This guide walks through two transfer scenarios:

1. Depositing a lump sum inflow into a investment or savings account. For example, from surplus Inheritance money into a savings account

2. Scheduling a recurring transfer between accounts. For example from a Savings to an Investment account or in the UK from a General Investment Account into an ISA.

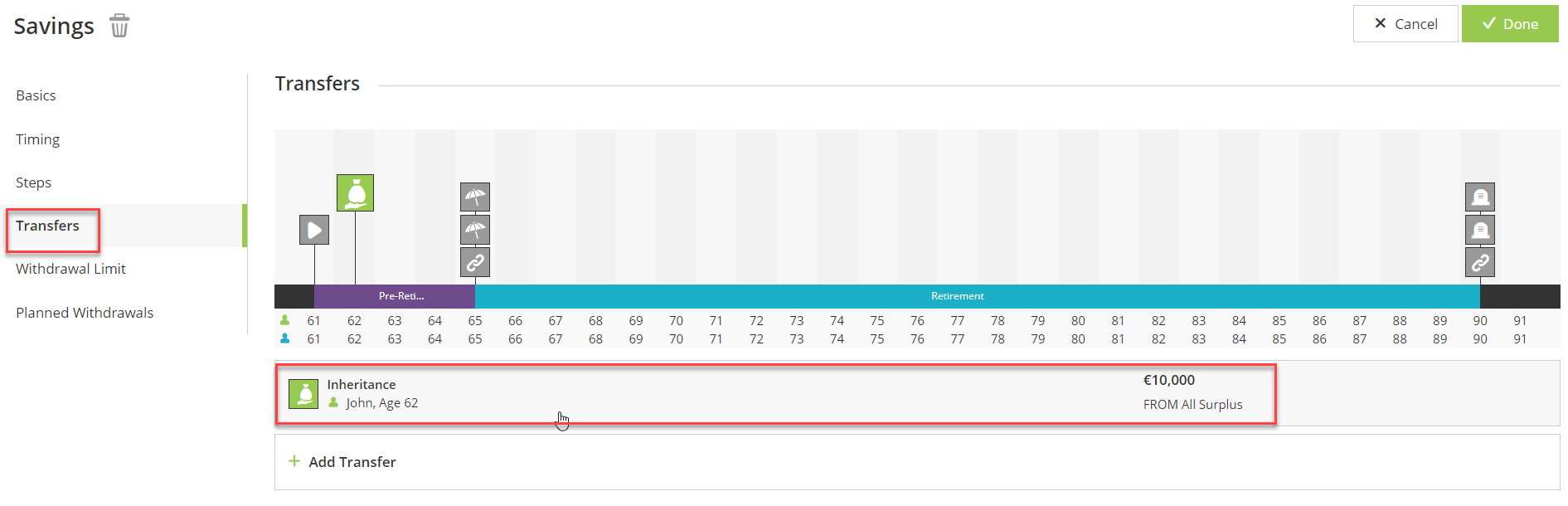

Transfers between accounts are scheduled on the Investments or Savings screen > Transfers panel

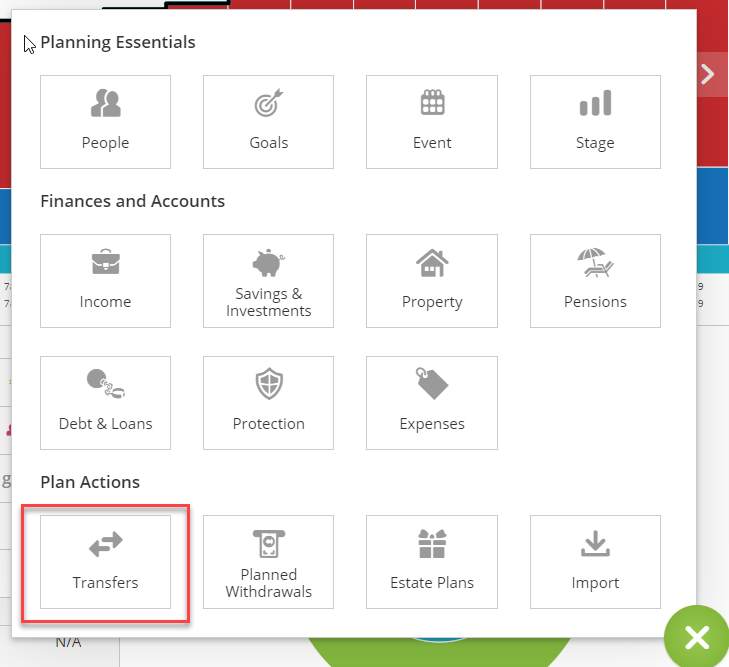

or via the Transfers option in the + button > Plan Actions in Dashboard view:

