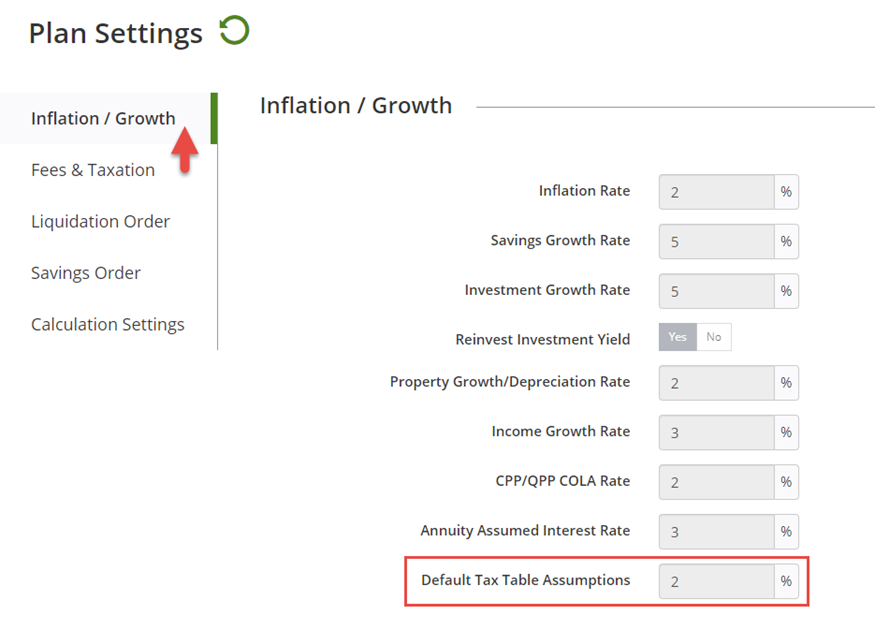

The Default Tax Table Assumption is a preference, which is set to apply an across-the-board annual escalation to the following assumptions relating to taxes and contribution allowances:

- Federal and Provincial income tax brackets

Note - Most, but not all, provincial and territorial tax brackets are also escalated in future years. Alberta, Nova Scotia, and Prince Edward Island are exceptions. The tax brackets for these three provinces are not indexed to grow into the future.

- Federal and Provincial personal amount

- Federal and Provincial Age-Based Tax Credit, base income and exemption amount

- Employment Insurance maximum earnings

- Provincial surtax income bracket (Ontario and Prince Edward Island only)

- Pension contributions maximum earnings

- Locked-In Retirement Account (LIRA) maximum withdrawal

- Registered Retirement Accounts (RRSPs and RRIFs) - Income brackets for tax withholdings on distributions

- Registered Disability Savings Plan (RDSP) Canada Disability Savings Grant (CDSG) income threshold and phase out limit

- Registered Disability Savings Plan (RDSP) Canada Disability Savings Grant (CDSG) income limit

- Registered Education Savings Plan (RESP) Canada Education Savings Grant (CESG) income limit

- Defined Contribution Pension Plan (DCPP) contribution limit

- Old Age Security (OAS) benefit amount and clawback amount

- Canada / Quebec Pension Plan (CPP/QPP) survivor’s pension

- Registered Retirement Savings Plan (RRSP) contribution limit

- Tax Free Savings Account (TFSA) contribution limit* (see following section for further details)

Escalation of future Tax-Free Savings Account (TFSA) contribution limits*

Future TFSA contribution room will be indexed to inflation or more specifically, using the software's Default Tax Table Assumption setting, which is usually set to match inflation. Annual increases are rounded to the nearest $500 each year going forward.

For example, the allowance of $6000 in 2019, if escalated at a Default Tax Table Assumption rate of 2% per annum, with rounding to the nearest $500, would increase from $6000 to $6500 in 2022, from $6500 to $7000 in 2025, and so forth. Of course, if in future years we receive a different direction from the government, the contribution allowance will be adjusted accordingly.

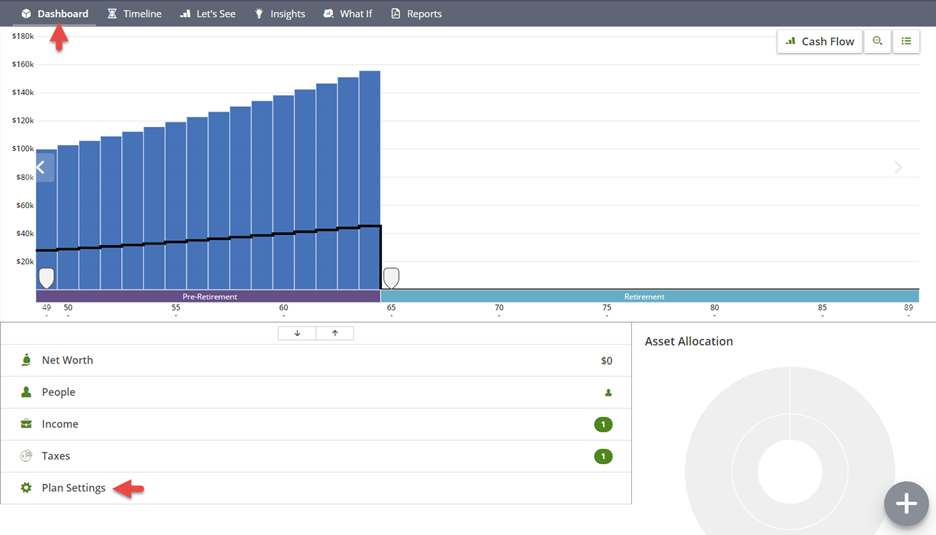

Note - The software models the future escalation of TFSA contribution allowances using the Default Tax Table Assumption, a setting found in the software's Plan Settings. This setting is used in place of the inflation rate, which is used separately for the escalation of future expenses. While the Default Tax Table Assumption is often set to match inflation, it is up to the firm or enterprise to choose and set what it deems to be a reasonable escalation rate for this setting. Read more >> about the Default Tax Table Assumption.

Tax related assumptions that are not escalated

The software does not escalate:

- Canada / Quebec Pension Plan (CPP/QPP) lump sum death benefit

- Provincial tax brackets for Alberta, Nova Scotia, and Prince Edward Island

We code for what we know

As a rule, Voyant software is coded to account for legislated rules and only escalates tax-related assumptions once we move beyond the known. For example, if the government were to announce that the annual saving allowance for Tax-Free Savings Accounts (TFSAs), which is currently $6,000 in 2021, is to be frozen at this level until 2024, the software would account for this and would only begin the escalation of the $6,000 contribution allowance from 2024 onward.

Note - For firms and enterprises who use Voyant’s white labelling/rebranding service, the option is available to escalate these tax related assumptions independently of one another, using different rates or to possibly exclude some from escalation. By default, AdviserGo is set to escalate all the aforementioned assumptions using a single Default Tax Table Assumption, which is currently set to escalate assumptions at 2% per annum. The option is available, however, to manage these assumptions separately.

Read more about our rebranding service here or contact Voyant support for more information.