AdviserGo can be used very effectively to demonstrate to clients the benefits of contributing annually to ISAs as a tax-free wrapper. One strategy for funding ISAs is through Bed & ISA.

To schedule the regular Bed & ISA from an unwrapped investment such as an OEIC or unit trust:

1. First, go to the Savings & Investments in dashboard

Note: You must have both the source and target accounts entered in the plan before you schedule this ongoing transfer.

2. Select either the target account (the ISA) or the source account (the unwrapped investment). Let's take the source account for example.

Click into the Unwrapped Investment.

3. Go to the Transfers screen and click Add Transfer. As the source account is the unwrapped investments, transfer FROM this account TO the ISA.

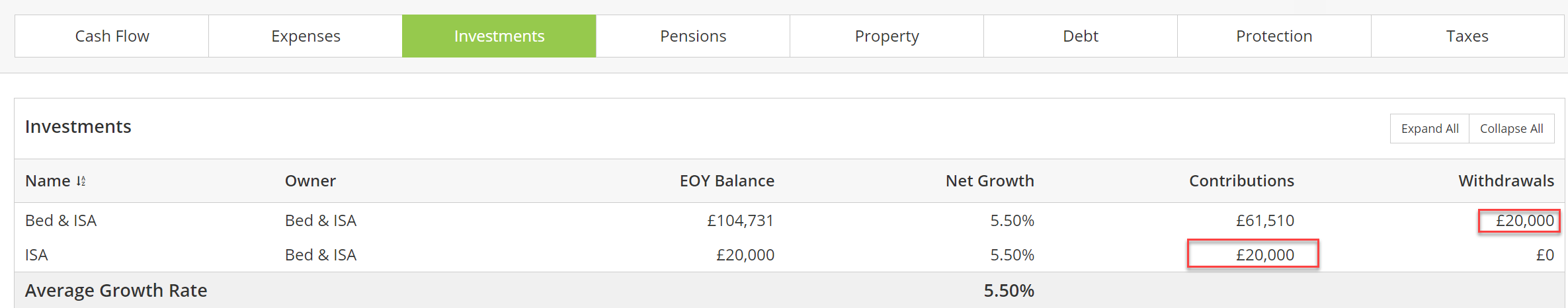

4. Set recurring contributions of £20 000 as a future value.

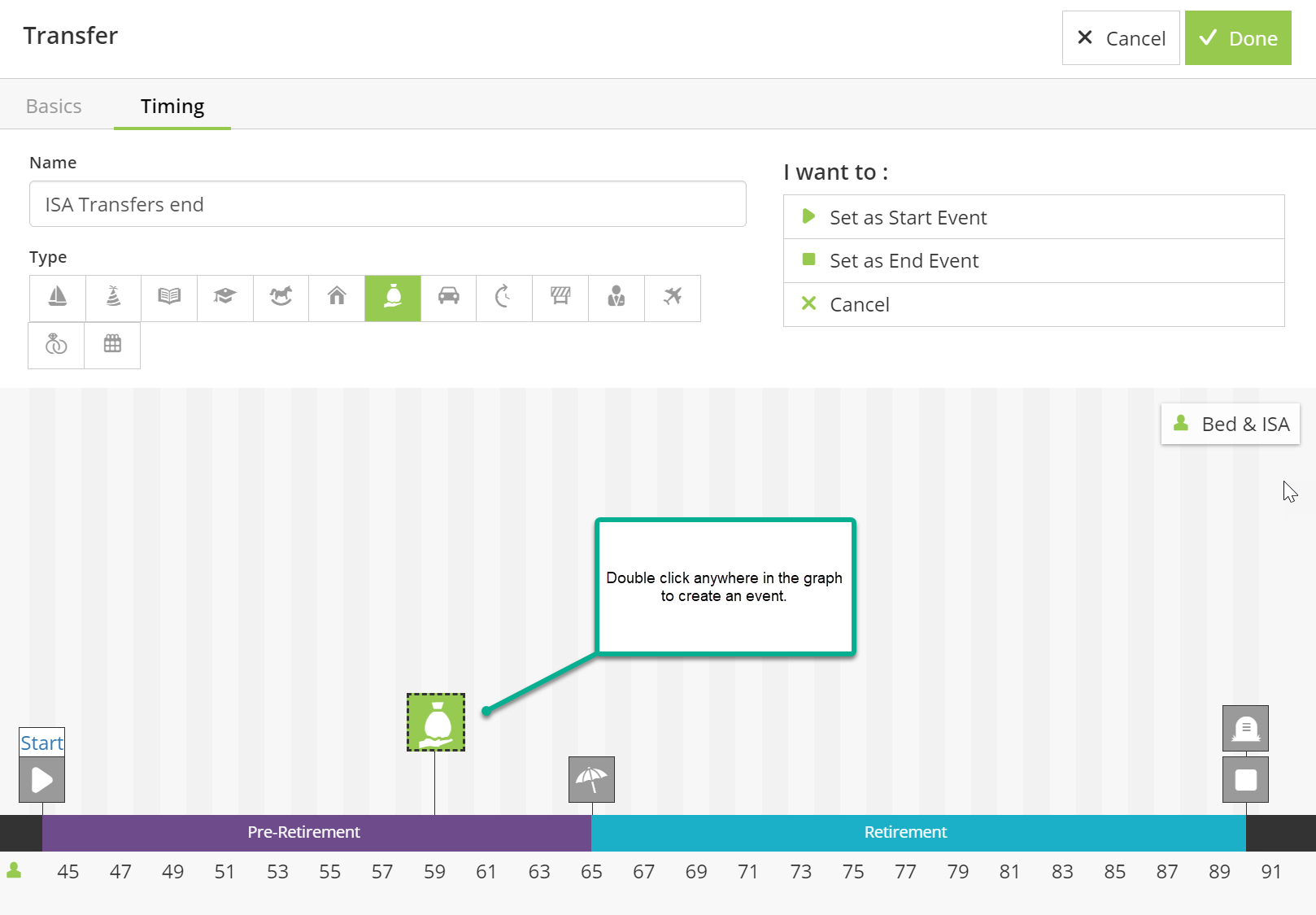

4. Update Timing - Select an event to schedule the beginning of the transfers - e.g. the Start event if transfers are to begin at the start of the plan and an end event for the transfers to stop, this may be mortality or another future event.

_______________

Tip: If you want these transfers to start/stop sometime in the future (in a future year of the plan), and if you don't have an event already created on your timeline, you can create an event by clicking into the year you want the transfers to start/stop within the timing section. In the example below I have set the contributions from the start of the plan and created an end event for the contributions to stop. I have selected choose Set as End event in this case.

Click Done to complete the transfer, and click Done again to come out of the account.

5. View YEAR VIEW to check the transfers are working as expected.

You can repeat the above process if you were to select a Cash ISA as a targeted account.

Do bear in mind that we normally inflate ISA contribution as the plan moves into years past the known legislated limits. You will find this assumed inflation rate for the software's various tax related assumptions in Plan Settings > Default Tax Table Assumptions %. Understand that this assumption inflates not only ISA contribution limits but also other tax related assumptions such as the future nil rate band. Any contribution that exceeds the normal allowance would therefore be inflated in line with this assumption.