To deposit a lump sum inflow into a investment or savings account:

1. Go to Dashboard view. Click on the + button bottom right and select Transfers

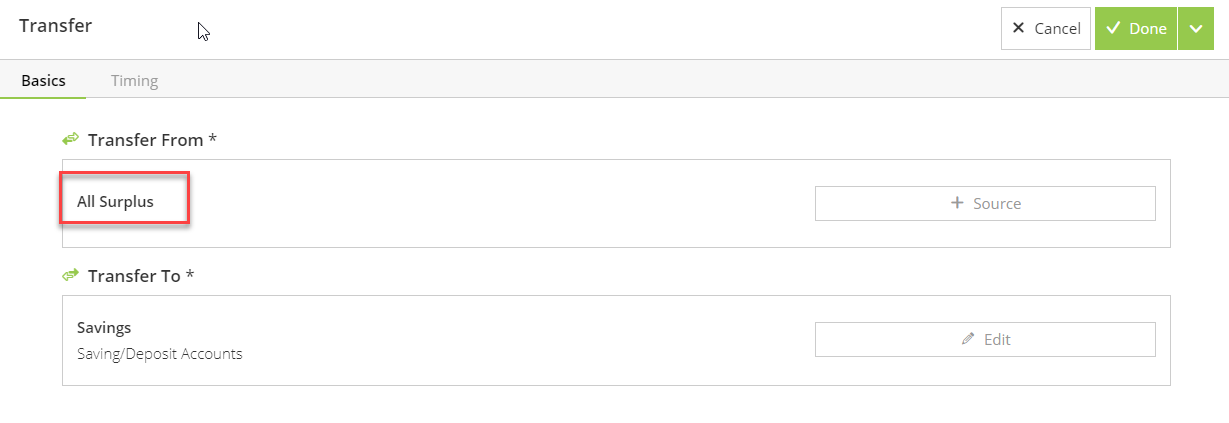

2. Select All surplus in the 'Transfer From' box and the saving or investment account you would like the money saved to in the 'Transfer To' box.

Note on Transfers From Surplus: In the year of the one-off lump sum inflows e.g. from inheritance or property liquidation the funds are classed as in Surplus. If not transferred or used surplus funds are moved to the default cash account at the end of the year. If saving money in the same year as the lump sum inflow, select All surplus as shown in the example above.

The same goes for transfers from annual surplus into a savings account, also select All surplus in the From section.

Note on Transfers To Account: The savings or investment account you are transferring into could be an actual existing account (one the client has at the start of the plan) or a hypothetical future one (an account that you create with a zero balance that will be funded in the future through this transfer).

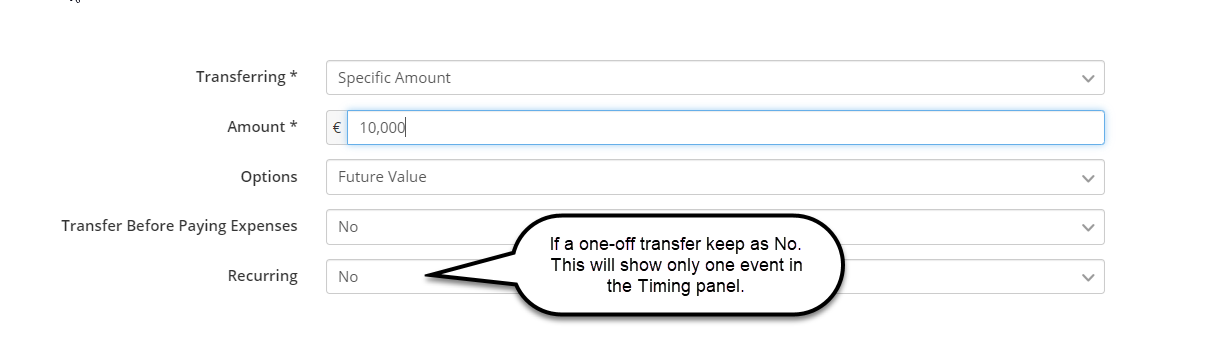

Complete the transfer details:

Optional: If you want to ensure that the lump sum is being transferred prior to paying expenses, to prevent any part of the lump sum from being used first to meet expenses, select Yes in the Transfer Before Paying Expenses box.

