choose to liquidate All or a Fixed amount or number of shares.

Note if you select a number of shares it will keep liquidating this number of shares each year until the pot has run out. To change this you will need to add in a Step via the Steps tab to change the number of shares liquidated year on year.

Here we will liquidate all the shares at Jason’s retirement in order to fund his celebratory holidays in that year.

Press Save

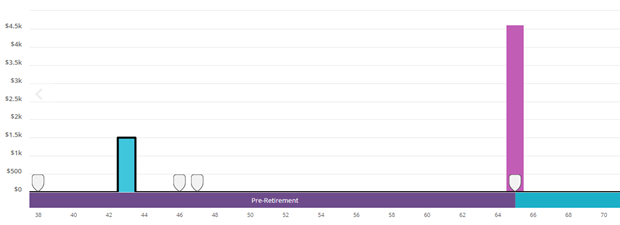

Let’s See - Cash Flow Chart

With only the stock option and a savings account in the plan to fund it the chart looks like this:

Year View

First let’s double click on the purchase year age Jason’s age 43 (2026) to show the Year View.

The Expenses tab shows 1,000 shares costing $1.50 per share (the strike price) at $1,500.

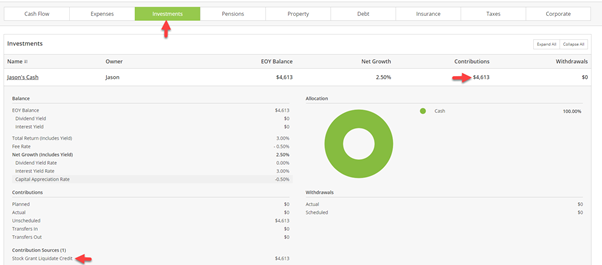

The Investments tab below shows:

- The withdrawal of the $1,500 from the savings account in order to fund the purchase of these shares.

- The value of the Employee Stock Option account. This is higher than $1,500 as the value is the Current price entered increased over time by the growth rate multiplied by the number of shares. In this case that is $1.60 x (1.04)^6 years x 1,000 shares = $2,025 rounded

Using 6 years as these are End of Year (EOY) balances.

Note: in the years before the shares are purchased there is an EOY balance of $0. In the years after purchase they continue to grow year on year by the growth rate.

Scrolling to the Liquidation event at Retirement. The Cash Flow tab shows the money inflow from the liquidation.

The Investments tab shows as default that the liquidations proceeds are moved to the Cash Sweep account. This can be changed by setting up a Transfer. As all the shares have been sold the Employee Share Option account is removed from the Investments view.

If the owner of the stock grant passes, the non-exercised shares will no longer be available in the plan.

For all the exercised shares, if the owner’s spouse is in the plan, Voyant will change the ownership of the stock grant to the spouse; If the owner’s spouse is not in the plan, Voyant will liquidate all the exercised shares and the liquidation proceeds will be deposited into the owner’s cash account and finally included in his/her estate.