_______________

Additional Notes

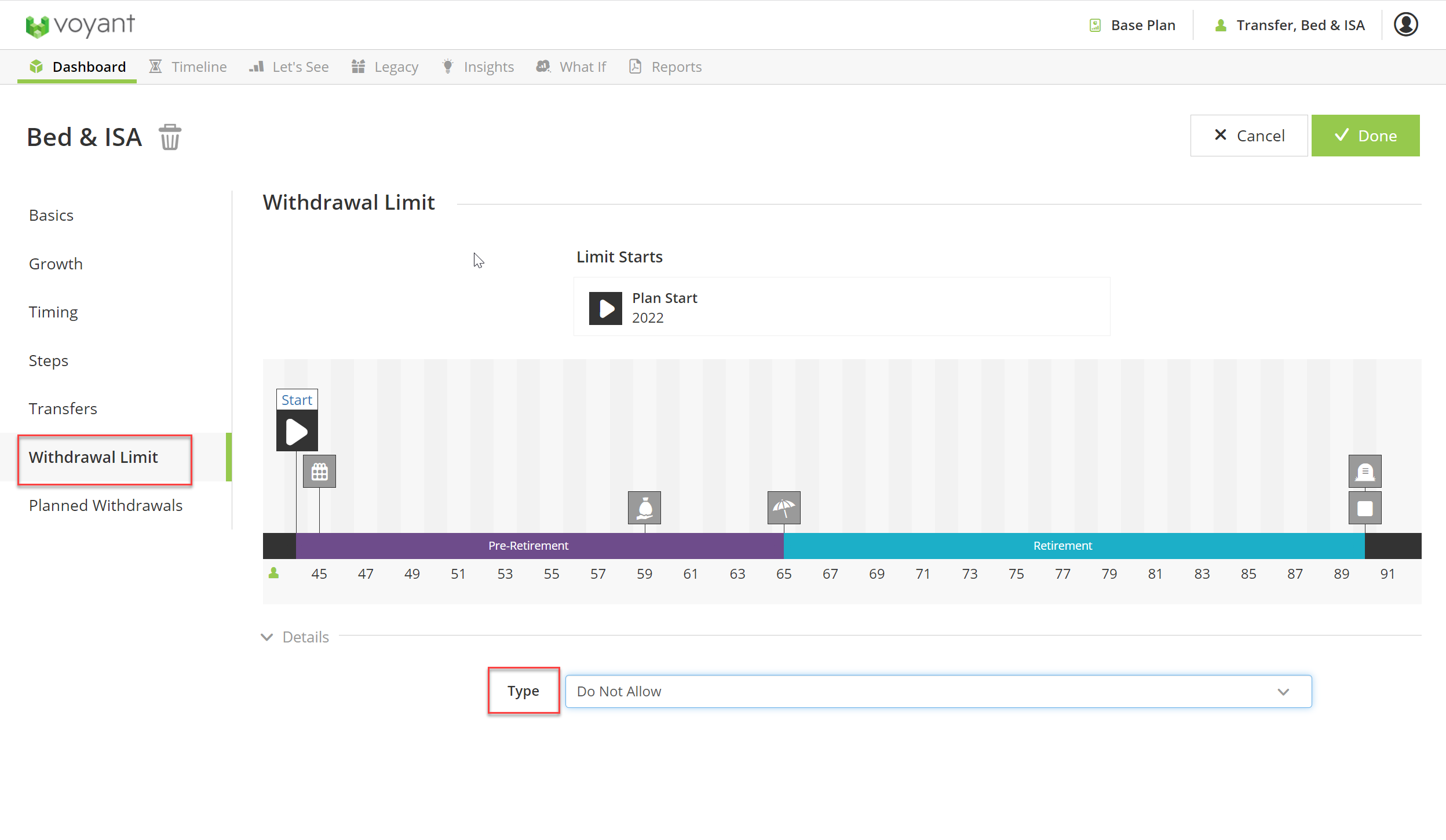

Transfers are not Subject to Liquidation Limits

Transfers between accounts are not subject to withdrawal limits. Even if you were to set withdrawal limit on an account (using settings on the Withdrawal Limit screen), thereby preventing the software from taking any ad hoc withdrawals to fulfill expenses, you could still schedule one-off or recurring transfers from the account to another using the settings the Transfers screen. Transfers between accounts are not subject to withdrawal limits and will be allowed to occur.