Otherwise, expenses will be met first, with the remaining funds being contributed/transferred to the target savings or investment account.

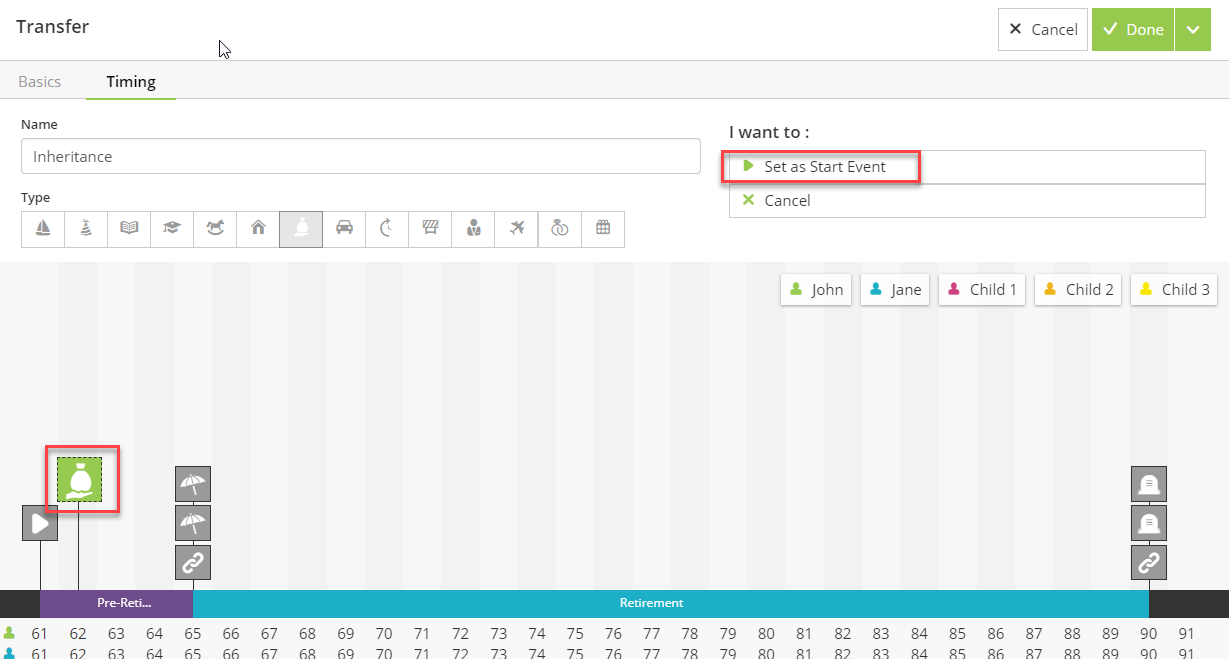

3. In the Timings screen, select the event that indicates the lump sum payout. You may need to add an event to the timeline and first schedule the payout using this event. If you selected Yes in Recurring, you will need to select a Start event and an End event.

4. Click Done

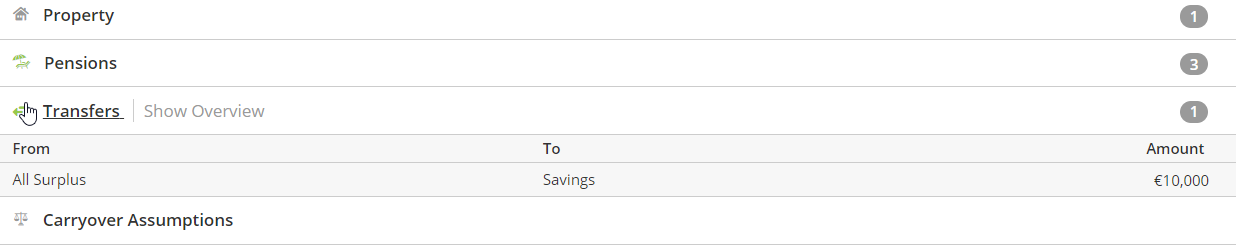

5. View and edit your transfer in the Dashboard view under the Transfers section

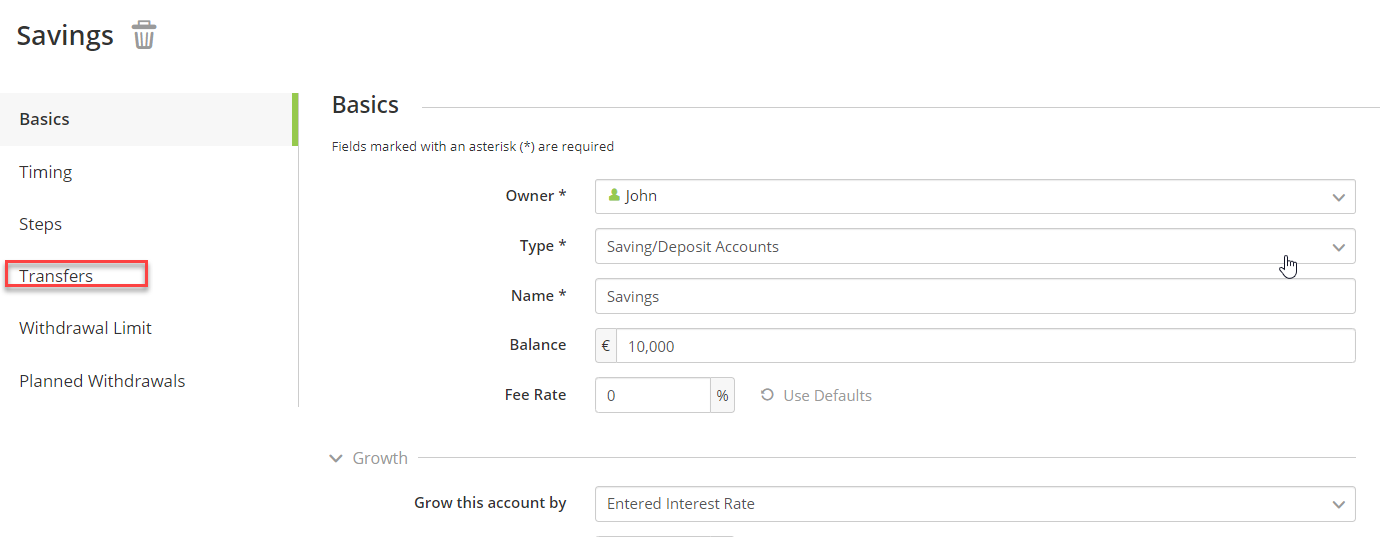

or within the transfers section of the account you are transferring to/ from.

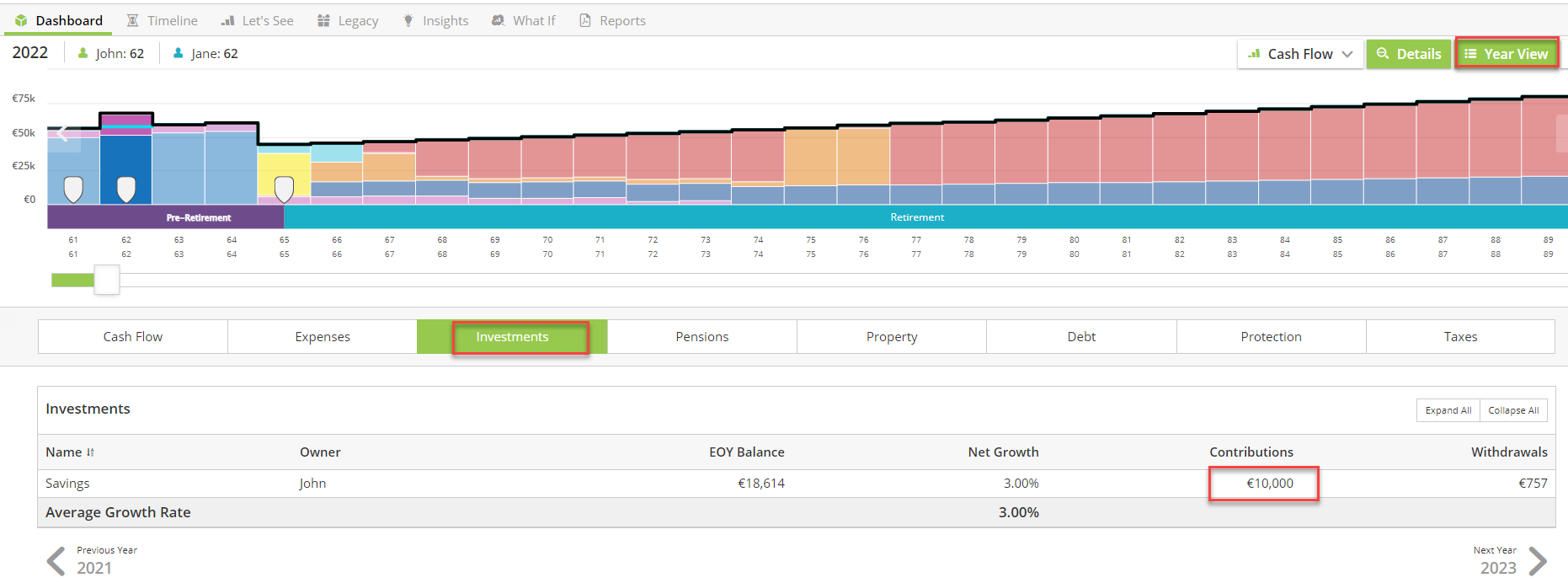

6. Check your transfer has worked by going to Let's See and double clicking on the year of the transfer to see the detailed information. Alternatively click on the Year View button top right.

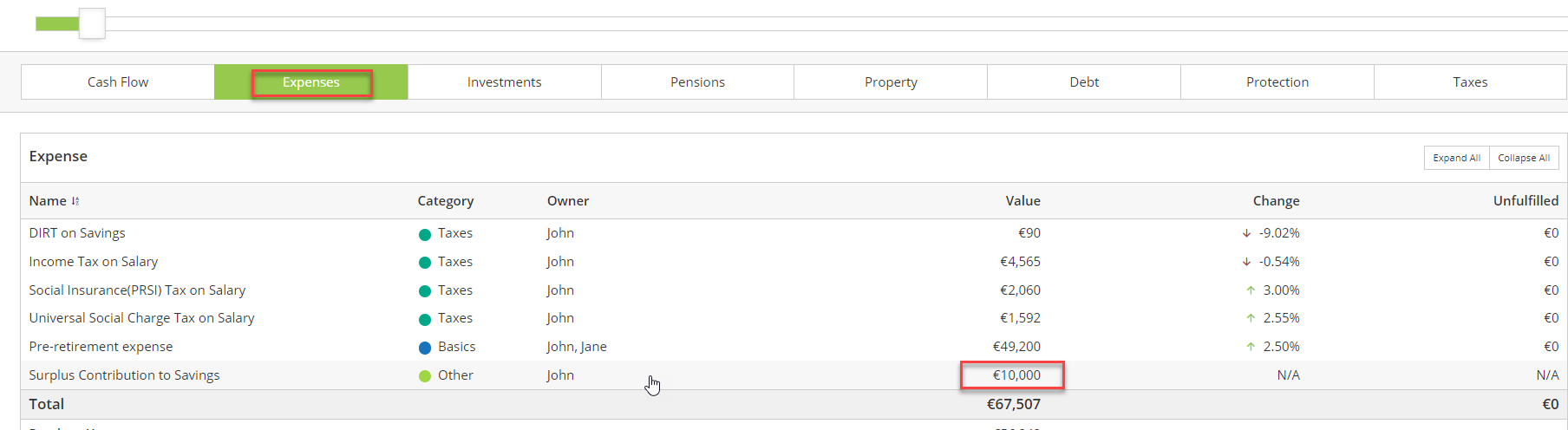

Transfers from surplus will also be shown as an Expense in that year:

Schedule a recurring transfer between accounts:

This could be for example to move money from savings into an portfolio account on a regular basis.

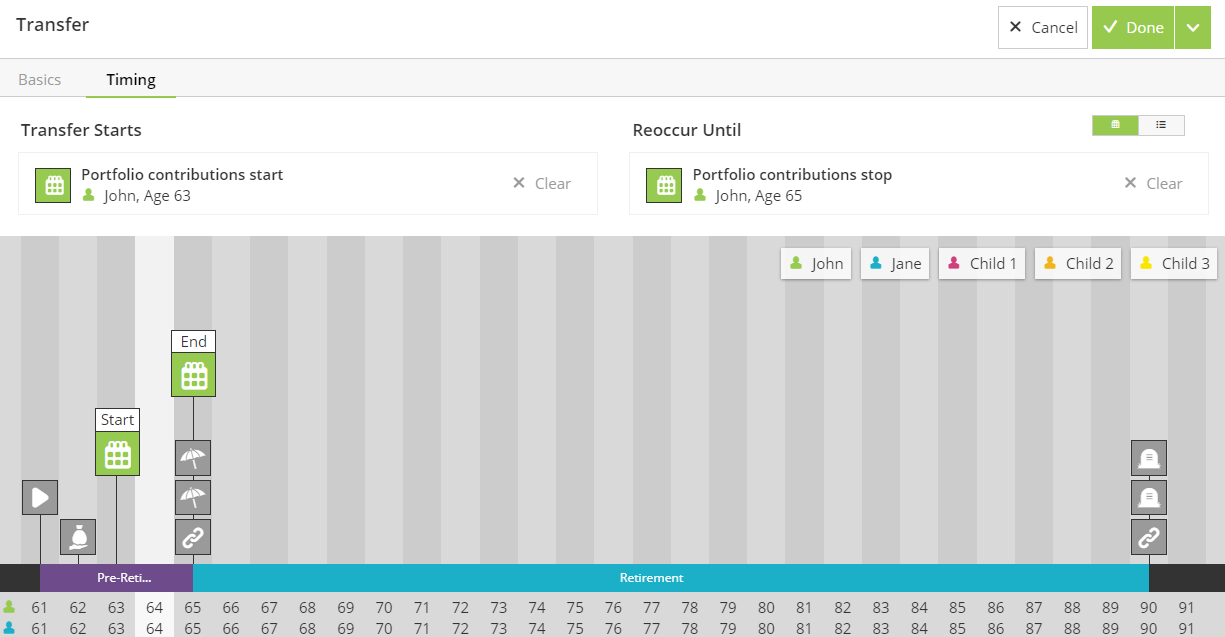

1. Make sure you have 2 events in the Timeline screen - one to signify the start of the transfers and the other the schedule the end of the transfers. You can use Events already on the Timeline if appropriate e.g. 'Start' and 'Retirement'.

2. Follow the steps above to start a new transfer

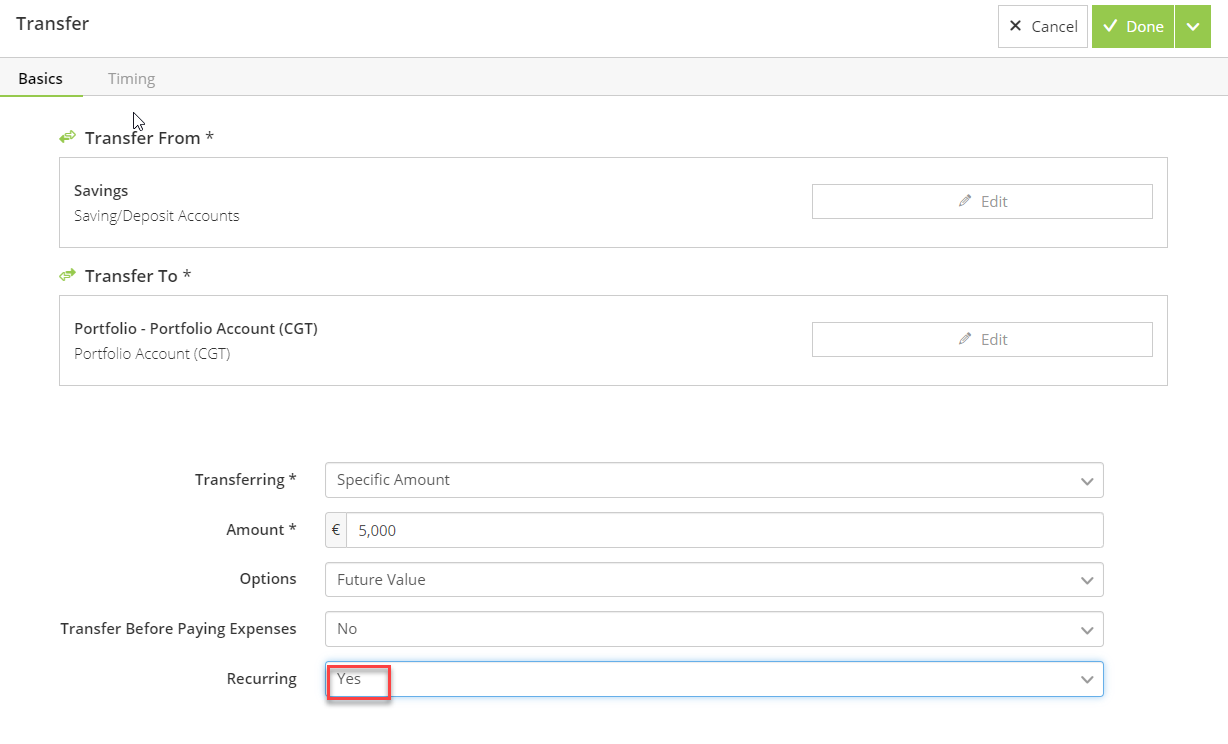

3. This time select accounts in the Transfer From and To boxes if transferring between accounts. For example, below shows a recurring transfer between a savings account into a portfolio account. The same approach would be used when moving money To and From any two available accounts in Voyant.

4. Select the Timing of this in the Timings section then click Done.

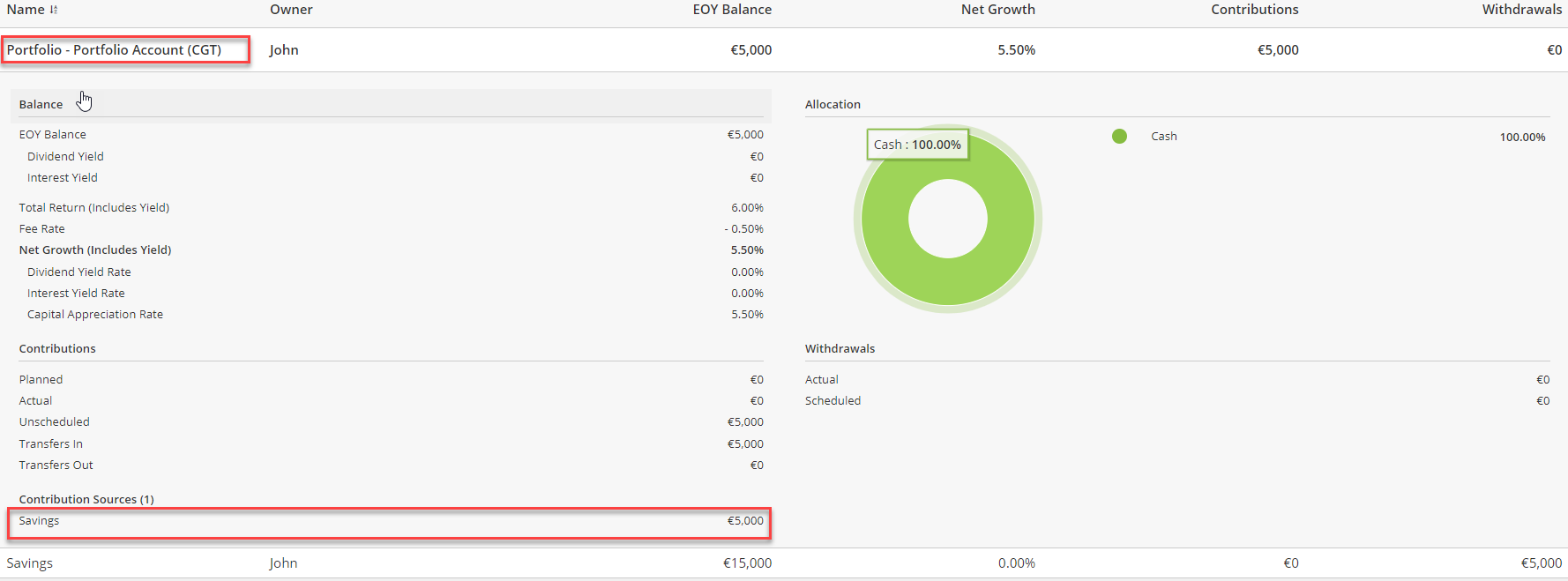

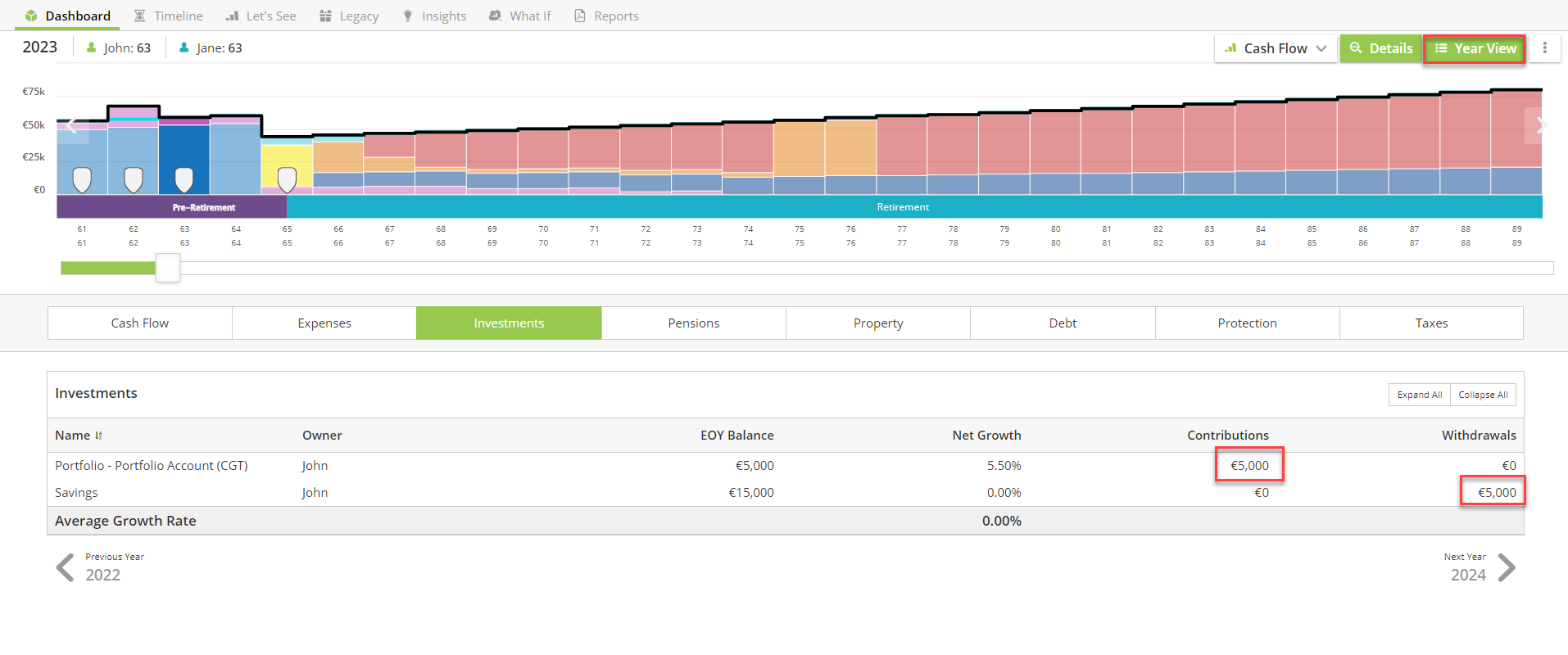

5. Check the transfer is set up by going to the detailed information view to see money being withdrawn from the savings account and contributed to the portfolio account:

and also by clicking on the account the money is being transferred to, where you can see the Contribution source: